From Squeezed to Savoured: A Financial Roadmap for the Sandwich Generation

You’ve spent decades building a career, saving diligently, and dreaming of a comfortable retirement. You’re so close. But lately, you feel a familiar squeeze. Your aging parents require more support, both financially and physically. At the same time, your adult children, navigating a competitive job market and the high cost of living, still lean on you for help.

Welcome to the “Sandwich Generation.” You are caught in the middle, caring for two generations simultaneously. It’s a role born out of love and filial piety, but it comes with immense financial and emotional pressure.

The decisions you make in this pre-retiree phase are critical. Mismanaging this squeeze can unravel decades of careful planning, forcing you to delay retirement, downsize your dreams, or worse, become financially dependent on your own children later. But with a strategic and compassionate approach, you can navigate these challenges, support your loved ones, and safeguard the golden years you’ve worked so hard for. This article will provide a practical framework to help you do just that.

Have the ‘Money Talk’ – Sooner Rather Than Later

In many Singaporean families, money is a taboo topic. We’re taught to respect our elders and not pry into their finances. However, having open conversations about money with both your parents and children is no longer just advisable—it’s essential.

With Your Parents: Frame the conversation around their well-being and ensuring their wishes are met. The goal isn’t to scrutinise their spending, but to understand the full picture. Key questions to gently explore include:

- Retirement Adequacy: Do they have a CPF LIFE plan, and is the monthly payout sufficient for their daily needs?

- Healthcare Provisions: Beyond the basic MediShield Life, do they have an Integrated Shield Plan (IP) for enhanced hospital coverage? This could be for a higher-class ward (like A or B1) in a public hospital or for a private hospital. Understanding their plan helps you anticipate out-of-pocket medical expenses. Are they covered by CareShield Life for long-term disability?

- Assets and Liabilities: Do they have other savings? Are there other income sources (rental income, income from investments)? Are they still servicing any loans?

With Your Adult Children: The conversation here is about fostering independence while understanding their goals. Discuss their career path, savings habits, and any significant financial goals like getting married or buying their first HDB flat. It’s crucial to manage expectations about the level of financial support you can provide for these milestones.

Having these conversations can be awkward, but ignorance is not bliss. A clear understanding allows you to plan effectively, preventing surprises and financial emergencies down the road.

Set Clear Boundaries: You Can’t Pour from an Empty Cup

Filial piety is a core value, but it shouldn’t mean sacrificing your own financial security. Your ability to help your family tomorrow depends on you being financially stable today. This is where boundaries become your most important tool.

Financial Boundaries: First, review your own retirement plan. How much do you need to set aside each month to reach your goal? Once this amount is earmarked, you can determine what you can sustainably afford to give to your parents and children. This isn’t about being ungenerous; it’s about being realistic.

Differentiate Needs from Wants: Are you funding a parent’s essential medical treatment or a discretionary expense? Are you helping a child with a downpayment for a BTO flat or funding a lavish wedding beyond their means? Prioritising needs over wants ensures your support has the greatest impact without derailing your own finances. Setting these boundaries early helps manage expectations and prevents resentment from building up on all sides.

Don’t Forget Your Own Oxygen Mask: Prioritise Your Retirement

The airline safety briefing has it right: you must put on your own oxygen mask before helping others. Your retirement security is paramount. If you are not secure, you cannot be a safety net for anyone else.

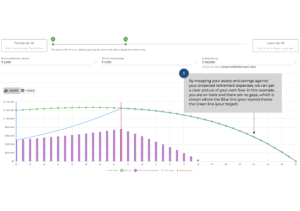

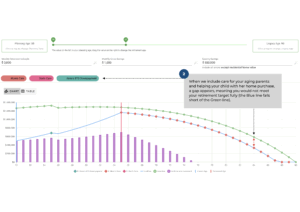

1. Stress-Test Your Plan: This is a comprehensive cash flow projection. Map all your assets—cash savings, investments, CPF balances, and properties—against all your liabilities and projected retirement expenses. Then stress-test this complete picture against the “what-ifs”:

- What if your investments underperform?

- What if you face a major medical emergency?

- What if your parents require costly long-term care?

This “stress-test” moves you from hoping you have enough to knowing you have a resilient plan that can withstand real-life pressures (see example below).

Above example of “Stress-Testing” your plan.

2. Build Your “Second Engine” with Private Investments: Your CPF is your stable foundation, but you need a “second engine” for growth, inflation-proofing, and liquidity.

- Maximise Your Supplementary Retirement Scheme (SRS): This is a powerful non-CPF retirement tool. It provides immediate tax relief today and allows you to invest in a wide universe of assets that can grow your nest egg faster.

- Create an Investment Portfolio: Combine the certainty of CPF LIFE with the growth potential of a diversified investment portfolio. This robust approach allows you to secure your essentials while still allowing a portion of your capital to grow, providing a comprehensive defence against inflation.

Essentially, we need to ensure you have robust, independent financial pillars that stand strong, even as you generously support your family.

Take Control of Your Future

Navigating the financial and emotional demands of the Sandwich Generation is one of the most complex challenges you will face. It requires a delicate balance of love, responsibility, and unwavering focus on your own future. Open communication, firm boundaries, and smart strategies are your keys to success.

You don’t have to figure this out alone. As a financial advisor specialising in retirement planning for pre-retirees, I host a complimentary bi-weekly online workshop designed for individuals like you.

In this hands-on workshop, you get to stress-test your retirement plan against your family’s needs, and build a clear roadmap that allows you to care for your loved ones without compromising the secure and fulfilling retirement you deserve.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg