Written by Leon Lim (team member) – If you are thinking about life insurance, you might wonder when is the best time to get it. The answer to that question depends on several factors. This includes your age and health, your family’s needs, and your financial situation. Let’s take a closer look at each of these factors to help you decide when is the best time for you to get life insurance.

What is life insurance?

Life insurance is a type of financial protection that provides a financial benefit to your loved ones if you pass away. It can help cover their expenses and provide them with financial stability in the event of your death. It can also help to pay off debts, such as a mortgage, and provide money for final expenses like funeral costs. It is important to remember that the best time to buy life insurance is when you are healthy and have dependants who rely on your income.

Do I need insurance if I have no dependants?

Some people believe that if they have no dependants, they do not need life insurance. However, this is not always the case. If you have debts, such as a mortgage, car loan, or credit card debt, life insurance can help your loved ones pay off these debts if you pass away. Life insurance can also help to pay for final expenses, such as funeral costs.

Why should I buy life insurance when I am young and healthy?

Do you need to get life insurance when you are in your 20s? 30s? It depends. One of the main reasons to purchase life insurance when you are young and healthy is that premiums are often less expensive when you are younger.

Additionally, if you are healthy, you are more likely to qualify as a “standard life” for any policy. Younger people also have more years to accumulate the cash value of their whole life policies. Thus, if you are young and healthy, purchasing life insurance can be both cost effective and a sound financial decision.

While life insurance can be a wise investment when you are young and healthy, it can be particularly difficult to buy if you are older and/or have a health condition. If you have a pre-existing condition, it can be more difficult to qualify as a “standard life”.

What are the consequences if I delay buying insurance for too long?

There is no rule that says you have to buy your insurance policy at a certain age. A young person who started working will neither have dependants nor much debt. While technically there is no need for a young person to get life insurance, it may be unwise or even risky to put it off for too long. Here are the top 3 reasons why:

1. More expensive premium

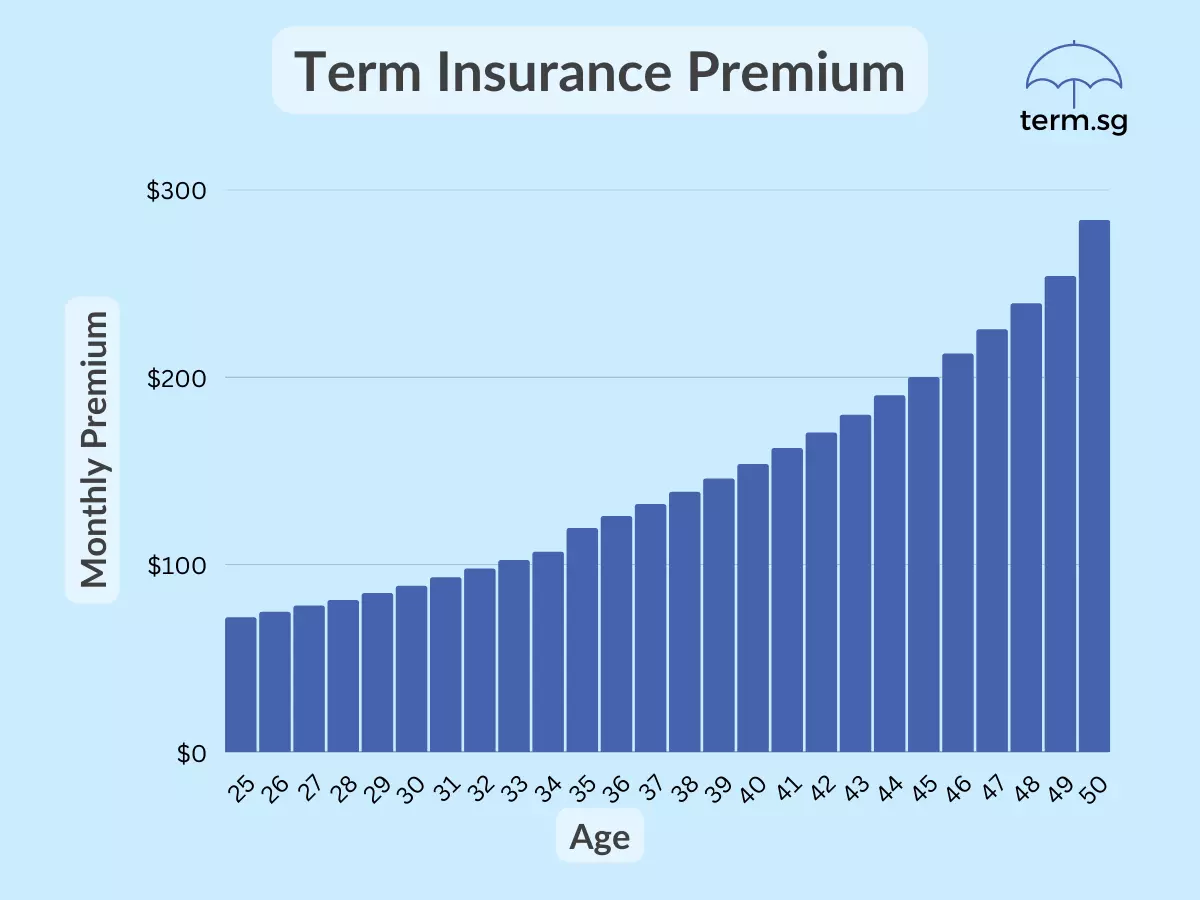

The longer you delay, the higher the premium. Let’s look at the following example.

If you were to get the coverage at age 25, your premium is only $71.76 per month. Every year that you delay comes at a cost of 5.67% increase on average.

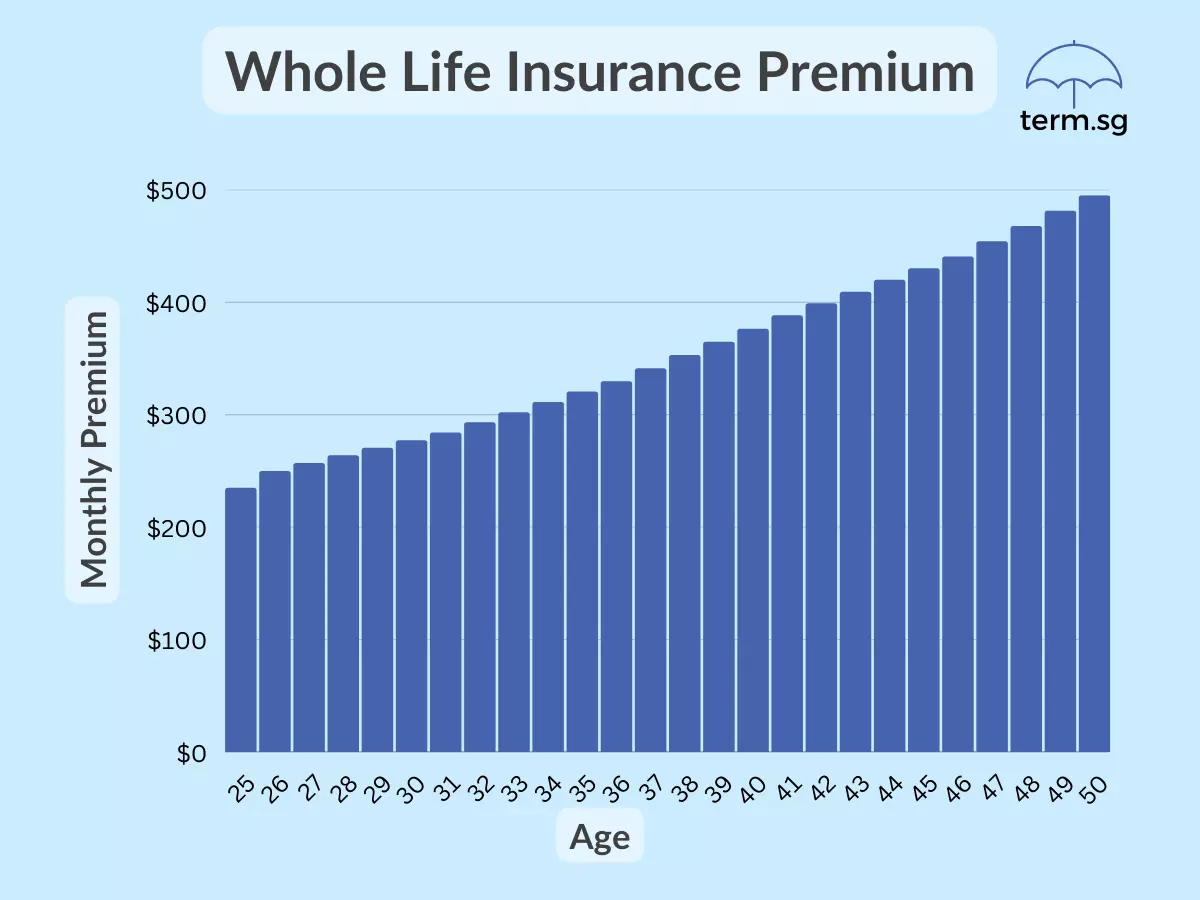

Let’s look at an example for whole life insurance.

If you were to get the coverage at age 25, your premium is only $234.75 per month. Every year that you delay comes at a cost of 2.95% increase on average. In addition, If you were to start older, your cash values will have a shorter time to accumulate and grow.

Nobody likes to pay more to get the same product, let alone paying more to get a worse product. This is what may happen if you delay too long:

2. Higher chance of being denied a standard policy

One of the possible risks of delaying for too long is NOT being accepted as a “standard life”. Certain health conditions may make it expensive or impossible to get a life insurance policy. It is important to already have an insurance policy before developing any medical conditions (ie. buy when you are healthy).

Moreover, it is very common to have 1 or more of these conditions as one get older:

Prevalence among adults aged 18 to 69 years 2017. Source: MOH

Here are the possible consequences of applying for insurance when you already have a pre-existing condition:

The worst case scenario is when you fall seriously ill without any insurance. And due to the illness, you are also unable to get any coverage for the rest of your life. You need to consider this risk when deciding when you should get an insurance policy.

3. Letting your loved ones bear the financial burden

Anyone with dependants is taking a huge risk if they do not have adequete life insurance. It is a tragedy If a person dies and their loved ones have to sell their home or dig deep into their savings to make ends meet. This is the true cost of delaying your life insurance coverage.

This could have been avoided if they have an affordable term insurance policy. Once you have loved ones who are dependant on you (eg. a newborn child), it is important to stop delaying and get yourself covered.

In most cases, we buy insurance not for ourselves but for our loved ones.

Conclusions | TL;DR

You can only buy insurance when you are still healthy. It also makes sense to buy when you are younger because premiums are cheaper. Delaying can have dire consequences for your loved ones.

If you are on a tight budget, you can consider buying an inexpensive term policy with a feature that allows you to increase the sum assured in the future without underwriting. For example, a policy with $1,000,000 sum assured for death and TPD for a 30 year old male (cover to age 60) is only $38.80 per month.

Lock in your insurance coverage before it is too late.

This article was originally published in term.sg

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Jacqueline started her financial planning journey with as an agent with a Tied Agency in 1997. Over time, as the insurance industry became more competitive and clients’ needs evolved, she saw the importance of improving customer experience by offering more well-rounded advice and customised products that would appeal to her clients at a deeper level.

In 2007, she joined Financial Alliance as an Associate Director as she is aligned with their vision of providing a service that is both balanced and unbiased. In doing so, she created an autonomous and productive team of her own.

Under her leadership, Jacqueline’s team grew in size and business has thrived. Today, she has 19 Advisory Associates under her management.

Perhaps the reasons for her team’s prominence and for people taking the plunge to join her are because of her candor, affection, and the consideration she has for her team members and clients.

The insurance industry is one of the most dynamic and complex industries in Singapore, but Jacqueline has made her agency flourish by staying agile and flexible, and she has kept up with all the changes by staying abreast of emerging technologies and trends.

Jacqueline’s commitment is that she will always be unselfish with her own time and her own energy in order to support her team members. This is based on her belief in helping them discover financial success by trusting them and motivating them to do their best.

If Jacqueline’s nurturing way resonates with you, come and learn more about how you can be part of her team.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策