Protect Your Home Loan: Compare Mortgage Insurance Plans in Singapore

If Something Happens to You, Will Your Family Lose the Home?

The Bank Doesn’t Care Who Dies, It Still Wants the Loan Repaid

That’s why mortgage insurance matters.What is Mortgage Insurance?

Your home is likely your biggest financial commitment.

Mortgage insurance pays off your home loan if you pass away or become totally and permanently disabled.

It ensures your family keeps the roof over their heads — no matter what life throws at you.

What a mortgage insurance does for your family?

Mortgage insurance clears the outstanding loan if you pass away or become disabled — so your loved ones won’t lose their home.

See what gives your family the best protection, with no obligations! (click or tap here)

Some people think CPF Housing Protection Scheme is enough. There are better options flexible coverages that you leave your family with more than just a home and let you carry the plan if you move.

Let’s compare them together, I’ll show you what fits.

Frequently Asked Questions

1. Is mortgage insurance compulsory in Singapore?

If you’re using CPF to pay for an HDB loan, CPF automatically includes you in the Home Protection Scheme (HPS). That’s the default setup. You can apply to be exempted if you’ve got a private plan that meets their requirements.

For private property, mortgage insurance isn’t mandatory. Many still get it because it’s a smart way to protect the people living under that roof.2. What’s the difference between HPS and private mortgage insurance?

HPS is CPF’s version, only for HDBs. It settles the loan directly with HDB — your family doesn’t get a cash payout.

Private mortgage insurance covers HDB, EC, and private property. The payout goes to your family as a lump sum, giving them flexibility to settle the loan or handle other financial needs.3. Can I use CPF to pay for private mortgage insurance?

Most of the time, no. Premiums for private plans are usually paid in cash — GIRO, PayNow, or credit card. There might be special cases, though it’s rare. Always best to check with the provider first.

4. What if I refinance my home loan? Does it affect my coverage?

If you’re on HPS, you’ll need to inform CPF once your loan structure changes. Otherwise, your coverage may no longer line up with the new loan terms. Private plans depend on the insurer’s policy. Some let you adjust the coverage amount when refinancing, others don’t. Good to clarify before committing.

5. What does mortgage insurance not cover?

Every policy has exclusions. Common ones include pre-existing health issues that weren’t disclosed, suicide within a waiting period, and anything involving illegal activity. If you’re unsure, ask your advisor to walk you through the specifics.

6. Can I keep my private mortgage insurance if I move to another house?

Yes, many private insurers allow that. Some policies can be adjusted when you move — just make sure the one you choose is portable. It’s one of the advantages of going private.

7. How do I decide how much coverage I need?

Look at your outstanding loan amount and how many years you have left to pay it off. HPS reduces as your loan reduces. Private plans offer two types — reducing (just covers the loan) and level (gives your family more flexibility since the payout stays fixed). Your choice depends on whether you’re just covering the debt or giving your family something extra.

8. What’s the claims process like?

If something happens, your family just needs to submit the documents — like a death cert or medical report. Once the claim is approved, the payout is released. With HPS, CPF pays off the loan directly. With private plans, your family receives the funds and decides how they want to use it.

About me.

MAS Licensed Financial Advisor Representative – License Number: TTM300083218

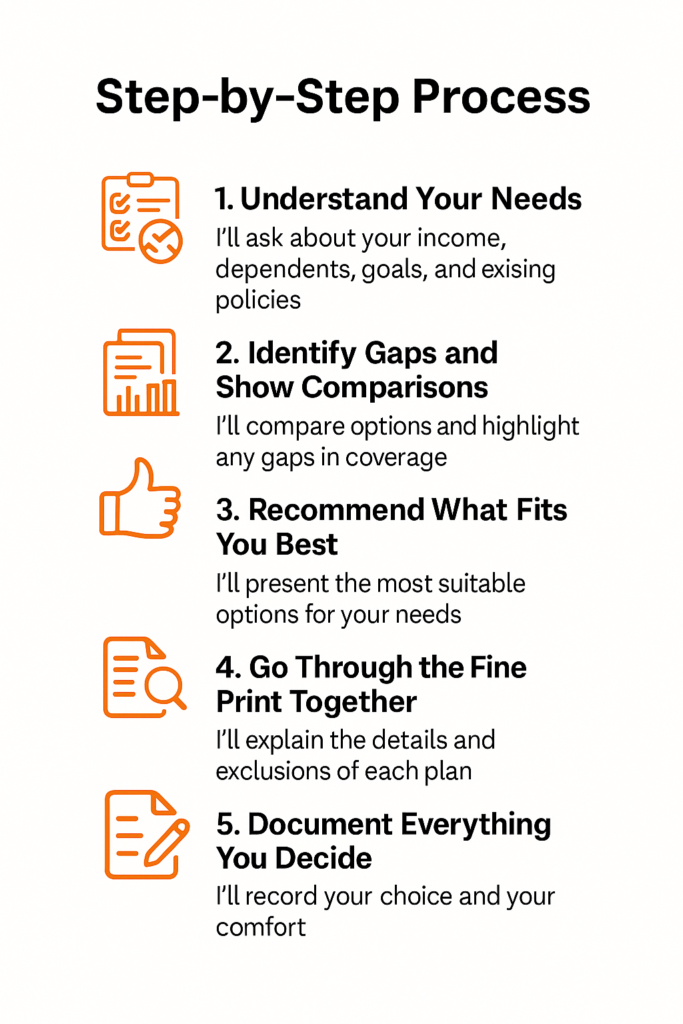

I’m Max, an independent MAS-licensed advisor. I help over 200+ Singapore families compare their options, without bias. Just what works best for them, and what I’ll do for you as well. Each recommendation is backed up by well researched reasons.

(For compliance purposes, I’m not able to share the names of the products or companies without a proper fact find.)

If you know what you want already, the process is simple. I send you a comparison and you choose what is it that you want.

It’s also clear that what we sometimes want is not what we need. That’s why an advisor is needed.

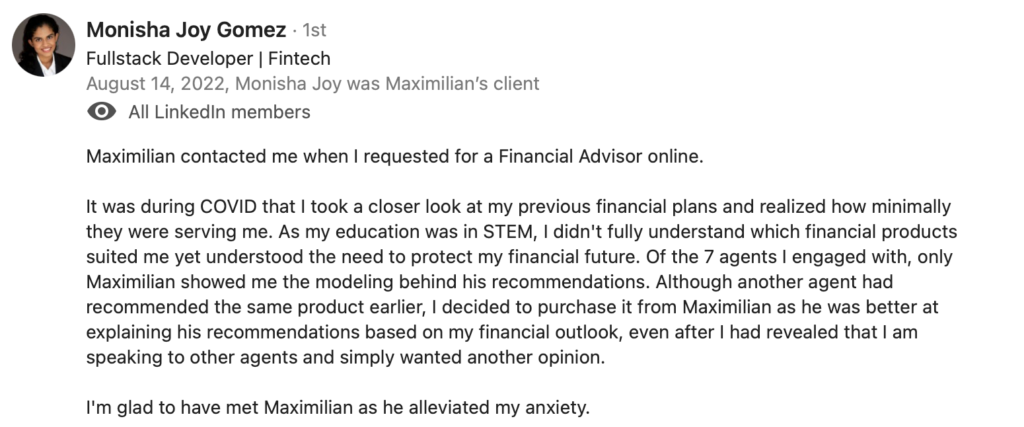

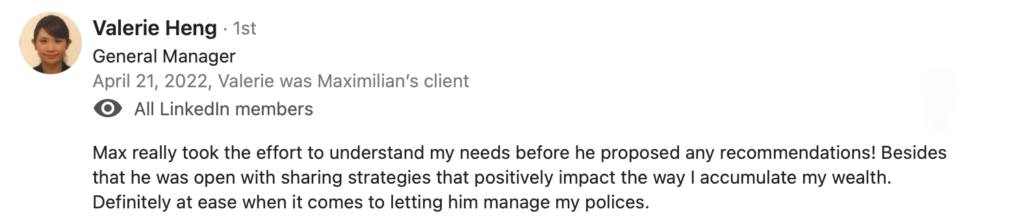

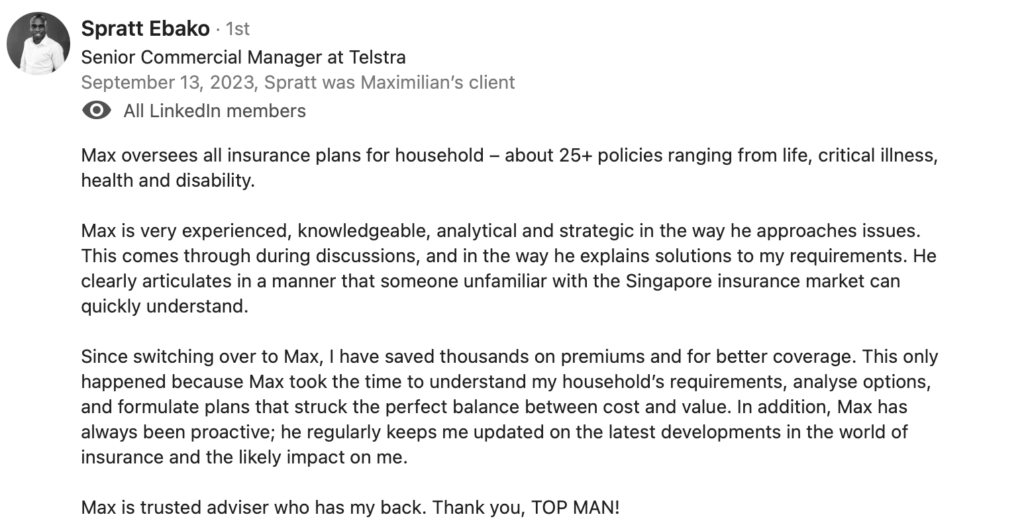

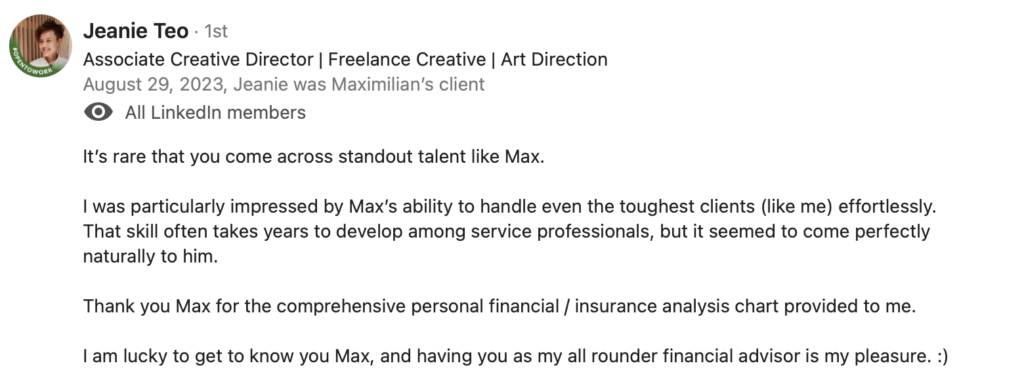

See what others have to say about my services.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg