Demystifying CPF

Introduction

Introduction The Central Provident Fund (CPF) is a mandatory savings scheme for Singaporeans and permanent residents. Despite its importance to the country’s financial landscape, CPF is often misunderstood and shrouded in confusion. In this article, we will demystify CPF, explaining what it is, how it works, and why it is essential. Now, don’t get me wrong, CPF may sound like another government acronym that’s bound to bore you to death, but hold on to your hats because we’re about to take a wild ride through the world of retirement savings.

What is CPF?

What is CPF? CPF is a government-administered savings and insurance scheme aimed at helping Singaporeans meet their financial needs in retirement. It was established in 1955 and has since been a crucial part of the country’s social security system. CPF is mandatory for all Singapore citizens and permanent residents, and employees and employers make monthly contributions to the scheme. Think of it as a forced savings plan, but for your retirement.

Why is CPF important?

Now, I know what you’re thinking, “Why can’t I just save my money in my own bank account and call it a day?” CPF is critical because it provides Singaporeans with a financial safety net in their retirement years. With the country’s aging population and the rising cost of living, CPF ensures that individuals have enough savings to support themselves in their old age. CPF also offers various schemes that cater to different life stages, such as housing and education. For instance, if you’re looking to buy a house, you can use your CPF savings to pay for your downpayment or monthly mortgage payments. And if you’re planning to further your studies, CPF also offers an education scheme that can help you pay for your tuition fees and other related expenses, or if you’re a parent you can use your CPF to fund your child’s tertiary and varsity (I know, fancy words, it just means Poly/Uni/Diploma – approved institutions) education.

How does CPF work?

a. Contribution rates

Contribution rates: CPF contributions are made by both employees and employers. The contribution rates vary depending on the employee’s age, income, and citizenship status. For example, Singapore citizens and permanent residents under the age of 55 contribute 20% of their monthly salary, with employers contributing an additional 17%.

b. CPF accounts: CPF contributions are credited to three accounts – the Ordinary Account (OA), the Special Account (SA), and the Medisave Account (MA). The OA can be used for housing, education, and investment purposes, while the SA and MA are meant for retirement and medical expenses, respectively.

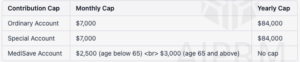

And if you’re wondering about the caps on contributions, don’t worry, we’ve got you covered:

Let’s start with the Ordinary Account. This account is mainly used for housing purposes. You can use your OA savings to pay for your downpayment or monthly mortgage payments. And if you’re feeling fancy, you can even use your OA savings to buy a new home or upgrade your existing one. Just make sure you don’t go overboard and buy a mansion that’s way out of your budget. We don’t want you ending up broke and homeless, do we?

Next up, we have the Special Account. This account is mainly used for your retirement savings. You can contribute up to a certain amount to your SA every year, which can help you reach your retirement goals faster. And if you’re feeling generous, you can even contribute more than the required amount to your SA. Who knows, maybe you’ll be able to retire to a private island in the Bahamas with all that extra cash.

And finally, we have the MediSave Account. This account is mainly used for your healthcare expenses. You can use your MA savings to pay for your medical bills or even buy medical insurance. So, if you’re feeling under the weather, don’t worry, your MA savings have got you covered.

c. Withdrawal rules

Withdrawal rules: CPF withdrawals are subject to various rules and regulations. For example, funds in the OA can be withdrawn for housing purposes, while the SA and MA can only be used for specific purposes such as retirement and medical expenses. Withdrawals are also subject to minimum sums, and individuals can only withdraw their CPF savings once they reach a specific age. Okay so on the topic of withdrawals it might seem daunting that you’re not able to get back all your CPF savings whenever you want to, and that’s a whole can of worms to untangle, I’ll explain in another article talking about CPF Life.

Here’s a very abridged version of what CPF life is all about.

CPF Life CPF Life is a life annuity scheme that provides Singaporeans with a monthly income in retirement. The scheme was introduced in 2009 to ensure that Singaporeans have a stable income stream in their old age. CPF Life premiums are deducted from the SA or OA accounts and are payable for life.

CPF offers several benefits, including low-interest rates on (2.6% or 0.1% higher than the CPF returns rate on your CPF – OA) home loans, subsidies for healthcare and education, and the ability to earn higher returns through CPF Investment Scheme (CPFIS). Check out my other Article on (CPFIS)

Common misconceptions about CPF

a. CPF is a Ponzi scheme: This is a common misconception that stems from the belief that CPF is similar to a pyramid scheme. However, CPF is not a Ponzi scheme, as it is backed by the Singapore government and is a mandatory savings scheme.

b. CPF is a form of taxation: CPF is often viewed as a form of taxation because contributions are mandatory. However, unlike taxes, CPF contributions are credited to individual accounts and can be withdrawn under specific circumstances.

c. CPF is only for retirement: used for retirement savings, it also offers various schemes that cater to different life stages, such as housing and education. This makes CPF a versatile scheme that can be used to meet different financial needs throughout a person’s life.

Conclusion

In conclusion, CPF accounts may not come with their own personal butlers or fancy amenities, but they do come with some pretty neat benefits. From housing to retirement to healthcare, CPF accounts have got you covered. So, don’t be afraid to embrace CPF and start planning for a secure future. And remember, when it comes to retirement savings, it’s never too early or too late to start.

FAQs

Q1. How do I check my CPF balance?

A: You can check your CPF balance through the CPF website or the CPF app.

Q2. Can I withdraw my CPF savings before retirement age?

A: CPF withdrawals are subject to various rules and regulations, and individuals can only withdraw their CPF savings once they reach a specific age.

Q3. How is CPF different from a pension scheme?

A: CPF is a mandatory savings scheme where individuals and employers contribute to the scheme, while a pension scheme is typically funded solely by the employer.

Q4. What happens to my CPF savings when I pass away?

A: Your CPF savings will be distributed according to your will or the Intestate Succession Act.

Q5. Can I use my CPF savings to invest in stocks or other financial products?

A: Yes, you can invest your CPF savings through the CPF Investment Scheme (CPFIS), which allows you to invest in a range of financial products such as stocks, bonds, and unit trusts. To find out more on how you can invest your CPF check out my other articles on this.

Q6. What happens to my CPF when I go be with the Lord or Underworld?

A: When you go to meet the Lord, your CPF savings will be distributed according to your CPF nomination. And if you haven’t made a nomination, well, your CPF savings will be distributed according to the intestacy laws in Singapore.

Now, I know what you’re thinking, “Intestacy laws? That sounds gross!” It’s Intestacy, no Intestines! But hear me out. Intestacy laws are just a fancy way of saying “default rules”. Basically, these rules determine how your assets (including your CPF savings) are distributed when you pass away without a will or a CPF nomination.

The distribution of your CPF savings will depend on whether you have any dependents or not. If you do have dependents, your CPF savings will be distributed to them according to a set formula. If you don’t have any dependents, your CPF savings will be distributed to your parents (if they’re still alive) or to your siblings (if your parents have passed away).

But here’s the thing, if you want to have more control over how your CPF savings are distributed after you go to meet the Lord, you can make a CPF nomination. This allows you to choose who will receive your CPF savings and how much they will receive. So, if you want to leave all your CPF savings to your favourite pet rock, you can do that (although I’m not sure how it’ll benefit your pet rock, to be honest).

In short, your CPF savings will be distributed according to your CPF nomination or the intestacy laws in Singapore. So, if you want to have more control over how your CPF savings are distributed, make sure you make a nomination. And if you don’t have a nomination or a will, well, let’s just hope your favourite pet rock knows how to manage money. If you want to know more about Intestacy laws, check out my other article.

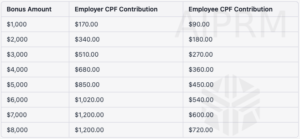

Q.7 What if i get bonuses, how do i calculate my CPF contributions and what are the caps?

A: Ah, the good old bonus. That extra bit of cash that makes you feel like you’re swimming in money. But before you start planning your next yacht party, let’s talk about how your CPF contributions are affected by your bonus.

You see, when you receive a bonus, your employer is required to contribute to your CPF account based on the total amount of your salary (including the bonus). So, the more you make, the more your employer has to contribute to your CPF account.

Now, you may be thinking, “Great! More money for my retirement!” But hold your horses, cowboy, because there are caps on the amount of CPF contributions that your employer and you can make.

For employees below 55 years old, the CPF contribution cap is $6,000 per month, while the employer contribution cap is $17,700 per year.

Please note that these calculations are based on the assumption that the employee is below 55 years old and has not hit the CPF contribution cap. If you have hit the contribution cap, the CPF contribution amount will be capped accordingly.

Q8. what if i get 30,000 bonus from my employer and I’ve already capped my monthly contribution?

If you have already hit the CPF contribution cap for your monthly salary and your employer gives you a $30,000 bonus, your employer will still be required to contribute to your CPF account based on the total amount of your salary (including the bonus).

However, there is a cap on the amount of CPF contributions that your employer can make per year, which is currently set at $37,740. This means that if your employer has already hit the annual contribution cap, they will not be required to contribute any additional CPF funds for your bonus.

On the other hand, if your employer has not hit the annual contribution cap and you receive a $30,000 bonus, your employer will be required to contribute a maximum of $5,460 to your CPF account, which is calculated as follows:

Employer CPF contribution = $30,000 x 17% = $5,100 Additional Medisave contribution = $30,000 x 1% = $300 Total employer CPF contribution = $5,100 + $300 = $5,400

Please note that this calculation is based on the assumption that you have already hit the monthly contribution cap of $6,000. If you have not hit the monthly contribution cap, your employer will be required to contribute more CPF funds to your account for your bonus.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Maximilan Tung

As an independent financial advisor, I am passionate about helping my clients navigate the often complex and overwhelming world of personal finance. With a diverse set of experiences and qualifications, I am able to provide a tailored approach to each individual’s unique financial situation. My mission is to educate and empower my clients, so they can make informed decisions about their money and work towards achieving their financial goals. Whether you are looking to invest, plan for retirement, or simply gain a better understanding of your finances, I am here to help. Let’s connect and start the conversation about your financial future.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg