Lump Sum or Dollar Cost Averaging… Which works better?

With regard to investment, u probably have asked yourself the question above…

The answer:- it depends 🙂

When we invest, there are 3 possible outcomes:-

a) market goes up

b) market goes sideways

c) market goes down.

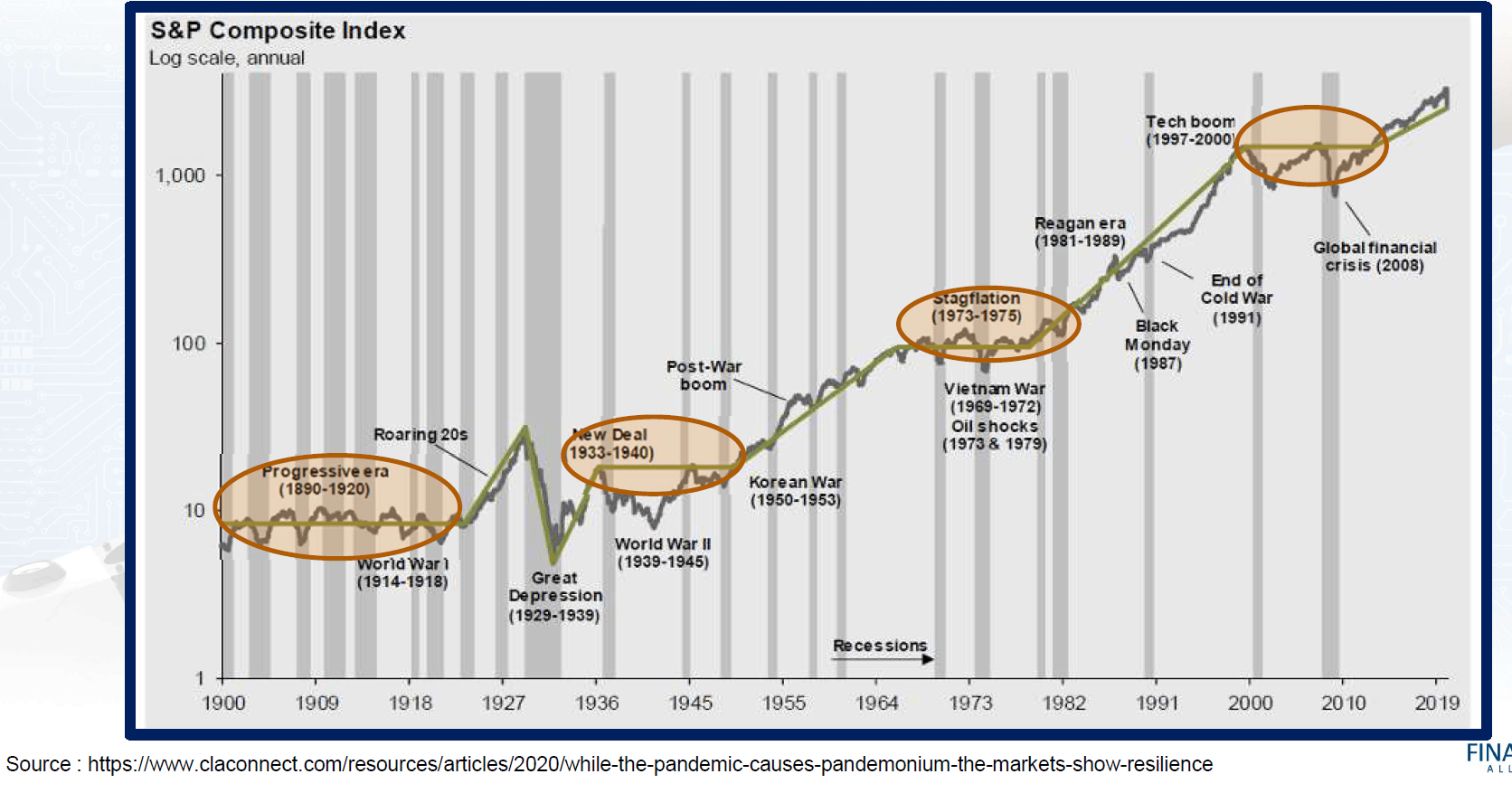

For lump sum investment, we make profit if (a) occurs. On the other hand, (b) and (c) are not uncommon as illustrated in the following diagrams:-

Periods when S&P Index (US) was trading sideways

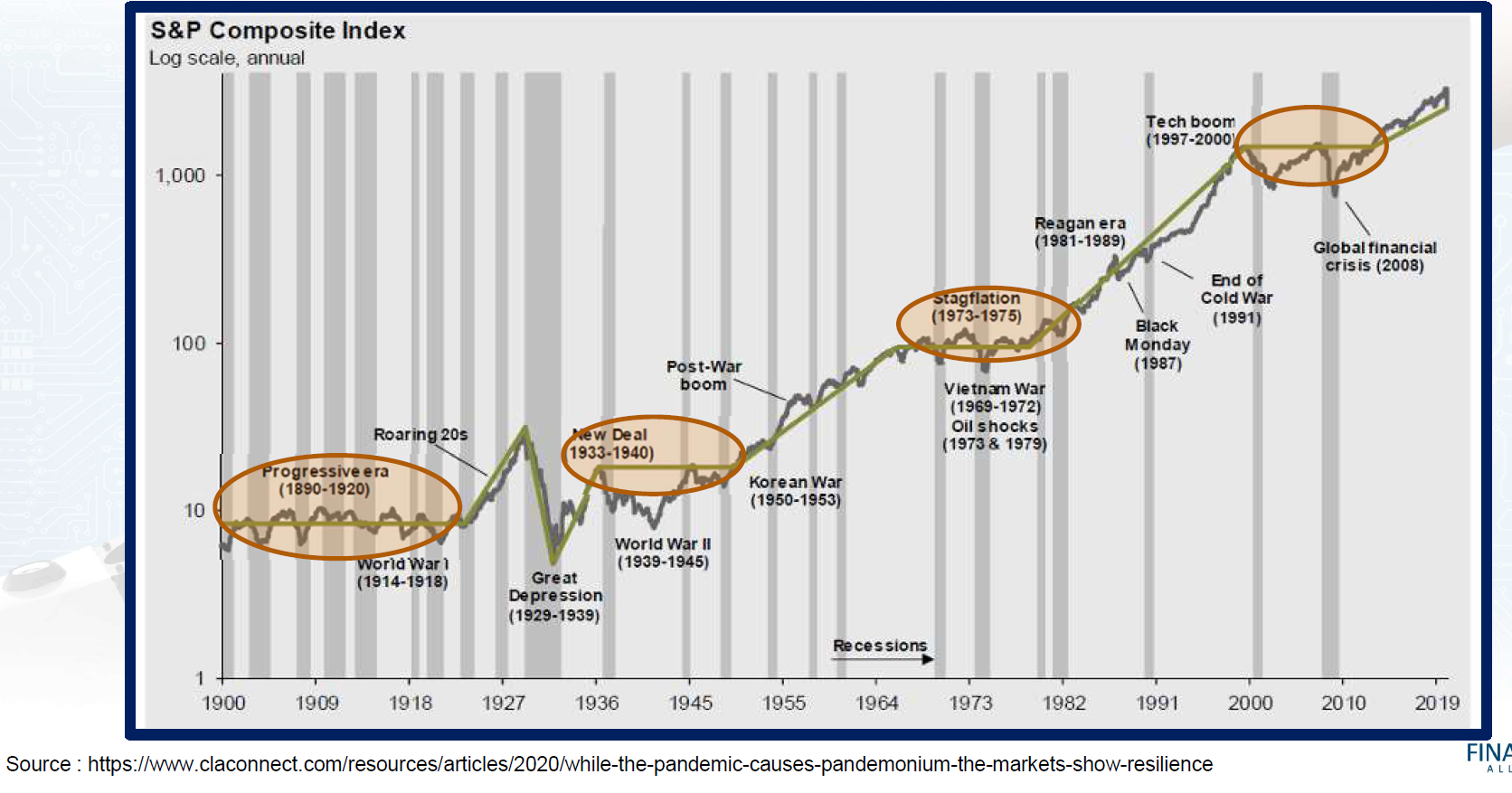

Magnitude & Frequency of Market Drawdown

Let me now define dollar cost averaging.

Dollar Cost Averaging (“DCA”) involves investing a fixed dollar amount at regular intervals (monthly/quarterly etc) over a period of time. By setting aside a fixed amount consistently, it allows you to manage your emotion while taking advantage of market volatility to buy more during a market correction.

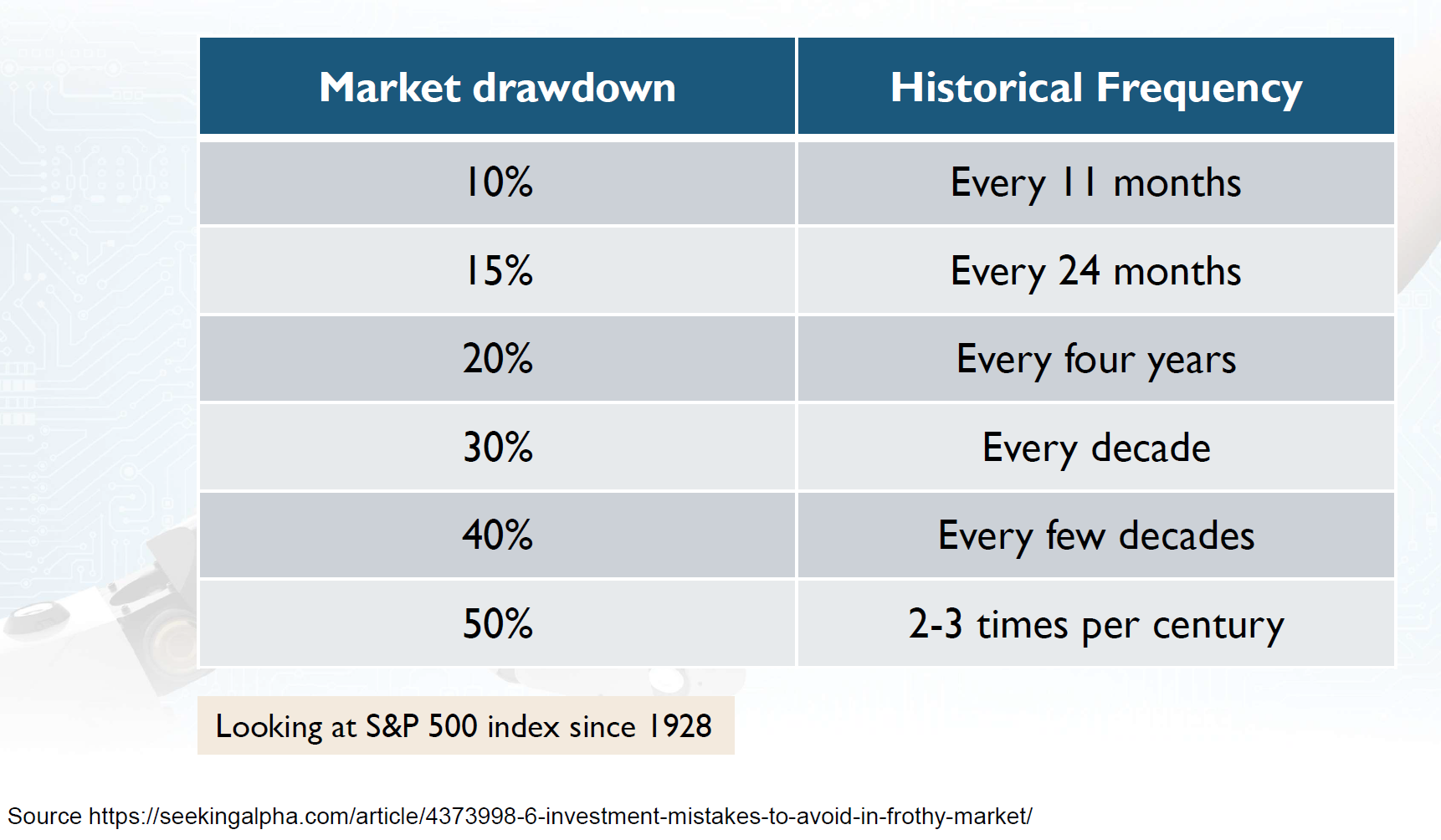

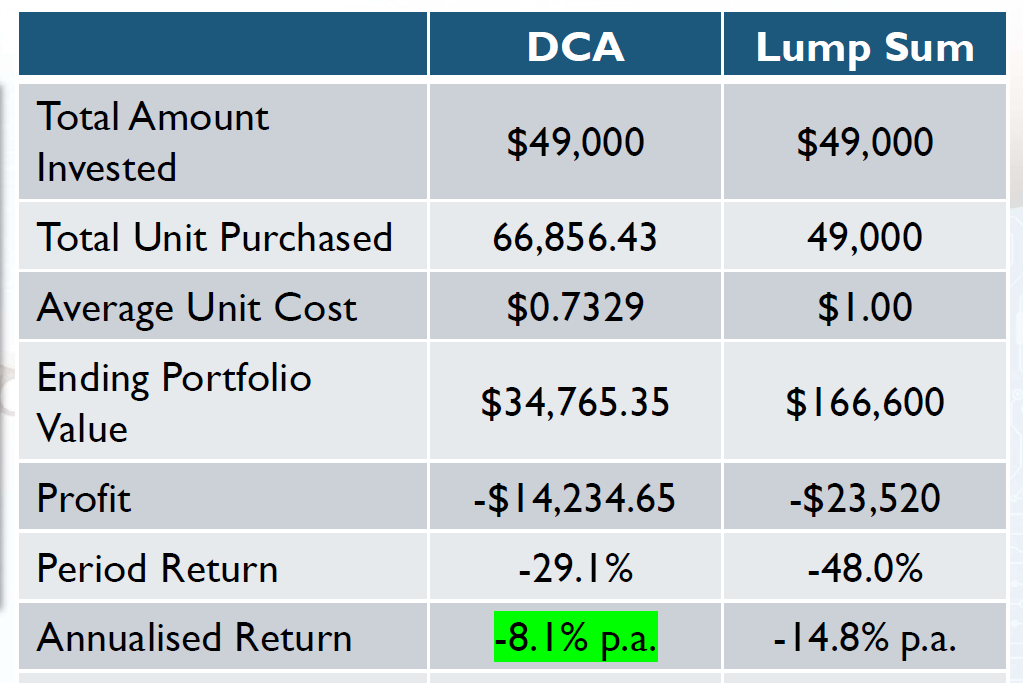

My Investment Director recently did an analysis on DCA, assuming certain scenarios, using the following parameters:-

a) a fixed amount of $1,000 is invested monthly;

b) a period of 49 months; and

c) a sideway market (market starts and ends at the same level) as well as a down market

1st scenario: Market Goes Up and Down a Lot (Up +120%, Down -90%)

2nd scenario: Market Goes Up and Down a bit (Up +30%, Down -30%)

3rd scenario: Market goes down -48%

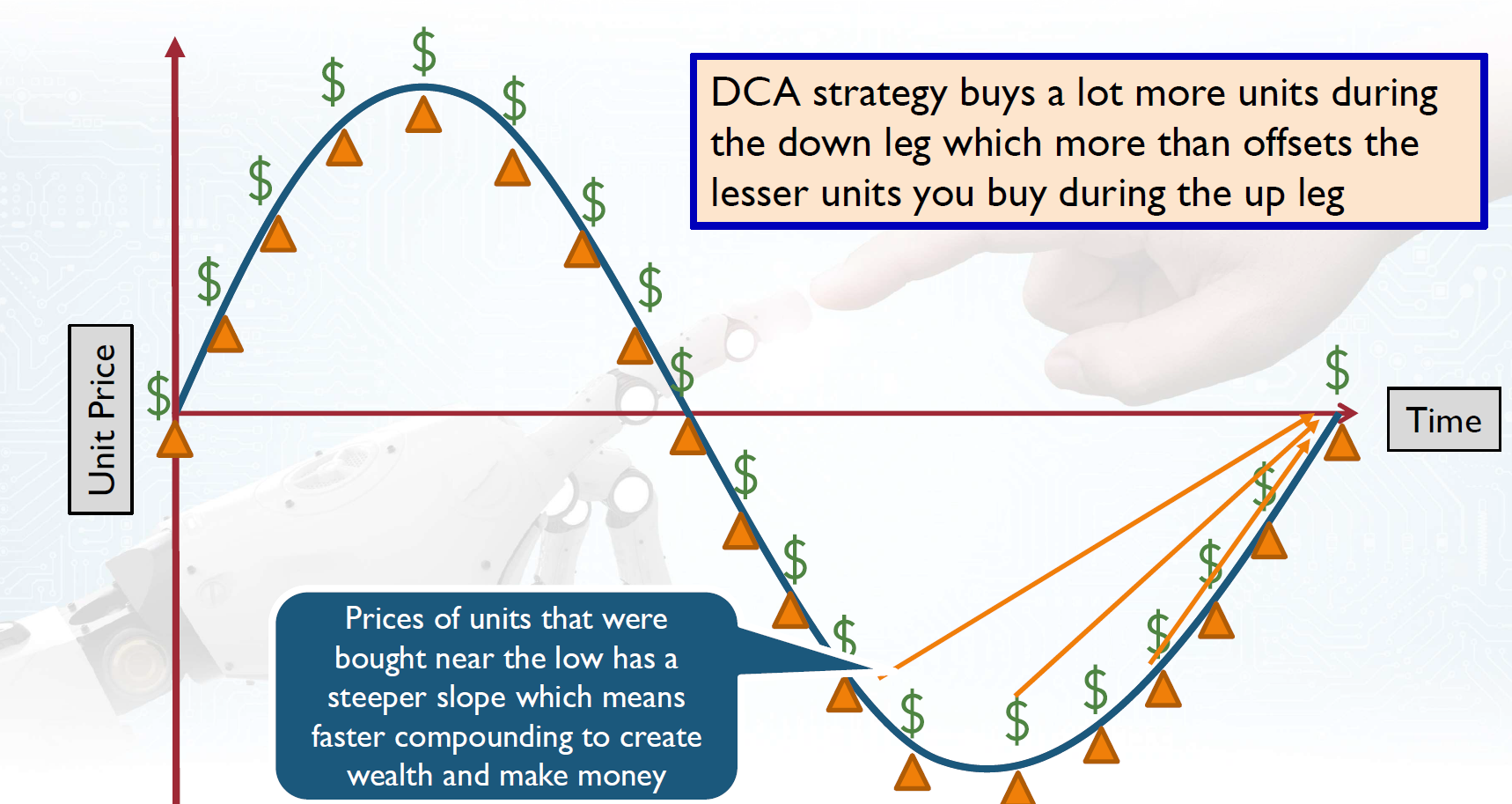

So long there is volatility, DCA outperforms lump sum in a sideway market (prices starts and ends around the same price) or in a down market.

Reason why DCA outperforms in a sideway market

The fact that more units are bought during the down leg allow faster compounding when the market recovers.

——————————————————————————————————————————————————————————–

Key Takeaways on DCA

a) Takes timing out of the equation (useful given the unpredictable nature of markets)

b) Helps to manage the emotional aspect of your investment journey (instead of looking at market corrections as a stressful period, we should now see such corrections as good opportunities to accumulate more units)

c) Ability to generate return in a sideway market

If you have any question on DCA strategy or connect with me.

Article is written by Thomas Ong Cheow Siang, Financial Advisory Manager.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Raymond Wee Sian Wen

🚥🚥I lead a team of fun-loving consultants who want to give the best advice to their clients. We are tight-knit & support each other through the ups and downs of managing our business. If like me, talking to others about their dreams and their money gives you the buzz, then message me. We’ll meet up for a chat about the work that I do. You could join my team and do this too.

📚📚Straight out of uni in the mid-1990s, I sought a career that connects with people and has flexible working hours.

⏰⏳This led me to join Prudential, where after a decade, I moved to Financial Alliance. Here, we have an array of financial service partners, which presents my clients with more choices for insurance and investments.

👨👩👦👦👨👩👦👦In my personal life, I have 2 school-going boys. It will be awhile before they fly the nest. So I bide my time setting aside & growing my assets, while I dream of the mountains I will climb and the causes I will champion, without consideration of work the Monday after.

I’d like to enable my clients to have a retirement dream too– where they live their last chapter with financial freedom & dignity.

If you are now at the peak of your life and career and are looking for sound financial ideas. Whatever you dream of, wherever you want to go, I will help you plan to get there—financially.

With over 20 years of experience and the right ideas to usher you through your unique life situations, I am able to craft a financial plan that works for you. Please drop me a message.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg