SRS – A Must-Have Tax-Saving Account for High Earners

- What is Supplementary Retirement Scheme (SRS)

The SRS is a voluntary retirement savings plan in Singapore that offers significant tax benefits to encourage individuals to save for their retirement.

- Why Contribute to SRS?

Contributing to your SRS account before the end of the year allows you to reduce your taxable income for the following year, potentially saving between $200 to $3,000 in taxes.

- Contribution Limits:

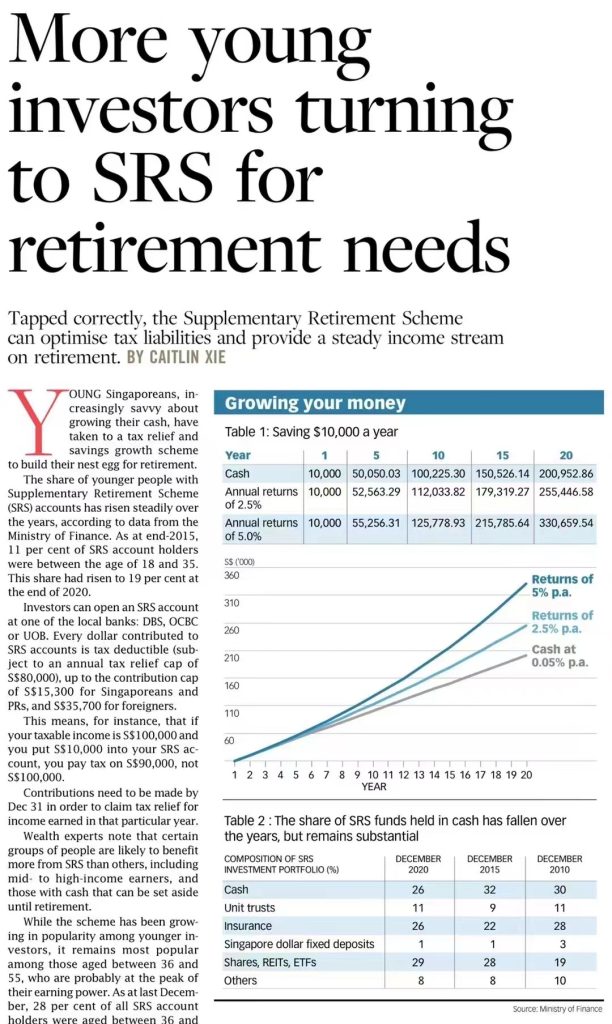

– Singapore Citizens and Permanent Residents: Up to $15,300 per year.

– Foreigners: Up to $35,700 per year.

- Withdrawal Rules:

After Statutory Retirement Age (currently 63): Withdrawals can be spread over 10 years, with only 50% of the withdrawn amount subject to tax. For example, if you withdraw $40,000 annually, only $20,000 is taxable. Given that Singapore’s personal income tax threshold starts at $20,000, you may not need to pay any tax if you have no other income.

Before Statutory Retirement Age: The full withdrawal amount is subject to tax, and a 5% penalty is imposed unless it meets specific exceptions, such as medical reasons, terminal illness, bankruptcy, or for foreigners after at least 10 years of holding an SRS account.

- Upcoming Changes:

The statutory retirement age is set to increase to 64 on July 1, 2026. Opening an SRS account now, even with a small amount, locks in the current retirement age of 63.

- How to Open an SRS Account:

You can open an SRS account for free with any of Singapore’s three local banks: DBS, OCBC, UOB

Simply search for “Open SRS” along with the bank name to access the application page.

- Considerations Before Contributing:

Tax Relief Cap: Ensure that your total tax reliefs do not exceed the $80,000 cap. For example, as a working mom this year, my combined tax reliefs (e.g., Working Mother’s Child Relief and CPF contributions) nearly reached the $80,000 cap, so contributing to SRS wouldn’t yield additional tax savings.

Fund Lock-In Period: Assess whether the tax savings outweigh having your funds locked in until the statutory retirement age.

- Investment Opportunities with SRS Funds:

SRS funds can be invested in a variety of financial products, including Fixed deposits, Single-premium insurance plans, Stocks, Real Estate Investment Trusts (REITs), Bonds, Exchange-Traded Funds (ETFs) , Unit trusts

Investment returns within SRS accounts are tax-free.

- My Perspective:

SRS is designed to encourage Singaporeans to save more for retirement during their working years. When investing through SRS, I recommend seeking sustainable, long-term growth with a diversified global portfolio. Leveraging the expertise of top investment institutions can provide various options tailored to different risk profiles.

If you’re interested in learning more or need personalised investment advice, feel free to reach out to me. Let’s work together to make your money work harder for you!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Wu Xian, Rachel 吴娴

Hello, I’m Rachel, an Independent Financial Advisor with Financial Alliance, Singapore’s largest independent financial advisory firm.

My Background

As a former frontline social worker, I had the privilege of helping dozens of immigrant families overcome life and financial challenges. I later spent 9 years in the international finance sector, focusing on corporate social responsibility and working on sustainable development projects with the world’s leading sovereign-backed investment company, striving to bring positive change to more families and communities.

Fluent in English, Mandarin and Cantonese, and well-versed in the cultural nuances of Singapore, Mainland China and Hong Kong, I’m able to offer personalised, efficient service to new immigrant families, local clients, and those from Chinese-speaking regions.

My Mission

Guided by the belief that “life influences life,” I focus on professionally safeguarding each client’s wealth, helping families create, preserve, and pass on wealth.

My Commitment

I provide customised financial plans tailored to each client’s needs, regularly reviewing and adjusting them to ensure their financial goals are met. Always putting clients’ interests first, I offer unbiased professional advice to break down information barriers and minimise financial risks, ensuring your long-term benefits.

Feel free to reach out if you have any questions or would like to learn more about my services. Thank you for visiting my website, and I look forward to connecting with you!

********

大家好,我是Rachel,是新加坡最大独立理财顾问公司Financial Alliance鑫盟理财的独立理财顾问。

我的背景

作为曾经的前线社工,我有幸帮助了数十个移民家庭解决生活和财务上的困难。随后,我在国际金融领域工作9年,专注于企业社会责任,并在全球领先的主权投资公司参与可持续发展项目,一直努力推动为更多家庭和社区带来积极的变化。

我精通中英粤三语,熟悉中新文化。这使我能够为新移民家庭、本地家庭以及来自其他华语地区的客户提供更贴心、更高效的服务。无论是在语言沟通还是文化理解上,我都能确保为客户带来更优质的服务和体验。

我的使命

秉承着“用生命影响生命”的信念,我致力于用专业守护每一位客户及其家庭的财富,让更多的个人和家庭实现创富、守富和传富。

我的承诺

我专注于通过个性化的风险管理策略,为每位客户量身定制财务方案,并定期评估和调整,以确保实现您的财务目标。始终以客户的利益和需求为出发点,提供中立的专业意见,助您打破信息壁垒,避免单一规划的财务风险,维护您的长期利益。

如果您有任何疑问或需要进一步了解我的服务,请随时联系我。感谢您访问我的个人网站,期待与您交流!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg