The Million Dollar Retirement in Singapore: From Intimidating to Manageable

For many Singaporeans in their 50s and 60s, there’s a number that looms large in their minds. You’ve seen it in newspaper headlines and heard it discussed over coffee: the idea that you need at least 1 million dollars—or perhaps more—to retire comfortably. For many hardworking individuals, seeing this figure can be incredibly disheartening. It can feel like a mountain so high that you feel defeated before you even begin the climb, leading to anxiety and a paralyzing fear of inaction.

The biggest danger of this “magic number” myth is that it’s not just intimidating; it’s often the wrong way to think about retirement altogether. Focusing on one giant, unattainable sum can cause you to keep your hard-earned savings in low-interest bank accounts, where its value is silently eroded by inflation year after year.

But what if I told you there’s a smarter, more manageable way to plan? Instead of fixating on a single lump sum, let’s shift our focus to what really matters: creating a reliable monthly “paycheque” that will last you for the rest of your life. This approach turns an overwhelming goal into a practical, step-by-step plan.

From an Intimidating Number to a Practical Monthly Goal

Let’s start by throwing out the million-dollar question. Instead, ask yourself a much simpler one: “How much do I need each month to live comfortably?” Think about your expenses today and how they might change. Grab a pen and paper and jot down some estimates.

- Household Essentials: Groceries, utilities, HDB conservancy charges, phone and internet bills.

- Transport: Public transport fares, or car-related expenses if you plan to keep one.

- Healthcare: Premiums for your MediShield Life or Integrated Shield Plan, regular check-ups, medication.

- Lifestyle: Eating out, hobbies, an annual holiday, gifts for your grandchildren.

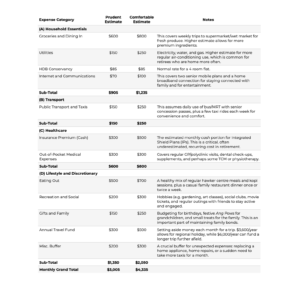

For example, let’s break down how a retired Singaporean couple could arrive at a monthly budget of $3,000 to $4,500. This estimate is based on the lifestyle of a couple who owns their HDB flat (fully paid), are generally healthy, do not own a car, and want to live a comfortable, active, and dignified retirement without being extravagant.

Here is a sample breakdown, showing a “Prudent” estimate and a more “Comfortable” one:

Above sample monthly retirement budget for a couple.

As you can see, it is very easy to arrive within the $3,000 to $4,500 range. The “Prudent” estimate allows for a pleasant, if modest, lifestyle. The “Comfortable” estimate provides a more aspirational retirement.

The most valuable takeaway here is not the specific numbers, but the exercise itself. I strongly encourage you to create your own version of this table. By doing so, you transform the scary, abstract idea of “retirement” into a clear, personal, and achievable financial goal.

Building Your Retirement Paycheque: Your Three Core Taps

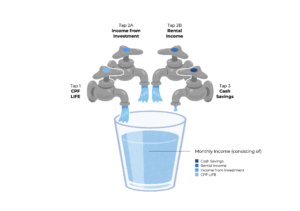

Once you know your monthly goal, the next step is to see where that money will come from. Think of your retirement income not as one big pot, but as flowing from three distinct “taps.” Our job is to turn on these taps at the right time to create a steady stream (see Fig. 2).

- Tap 1: The CPF LIFE is a national annuity scheme designed to give you a monthly payout for as long as you live, addressing the key fear of outliving your savings. The amount you receive depends on the savings in your Retirement Account (RA) when you choose to start your payouts, typically from age 65. Think of it as your reliable, government-backed base salary in retirement.

- Tap 2: This tap includes your investments and property—assets that can work for you to generate additional income. Many people fear investing at this age, worried about market crashes. However, the goal is no longer aggressive growth; it’s about generating stable, regular income.

- Investments for Income: The goal here is to have your savings work for you to generate a regular income stream. By carefully selecting a portfolio of these income-generating assets, you can create a reliable stream of dividends paid out to you. This becomes a valuable top-up to your foundational CPF LIFE payout, helping you comfortably meet your monthly retirement budget.

- Your Property: Your property can be actively used to create a reliable income stream. For those with investment properties, the rental yield already provides consistent cash flow. You can apply this same principle to your primary residence by renting out a spare room to generate a stable monthly income.

- Tap 3: The Savings Buffer This is your cash in the bank. Instead of seeing this as your primary retirement fund (where it loses value to inflation), think of it as your buffer for emergencies and planned big-ticket expenses. This fund can cover a home renovation, a special extended holiday, or unexpected medical costs, without forcing you to sell your income-generating investments at the wrong time.

Fig. 2: Monthly income from different “taps”.

The Two Biggest Threats to a Worry-Free Retirement

Two of the biggest anxieties in retirement are rising costs (inflation) and unexpected medical bills. A good plan addresses both head-on.

- Beating Inflation: The tap with your investments and property is your best tool against inflation. The income and growth from a diversified portfolio of investments have historically outpaced inflation over the long term, ensuring your purchasing power doesn’t shrink over time.

- Protecting Your Nest Egg: Your health is your wealth. A robust healthcare plan is the shield that protects your retirement income. It’s a three-layered defence:

- MediShield Life: Your basic, mandatory health insurance for large hospital bills.

- Integrated Shield Plan (IP): An upgrade offering coverage for private hospitals and higher-class public hospital wards, essential for greater comfort and choice.

- CareShield Life: Your critical long-term care insurance, providing monthly payouts in the event of severe disability.

Paying for a comprehensive health insurance plan isn’t an expense—it’s an investment in ensuring a single health crisis doesn’t derail your entire retirement plan.

Turn Your Plan into Reality

By shifting your perspective from a single “magic number” to a manageable monthly paycheque, the path to a secure retirement becomes much clearer. You can see how your different assets—CPF, property, investments, and savings—can work in concert to provide for you. You likely have more resources at your disposal than you realise.

Building this personalised roadmap takes careful thought, but you don’t have to navigate it alone. The choices you make in the coming years are critical, and getting them right can mean the difference between a retirement filled with anxiety and one filled with peace and purpose.

To help you take that crucial next step, I host a complimentary bi-weekly online workshop designed for individuals like you.

In this hands-on workshop, we dive deeper into the ‘Three Taps’ income model, tackle common retirement planning pitfalls, and answer your specific questions in a comfortable, online setting.

[Click here for more about this workshop]

If you are ready to move past the myth and build a practical, resilient retirement income plan, I am here to guide you.

Contact me today for a confidential, no-obligation consultation. Together, we can map out your income streams and build a retirement you can truly look forward to.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg