FINALLY!

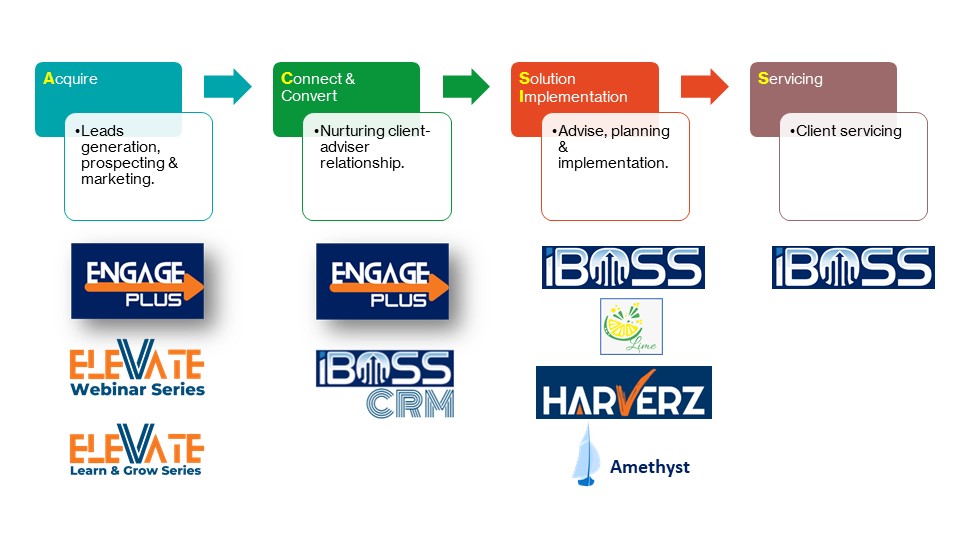

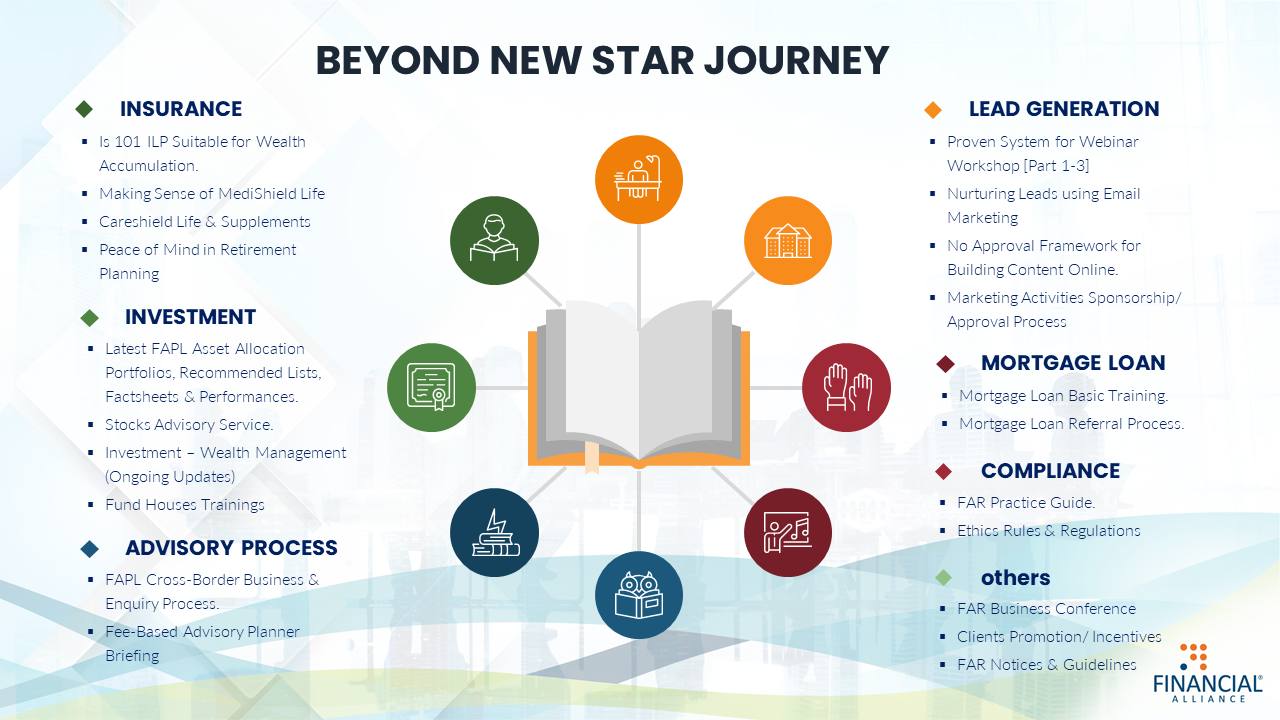

Join the Largest IFA* Firm in Singapore To Accelerate Your Career Progression By Providing Unbiased, Independent, Cost-effective Client-First Solutions

Especially If You Feel You Are Approaching A Mid-Career Crisis

Footnote:

*Independent Financial Advisory