5点教你选择适合自己的重疾寿险:终身寿险 vs 定期寿险 (Whole Life vs Term Life)

在新加坡,寿险是财务规划中至关重要的一环,它不仅关乎家庭的经济保障,也在你不在时为家人提供了一份稳定的依靠。注意,这不是医疗住院险。

然而,在购买寿险时,许多人都会面临一个重要的问题:“我该选择终身寿险还是定期寿险?”

“Whole Life Insurance or Term Life Insurance?”

今天,我们就来详细探讨这两种寿险的区别,以及如何根据自身需求做出明智的选择。

1. 寿险的两大类型:终身寿险 vs 定期寿险 对比表

|

对比项目 |

终身寿险 (Whole Life) |

定期寿险 (Term Life) |

| 保障期限 (Policy Term) | 终身保障 | 按选择的保障年限(如10年、20年、至65岁等) |

| 现金价值 (Cash Value) | 有现金价值,可累计红利 | 无现金价值 |

| 保费 (Premium) | 较高,但固定缴费期后无需再交保费 | 较低,保障期内按年缴纳 |

| 灵活性 (Flexibility) | 可部分取现(影响保额),适合长期规划 | 缺乏灵活性,保障期满后保单结束 |

| 适合人群 (Targeted Audience) | – 想要终身保障

– 计划未来留遗产或长期投资 |

– 短期或特定阶段(如孩子成长期间)需要高保额

– 预算有限 |

| 主要功能 (Main Coverage) | – 身故赔偿

– 全残保障 – 现金价值增长 |

– 身故赔偿

– 仅提供高性价比的纯保障 |

| 理赔方式 | 一次性赔付保额 | 一次性赔付保额 |

| 投资收益 | 通过参与分红基金(PAR Fund)获得稳定回报(非保证) | 无投资成分 |

| 保障的灵活性 | 一般包括附加全残、早期、中期和晚期的重疾保障 | 可选择是否附加全残、早期、中期和晚期的重疾保障 |

| 保费锁定 | 缴费期内保费固定,之后无额外支出 | 保费随年龄增加而可能调整 |

| 适用阶段 | – 长期规划的财富传承

– 注重保障与储蓄的结合 |

– 特定责任期(如孩子教育期、房贷期间) |

2. 寿险的核心作用:保障家庭经济安全

无论选择哪种寿险,其核心作用是为家庭经济安全提供保障,在意外发生时减轻家人的财务负担。

常见保障需求包括:

- 子女教育费用:确保孩子能够完成学业。

- 房贷偿还:减轻家庭成员的债务压力。

- 日常生活费用:补充因家庭收入减少而带来的经济缺口。

保额建议:通常以10至15年的年收入为参考。例如,若年薪为8万新元,建议配置80万至120万新元的寿险保额。

3. 适合不同情况的选择建议

|

需求场景 |

推荐保险类型 |

| 想保障遗产、为家人留一笔资金 | 终身寿险 |

| 孩子教育期间需要更高保障 | 定期寿险 |

| 预算有限,但需要较高保额 | 定期寿险 |

| 追求稳定增长与长期保险型储蓄 | 终身寿险 |

| 灵活调整保障年限,减少开销 | 定期寿险 |

| 在限定期限内,用最低的保费获取最高的保障,同时将节省的资金用于长期投资,最大化收益。 | 定期寿险 |

4. 买定投余的配置

买定投余的概念是以最低保费买入定期寿险的保障,同时把省下来的资金用于长期投资达到最大化收益。

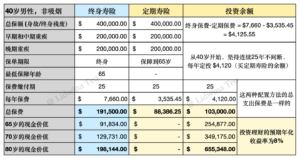

用以下例子来对比选择“终身寿险”和“买定投余”的区别。

一位40岁男性,所需要付的总保费是一样的 $191,500。

终身寿险在80岁的现金价值只有19万,但是买定投余的投资价值可有$65万。

但是终身寿险重疾保障终身,而定期寿险只保障到65岁。65岁之后可取现金价值来支付重疾所需的费用。

5. 如何做出选择?

- 明确需求

- 长期保障:终身寿险更适合。

- 阶段性需求:选择定期寿险即可满足。

- 评估预算

- 若预算充足,可优先考虑终身寿险。

- 若资金有限,定期寿险可提供经济高效的保障方案。

- 结合投资规划

- 若有较强的理财能力,可将节省的定期寿险保费用于投资,达到补充保障的效果。

总结:

重疾寿险选择不必复杂,一步一步对照,找到适合你的就是最好的。

想了解更多?我随时都在!

📞 WhatsApp: +6586802340

💬 微信 WeChat: lidwinabq

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Lidwina Teo 维娜

With 5+ years in client service, I’m passionate about delivering personalized financial planning that puts your best interests first. Backed by 150+ business partners, I tailor solutions to help you reach your financial goals.

Contact me now to request for a quotation or schedule a coffee session for further discussion. See you soon!

拥有5年以上客户服务经验,我致力于提供以客户利益为先的个性化理财规划。依托150多位业务伙伴,我为您量身定制方案,助您实现财务目标。

欢迎咨询,随时为您准备方案!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg