全方位了解新加坡的指数型万能寿险 Understanding Indexed Universal Life in Singapore

为什么新加坡的指数型万能寿险这么受欢迎?Why is Singapore Indexed Universal Life so popular?

1. 什么是指数型万能寿险 (Indexed Universal Life Insurance)?

指数型万能寿险 (Indexed Universal Life) 是一份结合了传统万能寿险和投资指数功能的高杠杆终身寿险。在保障身故的同时,还提供了一定程度的投资机会,实现更高的现金价值增长潜力。该类产品始于1997年的美国,但开始推出时并没有得到客户的认可。直到次贷危机发生,投资者被血洗,IUL 产品才开始流行。因为它具备收益区间上下限限制,能够确保保单收益在稳定区间增长,且既有生前利益,又有深厚福利。目前 IUL 产品主要集中在百慕大、新加坡和美国。百慕大的 IUL 产品大多通过信托持有,对于投保人财产保护隐秘性高。但还有一些国家地区的投保限制,新加坡的保单是个人持有,若有需要可以放进信托中。

2. 为什么新加坡IUL吸引全世界富豪喜爱?

- 是一份高杠杆的美金终身人寿保险。投保人可以直接把自己的身价涨达10倍。

- 有类似信托的功能,可以作为财富传承的一个工具,但不用承担遗产税。

- 它的增值空间和指数有密切关系。这保单的底层追踪知名指数,比如家喻户晓的标普500指数(S&P 500)。

- 既可以享受市场上涨的红利,又不需要承担市场下跌的风险。这就是 Cap Rate (市场上涨的封顶)和 Floor Rate(市场下跌的保底)。

- 虽然保费是一笔投入,它是用定期投资的方式把一笔投入的资金分12份(12个月)投入指数,从而降低风险。

- 不仅可以积累现金价值,在一定的年数之后还可灵活部分提取,同时也不降低身故赔付保额。

最重要的一点是保险公司的精算师用这个投资策略对这些指数进行回测,有把握和信心才会推出这个保险产品。

3. IUL存在的风险是什么?

首先,我们必须了解每份保险都有 Cost Of Insurance,保障费用。这是保险公司需要承担的风险,他会根据受保人的年龄,身体健康情况和其他因素来计算的。IUL也一样。

比如一个人投保美金100万保额,保费是美金10万块,那么保险公司就会用相差的美金90万和受保人的条件来计算保障费用,这些费用都算在保费当中了。投保人不需要额外付费。

IUL存在的风险就是保单失效(policy lapse)。当投保人在制定的年数部分提取后,虽然不会减低保额,但若市场真的都不好,保单里的金额又少了,同时得付保障费用,那么保单就有风险失效的风险。

但是,这个保单失效的机率偏低,因为保单是用定期投资的策略把保费分批买入指数,买入的期限是一年,所以影响不会太大。指数每个月都下跌的概率很低。

这里可见定期投资的魅力很大,可降低风险。

还有,在保单预计失效前几年,保险公司会通知你,让你再缴费让保单继续生效。

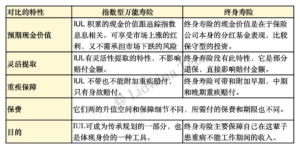

4. 我应该买IUL还是终身寿险 (Whole Life Insurance) 呢?

5点对比 IUL vs Whole Life:

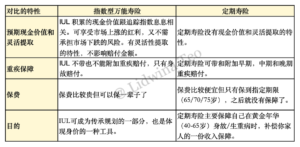

5. 我应该买IUL还是定期寿险 (Term Life Insurance) 呢?

4点对比 IUL vs Term Life:

其实不管是 IUL, 终身寿险或者定期寿险,都是可以配合着制定一份最适合个人的需求。

因此,最重要的是根据个人的需求来制定专属的财富保障和传承的计划。

6. 我想了解以我的情况买入 IUL 的保费是多少呢?

若想了解新加坡IUL,欢迎联系我, WhatsApp +65 86802340 或者微信 lidwinabq,我可以为你量身定做一份报价。

分享小故事~ “为什么我的财富最后分给了我最恨的两个男人?”

有一个女强人,她非常能干和她老公育有一女。但老公外遇,她果断离婚,独自养大自己的宝贝女儿。

在女儿出嫁的那天,她准备了2百万的嫁妆给她的女儿。没想到,半年后发现女儿嫁得不幸福,女婿也出轨了。这个妈妈就很讨厌这个女婿。

卡!不幸的事,女儿因为伤心过度晚上外出开车散散心,结果意外车祸身亡了。更不幸的事,她女儿还年轻,没立遗嘱,女儿的遗产就跟着无遗嘱法令分配遗产。

最后,她女儿的遗产一半分给了女婿,一半给她和她前夫平分。

原本的2百万,最后只剩下50万,150万都分给了她这辈子最恨的两个男人。

若是她那时有买IUL,她的钱就不会被分给她最恨的男人了。

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Lidwina Teo 维娜

With 5+ years in client service, I’m passionate about delivering personalized financial planning that puts your best interests first. Backed by 150+ business partners, I tailor solutions to help you reach your financial goals.

Contact me now to request for a quotation or schedule a coffee session for further discussion. See you soon!

拥有5年以上客户服务经验,我致力于提供以客户利益为先的个性化理财规划。依托150多位业务伙伴,我为您量身定制方案,助您实现财务目标。

欢迎咨询,随时为您准备方案!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg