Budget 2023 & How these changes may affect you

Recently the government announced the Budget 2023, which is meant to help the people and ensure a fairer tax system.

Here are some of the notable changes which may affect your cashflow:

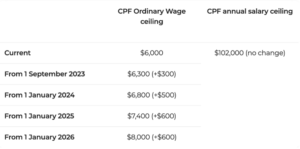

1. CPF wage ceiling will be increased from $6,000 to $8,000 (from yr 2023-2026)

This is meant to boost retirement savings for middle-income earners.

Source: www.cpf.gov.sg

NOTE: There is no change to the CPF annual salary ceiling ($102,000) and CPF Annual Limit ($37,740).

How will this change affect you as a CPF member?

Your Income < $6,000/mth

This change does not affect you.

Your Income $6,000 – $8,000/mth, but annual income < $102,000

As there will be additional mandatory contributions from employer and employee, you will see a reduced take-home pay, but increased CPF contributions.

Your Income > $6,000/mth and Annual income > $102,000

This change does not affect you.

You may see a reduced monthly take-home pay (due to increased CPF mandatory contributions), but your annual take-home pay (including bonus) will remain the same.

Implications

If your income is > $6,000/mth, it would be good to review your monthly cashflow, together with the increased CPF contributions, to see how best to manage your expenses together with mortgage repayments.

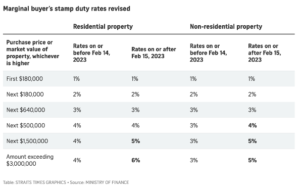

2. Increase in marginal Buyer stamp duty (wef 15/02/2023)

Source: Budget 2023: Buyer’s stamp duties for property purchases to be raised from Feb 15

As the change only affects properties above $1,500,000, it is mainly targeted at high-end luxury properties.

Source: Budget 2023: Buyer’s Stamp Duty hike

How will this affect you?

Homeowner

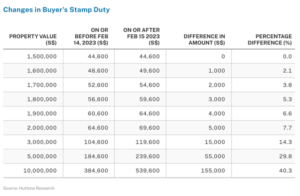

As a homeowner intending to purchase for own stay, you would need to factor in the marginal 1-2% increase in stamp duty during your purchase.

Property investor

As a property investor, this marginal 1-2% increase may reduce your rental yield.

Together with the increase in property tax wef 2023, you would need to carefully evaluate the profitability of your investment property.

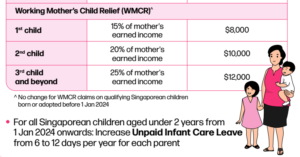

3. Change in Working Mother Child Relief

There’s been change in working mother child relief from a percentage of your income to a fixed amount.

How will this change affect you as a working mother?

Your income <$53,000/yr

This change will benefit you, since the fixed amount of relief is a higher percentage of your income, and therefore less tax is payable.

Your income >$53,000/yr

You can expect to pay more tax, since the fixed amount of relief is a lower percentage of your income.

The good thing is that this only applies to children born on or after 01/01/2024, and does not affect existing Working Mother Child Relief claims.

Read the summary of budget here

Click here to calculate your estimated benefits

What’s next?

With all the upcoming changes in place, it would be useful to review your financial status, to minimize the impact on your cashflow and your financial goals like retirement funding. If you have any queries, do email me at winniechan@fapl.sg for a chat on your finances.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Chan Wen Li Winnie

Winnie Chan is a distinguished Certified Financial Planner (CFP) with over a decade of expertise in financial advisory services. Her commitment to her clients has led many to achieve their financial aspirations while ensuring their families’ protection. Winnie‘s extensive experience in insurance claims has been instrumental in securing successful payouts, providing crucial financial relief during challenging times.

Her passion for community engagement is evident through her financial education initiatives. She has conducted insightful financial talks for esteemed organizations such as Carousell Group, Singapore National Eye Centre and Singtel, empowering their employees with valuable financial knowledge.

Outside of her professional commitments, Winnie balances her life with a passion for fitness and music. She enjoys rigorous workouts at the gym and is a pianist, recently awarded ABRSM Piano Performance Grade 6 (Merit).

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg