The Silent Thief: How Inflation is Robbing Retirees (And How to Fight Back)

Every time you pay a little more for your morning kopi or notice your usual cai png lunch costs an extra fifty cents, you’re feeling the effects of a quiet but relentless force. It’s a force that works 24/7, slowly but surely reducing the value of every dollar you have saved. I call it the “silent thief” of retirement, but you know it by its official name: inflation.

For those in their 50s and 60s, inflation isn’t just an economic headline; it’s one of the greatest threats to a secure and dignified retirement. A nest egg that seems perfectly adequate in 2025, could feel alarmingly small in 2035. The recent GST hikes are a clear reminder that costs inevitably go up.

Ignoring this silent thief is a risk we cannot afford. The good news is that with a clear understanding and a proactive strategy, you can protect your hard-earned savings and ensure your retirement income doesn’t just last, but maintains its purchasing power for the rest of your life.

Know your Enemy: Inflation by the Numbers

Over the last few decades, Singapore’s long-term average inflation rate has been around 2-2.5% per year. While that may not sound like much, its effect is like a slow leak in a tire—eventually, it leaves you flat.

Consider the “Rule of 72,” a simple way to estimate how long it takes for your money’s value to halve. If inflation averages 3%, it will take 24 years (72 divided by 3) for the purchasing power of your savings to be cut in half. The $500,000 you have today could have the buying power of just $250,000 when you need it most.

This is precisely why keeping the bulk of your retirement fund in a standard savings account is a losing strategy. For many years, the interest rates offered by banks have been lower than the rate of inflation, meaning your money is effectively shrinking every single day.

Your CPF LIFE Payouts: The First Line of Defence

Fortunately, our CPF system has a built-in tool designed to help with this problem. When you choose your CPF LIFE plan, you have an important option: the CPF LIFE Escalating Plan.

Unlike the Standard Plan which provides a level payout for life, the Escalating Plan starts with a slightly lower monthly payout but then increases by 2% every single year. This annual increase is specifically designed to help your income keep pace with the rising cost of living. While it means a little less in your pocket at age 65, it can mean significantly more by the time you are 80, providing a crucial buffer against inflation in your later years. Think of this as your foundational, inflation-aware income stream.

Putting Your Savings to Work: Building Your Second Income Engine

While CPF LIFE forms a solid foundation, the key to truly inflation-proofing your retirement is to build a second income engine from your savings. This involves a strategic shift from being a passive saver to an active owner of income-generating assets. Whether you choose to do this by carefully selecting a portfolio of individual dividend-paying stocks or by investing in professionally managed funds, the underlying principle is the same: creating a diversified stream of income without exposing your nest egg to excessive risk is critical. The goal is not to chase the highest possible returns, but the most reliable and sustainable income.

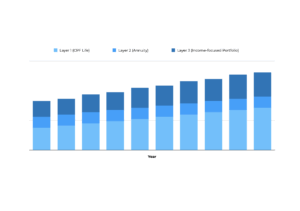

A prudent way to structure this is to think of your retirement “paycheque” in layers, with each layer serving a specific purpose. For example:

- Layer 1 (The Foundation): Your CPF LIFE payout provides a guaranteed lifetime income stream to cover your most basic, essential needs.

- Layer 2 (The Security Layer): To supplement this, you might use a portion of your savings for an Annuity Plan. Let’s say your essential monthly expenses are $2,500 and your CPF LIFE provides $1,600. An annuity could be structured to reliably pay out the remaining $900, ensuring all your non-negotiable expenses are covered with a high degree of certainty.

- Layer 3 (The Inflation-Fighting Layer): With your core needs secured, the rest of your investment portfolio can be dedicated to fighting inflation and funding your lifestyle wants (like travel, hobbies, and dining out). This is where an Income-Focused Portfolio can be effective. It provides a diversified stream of income through distributions, while its underlying potential for capital growth helps your overall purchasing power stay ahead of rising costs.

By combining the certainty of CPF LIFE and annuities with the growth potential of diversified funds, you create a robust, multi-layered income stream (see Fig. 1). This approach allows you to secure your essentials while still allowing a portion of your capital to grow, providing a comprehensive defence against the silent thief.

Fig. 1: Creating a multi-layered income stream.

Don’t Let the Thief Win

The threat of inflation is real, but it is not unbeatable. Passively letting your savings sit in cash is an invitation for this silent thief to rob you of your future security. By taking proactive steps such as optimising your CPF LIFE plan and building a diversified, income-focused investment portfolio, you can turn the tables.

Crafting a resilient portfolio that balances your immediate income needs with the long-term necessity of growth requires careful planning and a steady hand. The choices you make now will determine whether your retirement income dwindles or endures.

To help you take that crucial next step, I host a complimentary bi-weekly online workshop designed for individuals like you.

In this hands-on workshop, you get to stress-test your retirement plan against inflation, tackle common retirement planning pitfalls, and get your specific questions answered in a comfortable, online setting.

[Click here for more about this workshop]

If you are ready to build a robust financial plan that protects your purchasing power for decades to come, I am here to help.

Let’s connect for a no-obligation consultation to design your inflation-proof retirement income strategy.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg