CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg

On Average, 1 in 3 people in Singapore will be diagnosed with cancer sometime in their lives.¹

In 2020, 28.6% of total deaths in Singapore are caused by cancer.²

According to MOH, cancer is the second leading cause of hospitalization among Singaporeans in 2019-2021.²

It is against this backdrop that the Ministry of Health (MOH) made sweeping changes to the financing of outpatient cancer treatment³. This is done with the aim of keeping the overall expenditure on cancer treatments sustainable and rise in insurance premiums manageable.

Under the new outpatient cancer financing framework, MediShield Life and private Integrated Shield Plans (IPs) will only cover outpatient cancer drug treatments that are included in the Ministry of Health’s Cancer Drug List (CDL)³.

The CDL specifies both the drug name and the cancer type it is approved to be used on. This means that even if a particular drug has been included on the CDL for one type of cancer, it does not mean that treatment will be covered for another type of cancer.

Therefore, cancer treatments prescribed by your doctor that are not on the CDL will need to be paid for in cash or by some other insurance policy, such as a critical illness plan or cancer-specific standalone policy. This is because Integrated Shield Plans are forbidden from providing coverage for non-CDL drugs and treatments.

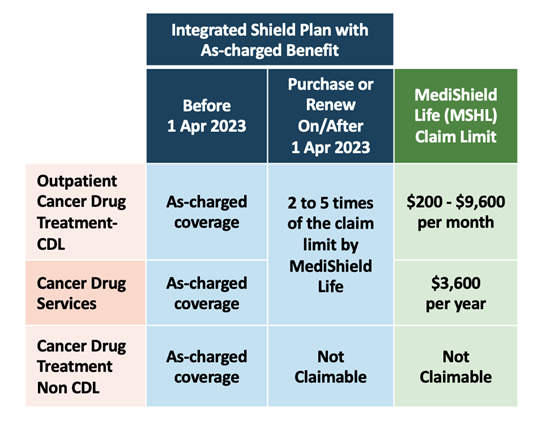

In addition to specifying the drug and type of cancer, the CDL also introduces limits on MediShield Life claims and the maximum amount of MediSave allowed to be used. In the past, the majority of Integrated Shield Plans operate on an as-charged basis.

Under this round of changes, separate claim limits for cancer drug services have been introduced. These cover ancillary procedures that are part of the cancer treatment, including consultations, scans, lab investigations, chemotherapy preparations, supportive care drugs and blood transfusions.

This means that if a particular approved treatment on the CDL costs more than the allowable MediShield Life claim limit, patients would need to claim against their integrated shield plans – up to the policy limits. If this is still insufficient, patients will then need to top-up any shortfall in cash.

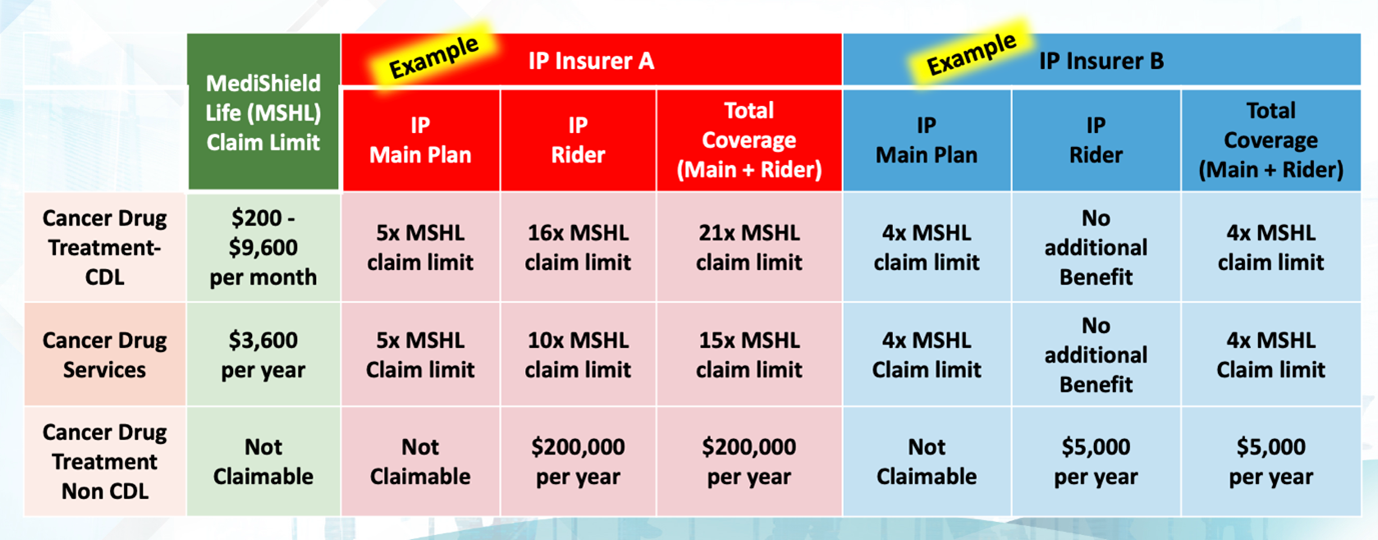

In response to the Cancer Drug List (CDL), Integrated Shield Plan (IP) providers have started to offer rider plans for IP policyholders to enhance outpatient cancer drug treatment coverage.

However, it is important to realise that IP riders’ coverage differs significantly among the IP insurers. Therefore, the impact on IP policyholders varies depending on the IP rider’s coverage level.

These changes to the way outpatient cancer drug treatments can be financed have huge implications for Integrated Shield Plan (IP) policyholders. The best time to review your coverage is now – when you are in good health and do not require claims for cancer treatment (and hopefully never).

Here are three things you should do today to ensure you are adequately protected financially, so that even if the worst were to occur, finances would not be a worry or impediment to your recovery.

Do you know what is your coverage gap that resulted from the reduction in coverage on outpatient cancer drug treatment? Even if the policies you bought previously were adequate for you previously, this might not hold true in light of the changes.

If you are considering switching your IP because you are attracted by the more comprehensive riders provided by another insurer, you should not make this decision lightly. It is usually a bad idea to switch IP insurers, and you need to fully understand the implications of doing so.

Besides IP riders, there are other options that you can use to boost your cancer coverage. These include standalone cancer plans, critical illness policies, and more. Each of these options have varying costs, claim criteria, and should be used as part of a holistic protection portfolio.

At Financial Alliance, our focus is you. We provide quality advice – unbiased, client-centered, and grounded in deep expertise – ensuring your cancer protection plan truly serves your best interests.

Our experienced consultants and in-house research team assess a wide array of options to deliver well-rounded and customized cancer protection solutions, thoroughly researched for your peace of mind.

Access a comprehensive suite of quality financial products and services with us. We provide the responsive service and robust support you need to achieve your financial goals, starting with the right cancer protection.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

There are many cancer protection plans in the market.

Some are suitable for younger clients, some are suitable for senior clients.

There are also plans that is made for clients that have contracted cancer in the past and wants to cover for future cost of relapse.

Every client of ours is unique. We want to ensure that you get the best Cancer Protection Plan within your budget.

Schedule a consultation session with our financial consultant to and get a FREE Cancer Plan Comparison Report.

By clicking “Schedule a Consultation Session” above, you consent to our Terms of Service, Privacy Policy, and consent to receive automated calls/texts from Financial Alliance Pte. Ltd. Consent is not a condition of any solicitation of services.