Term Life Insurance: Malaysia vs. Singapore — What’s the Difference? [Real Case Comparison]

Many foreigners working in Singapore — especially Malaysians — actually don’t realize that:

Term Life Insurance (or Mortgage Insurance) in Singapore is not only affordable, but also very foreigner-friendly!

Recently, I’ve had several Malaysian clients proactively reach out to ask about term life insurance options in Singapore.

They were surprised to discover: The premiums they pay in Malaysia are actually more expensive than those in Singapore!

But why is that?

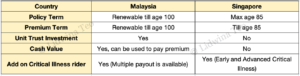

In Malaysia, term life insurance is often bundled with investment-linked products, such as ILPs or unit-linked plans.

These plans do offer some cash value, which can help offset a few months’ premiums during financial hardship,

but the annual premiums are also much higher—making them unsuitable for people who simply want “pure protection.”

In contrast, Singapore allows you to keep protection and investment completely separate.

If you’re just looking for a simple, straightforward, and cost-effective insurance policy,

then term life insurance in Singapore might suit you better.

Table above shows the difference between Malaysia and Singapore term life insurances.

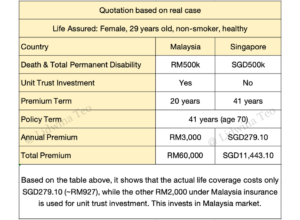

Real Case Comparison

Below is a comparison chart I’ve compiled based on real policy documents from my clients,

so you can easily see the key differences between Malaysian and Singaporean term life insurance:

Although the premium payment terms are different in the above cases, the total premium for term life insurance in Singapore is still cheaper than in Malaysia.

In fact, the main purpose of buying term life insurance is to obtain sufficient coverage and protection. The second consideration is whether the premium is sustainable in the long run.

With these two factors in mind, you’ll be able to determine which protection plan suits you better.

Secure your protection first, and then you can use the remaining funds for investments—ideally in a globally diversified portfolio.

Frequently Asked Questions

Q1: If I buy term life insurance in both countries, will I be compensated twice in the event of a claim?

Yes, you can. As long as the policies are bought separately and not declared as duplicate coverage,

you can claim from both. This double coverage can help ease your family’s financial burden.

Q2: I’m a Malaysian. Can I buy term life insurance in Singapore directly?

Yes, you can! You don’t need a work pass to buy term life insurance in Singapore.

You also don’t have to fly in—it can all be done remotely with an e-signature and payment via credit card.

Q3: Is life insurance in Singapore expensive?

It depends on your age. Term life insurance is actually one of the most affordable types of life coverage.

For example, a healthy 30-year-old male can get SGD 1 million coverage up to age 85

for approximately SGD 1,000 per year.

That’s roughly RM 3,300 for RM 3,300,000 in coverage.

The payout leverage is very high—definitely value for money.

If you’d like to know more about life insurance in Singapore, feel free to contact me:

WhatsApp: +65 8680 2340

WeChat: Lidwinabq

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Lidwina Teo 维娜

With 5+ years in client service, I’m passionate about delivering personalized financial planning that puts your best interests first. Backed by 150+ business partners, I tailor solutions to help you reach your financial goals.

Contact me now to request for a quotation or schedule a coffee session for further discussion. See you soon!

拥有5年以上客户服务经验,我致力于提供以客户利益为先的个性化理财规划。依托150多位业务伙伴,我为您量身定制方案,助您实现财务目标。

欢迎咨询,随时为您准备方案!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg