Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

罗国强(Kenny Loh) 是一位杰出的财富咨询总监,专长于综合投资规划与遗产管理。他擅长协助客户实现投资资本增值,并建立退休被动收入来源。同时,他通过税务优化的方式帮助客户将投资组合高效转移给受益人,运用风险缓释策略确保资本增值的税务效率,并通过战略性资产配置实现财富传承的最优化。

除咨询工作外,罗国强是新加坡交易所学院(SGX Academy)的特聘讲师,专注于新加坡房地产投资信托(S-REIT)投资领域,并定期在MoneyFM 89.3电台分享专业见解。他拥有认证遗产与传承规划顾问(Certified Estate & Legacy Planning Consultant)及国际认证财务规划师(CFP)资格。

在逾十年的综合遗产规划经验中,他独创“遗嘱、持久授权书与备用信托三合一”解决方案,兼顾客户的社会责任、法律义务、情感需求及家庭和谐。他持有工商管理硕士与电气工程硕士双学位,并获英国遗嘱撰写及遗产规划从业者协会(SWWEPP)与亚洲认证机构遗产规划从业者有限公司(EPPL)联合授予副遗产规划从业师(AEPP)专业资格。

Arrange for a non-obligatory one-to-one free consultation here!

立即预约免费一对一咨询(无需承担任何义务)!

My Videos

My Events

Quick Insurance Comparison

Testimonials

Tan Kiam Hong

Senior Manager, Business Transformation

Andrea Lin

Senior Proposal Specialist, Asset and Wealth Management

Christopher Cheong

Teacher

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg

Take control of your insurance by exploring our self-service options, offering autonomy and flexibility for knowledgeable individuals.

Contact Me

ACKNOWLEDGEMENT

By submitting this form, I confirm that

提交此表格,即表示

- I have read and understood FAPL’s Personal Data Policy, and hereby give my acknowledgement and consent to FAPL to use my personal data in accordance with FAPL’s Personal Data Policy.

- 我已阅读并理解鑫盟理财私人有限公司的个人数据保护政策,并同意鑫盟理财私人有限公司根据个人数据保护政策所阐述的用途使用我的个人资料。

- I have read and understood the disclaimers above and hereby affirm my acceptance of these terms.

- 我已阅读并理解了上述免责声明,特此声明接受这些条款。

- I have not been directly contacted or approached by any representative or employee of FAPL with an offer or solicitation to apply for any financial products not offered in my home country.

- 鑫盟理财私人有限公司的代表或员工并未直接与我联系或提出要约或招揽购买我原居住国境内所不提供的任何金融产品.

- Financial Alliance Pte Ltd ( “FAPL”) is licensed by the Monetary Authority of Singapore (“MAS”) and allowed to conduct financial advisory activities in accordance with the Financial Advisers Act (Cap. 110) (“FAA”) and the Securities & Futures Act (Cap. 289) (“SFA”) within the jurisdiction of the Republic of Singapore and in accordance with the licenses granted by MAS

- 鑫盟理财私人有限公司( “鑫盟理财”)持有由新加坡金融管理局(“MAS”)所颁发的牌照,并许可在新加坡共和国境内依据财务顾问法(第110章)和证券与期货交易法(第289章)进行财务咨询等相关业务

- Any services provided by FAPL to persons not ordinarily resident in Singapore are provided solely on an offshore basis from Singapore, resulting from direct enquiry on the part of the foreign residents.

- 鑫盟理财为非新加坡居民所提供的任何服务仅限于直接向鑫盟理财发出咨询请求的国外居民。

- As an integral part of the provision of such services, FAPL may from time to time make available to such residents, documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of the foreign jurisdiction).

- 作为提供此类服务的一部分,鑫盟理财会不时向此类咨询者提供有关产品的参考文件和信息(例如,关于海外司法管辖区以外的资金管理或投资咨询服务等信息)。

- Such documents and information are provided by Financial Alliance Pte Ltd (“FAPL”) is for general information only and is not intended for anyone other than the recipient.

- 此类由鑫盟理财所提供的文件和信息仅供收件人做一般信息参考。

- It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

- 此类文件和信息不会把-个人投资目标,财务状况或其特定需求等考虑在内。

- It does not constitute the making available of, or an offer or solicitation by FAPL to buy or sell or subscribe for any such capital markets product or to enter into a transaction or to participate in any particular trading or investment strategy nor an advice or a recommendation with respect to such financial products.

- 鑫盟理财向该人士提供此类文件和信息将不构成要约或招揽购买或出售或认购任何此类资本市场产品,或达成交易或参与任何特定的投资策略,也不构成有关此类金融产品的建议或推荐。

- These documents may not be published, circulated, reproduced or distributed in whole or in part to any other person without FAPL’s prior written consent.

- 未经鑫盟理财的事先书面同意,不得将这些文件全文或部分发布,传播,复制或分发给其他人。

- This document is not intended for distribution to, publication or use by any person in any jurisdiction, where such distribution, publication or use would be contrary to applicable law or would subject FAPL and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

- 鑫盟理财无意在分发,出版或使用此类文件可能违反当地法律,或本公司及关联公司或关联人士需要注册,获得许可或符合规定的司法权区向当地人士分发、出版此类文件或供其使用。

- You shall ensure that you have and will continue to be fully compliant with all applicable laws in your home country when entering into discussion or contracts with FAPL.

- 在与鑫盟理财进行讨论或签订合约时,您应确保您已完全遵守并将继续遵守您所在原居住国的所有适用法律及条规。

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Scan for Contact Details

Join our newsletter

Subscribe to our newsletter to receive updates on our latest content!

By providing the info below, I confirm that I am the user and/or subscriber of the telephone number(s) and email address provided by me and I consent to receive from Financial Alliance and/or its financial adviser representatives, any marketing, advertising and promotional information organise by Financial Alliance via voice calls, SMS/MMS (text messages) or faxes to my telephone number(s) provided below. I understand I may withdraw any consent I have given at any time by writing in to Financial Alliance Pte Ltd.

Scan for WeChat QR

Contact Me

ACKNOWLEDGEMENT

By submitting this form, I confirm that

提交此表格,即表示

- I have read and understood FAPL’s Personal Data Policy, and hereby give my acknowledgement and consent to FAPL to use my personal data in accordance with FAPL’s Personal Data Policy.

- 我已阅读并理解鑫盟理财私人有限公司的个人数据保护政策,并同意鑫盟理财私人有限公司根据个人数据保护政策所阐述的用途使用我的个人资料。

- I have read and understood the disclaimers above and hereby affirm my acceptance of these terms.

- 我已阅读并理解了上述免责声明,特此声明接受这些条款。

- I have not been directly contacted or approached by any representative or employee of FAPL with an offer or solicitation to apply for any financial products not offered in my home country.

- 鑫盟理财私人有限公司的代表或员工并未直接与我联系或提出要约或招揽购买我原居住国境内所不提供的任何金融产品.

- Financial Alliance Pte Ltd ( “FAPL”) is licensed by the Monetary Authority of Singapore (“MAS”) and allowed to conduct financial advisory activities in accordance with the Financial Advisers Act (Cap. 110) (“FAA”) and the Securities & Futures Act (Cap. 289) (“SFA”) within the jurisdiction of the Republic of Singapore and in accordance with the licenses granted by MAS

- 鑫盟理财私人有限公司( “鑫盟理财”)持有由新加坡金融管理局(“MAS”)所颁发的牌照,并许可在新加坡共和国境内依据财务顾问法(第110章)和证券与期货交易法(第289章)进行财务咨询等相关业务

- Any services provided by FAPL to persons not ordinarily resident in Singapore are provided solely on an offshore basis from Singapore, resulting from direct enquiry on the part of the foreign residents.

- 鑫盟理财为非新加坡居民所提供的任何服务仅限于直接向鑫盟理财发出咨询请求的国外居民。

- As an integral part of the provision of such services, FAPL may from time to time make available to such residents, documents and information making reference to capital markets products (for example, in connection with the provision of fund management or investment advisory services outside of the foreign jurisdiction).

- 作为提供此类服务的一部分,鑫盟理财会不时向此类咨询者提供有关产品的参考文件和信息(例如,关于海外司法管辖区以外的资金管理或投资咨询服务等信息)。

- Such documents and information are provided by Financial Alliance Pte Ltd (“FAPL”) is for general information only and is not intended for anyone other than the recipient.

- 此类由鑫盟理财所提供的文件和信息仅供收件人做一般信息参考。

- It does not take into account the specific investment objectives, financial situation or particular needs of any particular person.

- 此类文件和信息不会把-个人投资目标,财务状况或其特定需求等考虑在内。

- It does not constitute the making available of, or an offer or solicitation by FAPL to buy or sell or subscribe for any such capital markets product or to enter into a transaction or to participate in any particular trading or investment strategy nor an advice or a recommendation with respect to such financial products.

- 鑫盟理财向该人士提供此类文件和信息将不构成要约或招揽购买或出售或认购任何此类资本市场产品,或达成交易或参与任何特定的投资策略,也不构成有关此类金融产品的建议或推荐。

- These documents may not be published, circulated, reproduced or distributed in whole or in part to any other person without FAPL’s prior written consent.

- 未经鑫盟理财的事先书面同意,不得将这些文件全文或部分发布,传播,复制或分发给其他人。

- This document is not intended for distribution to, publication or use by any person in any jurisdiction, where such distribution, publication or use would be contrary to applicable law or would subject FAPL and its related corporations, connected persons, associated persons and/or affiliates to any registration, licensing or other requirements within such jurisdiction.

- 鑫盟理财无意在分发,出版或使用此类文件可能违反当地法律,或本公司及关联公司或关联人士需要注册,获得许可或符合规定的司法权区向当地人士分发、出版此类文件或供其使用。

- You shall ensure that you have and will continue to be fully compliant with all applicable laws in your home country when entering into discussion or contracts with FAPL.

- 在与鑫盟理财进行讨论或签订合约时,您应确保您已完全遵守并将继续遵守您所在原居住国的所有适用法律及条规。

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Uncover Your Potential with Financial Alliance

Financial Alliance actively seeks skilled professionals, both experienced and aspiring, with a wide range of opportunities to showcase their expertise and grow their careers.

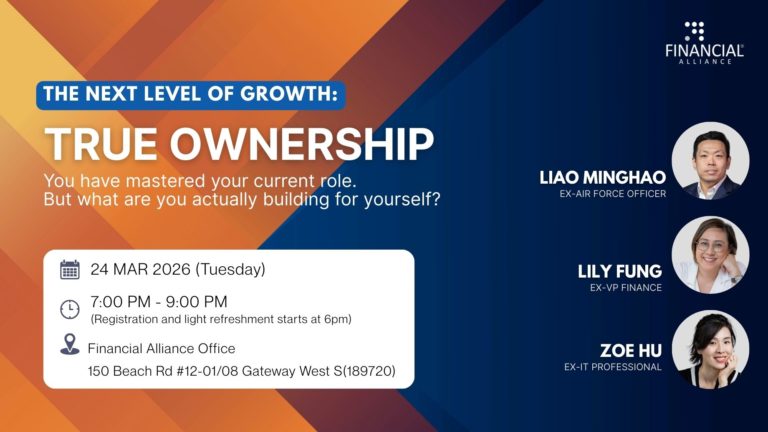

Next Level of Growth: True Ownership

Are you a high-performing professional or service member exploring your next great chapter? Join us for an exclusive, no-pitch evening with three highly successful individuals who pivoted from distinguished careers into independent wealth management.

Our 7 Unique Value Proposition

Explore the 7 unique key offers that Financial Alliance will help you to grow your career and business.

U+ Business Opportunity Webinar

Have a question for us? Join our webinar to have your question answered by Mr. Tony Ong, Director of FAR Development.

Discover Financial Alliance

Learn more about Financial Alliance and how we accelerate our consultant’s career in the financial advisory industry.

Non-advisory Products

For those comfortable managing their own insurance needs, these are some options to purchase life insurance products without the assistance of an advisor. While this provides autonomy, it’s important to note that individuals are responsible for comprehending the policy details and managing any claims processes independently.