5 Common Insurance Mistakes That Cost You in the Long Run

Insurance is something most of us buy and forget. The policy gets filed away, premiums get deducted, and life goes on… until we really need it.

The truth is, a few common mistakes can lead to financial gaps or wasted premiums over the years. Here are the 5 mistakes I see most often – here’s how to avoid them:

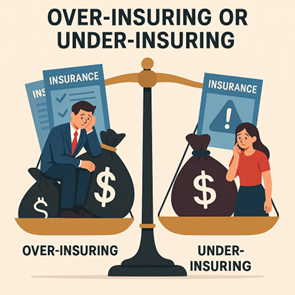

1. Over-Insuring or Under-Insuring

- Over-insuring: Paying for duplicate coverage that ties up money you could use for retirement or investments.

- Under-insuring: Scrimping and saving on necessary policies and leaving yourself exposed to big medical or income risks.

Tip: Not the number of insurance policies that is important, but the right kind of coverage.

2. Buying Without an Overview of Your Portfolio

Purchasing policies separately through banks or roadshows may feel convenient, but without a big-picture view of your portfolio, you might miss out on essential coverage or pay for overlapping policies. It also gives you a false sense of security and might not cover you for essential areas that are needed.

Tip: A complete portfolio review ensures every dollar works effectively.

3. Relying Solely on Employer Insurance

Company insurance is a nice perk, but it ends the day you leave your job.

- Switching jobs, retiring early, or retrenchment could leave you unprotected

- Buying new coverage later might be costly or even impossible if health changes

Tip: Treat company coverage as a bonus, not your foundation.

4. Not Reviewing Policies Regularly

Marriage, kids, new home, or career shifts all change your insurance needs. Without reviews, you risk:

- Inadequate sums assured coverage

- Paying for outdated or redundant riders

- Missing out on newer, more cost-efficient products

Tip: Keep your coverage relevant and efficient through annual review of your portfolio

5. Delaying Important Coverage

Waiting to buy insurance is one of the costliest mistakes people make.

Here’s why:

- Premiums increase with age – every year you wait means you’ll pay more for the same coverage.

- Health risks rise over time – and the biggest cost isn’t higher premiums, it’s the risk of being rejected or partially covered by the insurer.

- If you develop a medical condition before signing up for a policy, here’s what can happen (from worst case scenario to the least severe):

- Declined (Uninsurable) – the insurer rejects your application entirely

- Accepted with Exclusions – certain conditions or body parts are excluded from coverage, but premiums remain the same

- Accepted with Loadings – your coverage is intact, but premiums can be 100%–200% higher

Delaying doesn’t just cost you money, it can cost you insurability.

Tip: The best time to secure essential coverage is before you need it – while you’re healthy and premiums are still affordable.

The Good News

Most of these mistakes are easily avoided.

A simple yearly insurance review ensures your policies are:

- Relevant to your current life stage

- Cost-efficient without duplication

- Ready for life’s surprises

Think you might be making one of these mistakes? Let’s find out together — it might be easier (and cheaper) to fix than you think!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Lisa Ling 林惠萍

As a wealth management coach, I’m passionate about helping people achieve the financial stability and freedom they deserve. After more than two decades in the finance industry, I left my Private Banking career to pursue a new opportunity as a Senior Financial Advisory Manager at Financial Alliance. I specialized in creating personalized insurance and investment strategies tailored to each clients’ individual needs.

I take pride in being able to provide customers with tailored solutions that best fit their needs. (Refer to my clients testimonials on their experiences) My main aim is to make sure my clients are provided with the tools they need to achieve financial independence and success with confidence.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg