Investing can seem like a daunting task, especially for those who are just starting out on their journey to financial independence in Singapore. However, investing is essential for building wealth and achieving financial goals. In this article, we will provide a beginner’s guide to investing for independent lifestyles in Singapore.

Investing is a crucial part of building wealth and achieving financial freedom in Singapore. It allows you to grow your money over time and earn a return on your investment. By investing, you can:

Investing is a powerful tool for building wealth and achieving financial freedom, but what happens if you don’t invest in Singapore? Here are some consequences of not investing:

Overall, the consequences of not investing in Singapore can be significant, especially given the high cost of living and increasing retirement age. By not taking advantage of the potential growth and tax benefits that investing offers, you’re missing out on opportunities to achieve financial freedom and live the life that you want in Singapore. It’s never too late to start investing, and even small investments can make a big difference over time.

There are several types of investments that you can choose from in Singapore, each with its own set of risks and rewards. Some common types of investments include:

When choosing your investments, it’s important to understand the risks associated with each type of investment. Stocks, for example, can offer high returns but are also volatile and can be affected by market fluctuations. On the other hand, bonds offer lower returns but are generally less volatile and offer more stability.

Unit trusts and ETFs are a good option for beginners because they offer diversification, which means that your money is spread across a variety of stocks and bonds. This can help to reduce your risk and provide more stability in your portfolio.

REITs can also be a good investment option, especially if you’re looking for a long-term investment that can provide a steady stream of income. However, investing in REITs requires more research and understanding of the real estate market in Singapore.

Getting started with investing in Singapore can be overwhelming, but it doesn’t have to be. Here are some steps to help you get started:

When choosing your investments in Singapore, it’s important to keep your goals and risk tolerance in mind. If you’re investing for retirement, for example, you may be more willing to take on higher levels of risk in the pursuit of higher returns. If you’re saving for a down payment on a home, on the other hand, you may want to focus on lower-risk investments that offer more stability.

Here are some institutions in Singapore that offer investment options and are open to independent financial advisors:

DBS Bank

OCBC Bank

UOB Bank

Standard Chartered Bank

Citibank

Maybank

Phillip Securities

KGI Securities

iFAST Financial

FSMOne

POEMS

Saxo Capital Markets

Interactive Brokers

TD Ameritrade Singapore

IG Markets

These institutions offer a range of investment options that cater to different risk tolerances and investment goals. Some are also able to utilize CPF funds for investment purposes, while others may offer special promotions for independent financial advisors or their clients. It’s important to do your own research and consult with a financial advisor to determine which institutions and investment options are right for you.

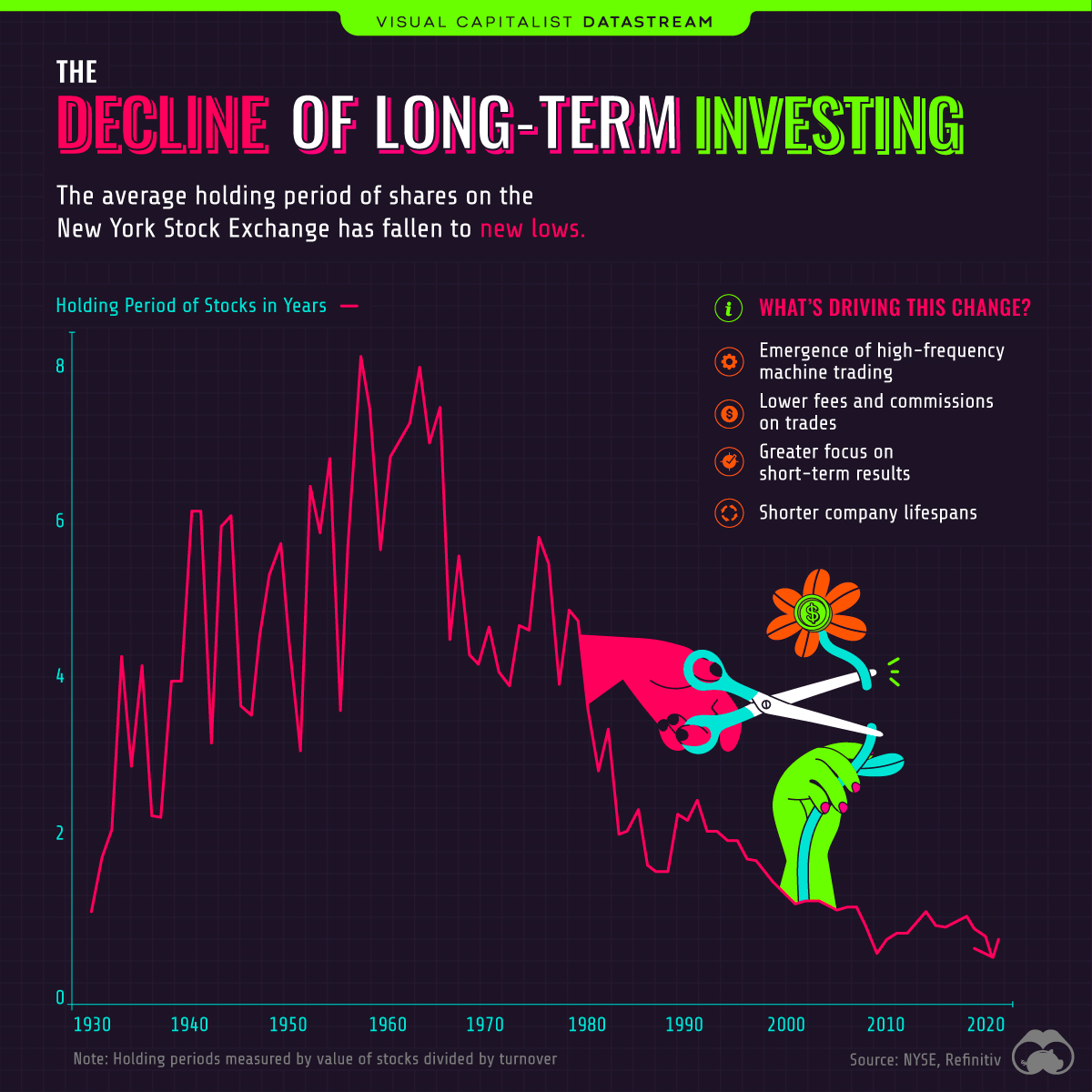

https://www.visualcapitalist.com/the-decline-of-long-term-investing/

https://www.visualcapitalist.com/the-decline-of-long-term-investing/If you are interested in investing, you may have some common questions and objections about this topic. Here are some of the most frequently asked questions and objections that people often have:

“I want to invest my money for about 6 to 12 months and get 20% returns.”

Investing with the goal of getting 20% returns in only 6 months to a year is a high-risk strategy that is not recommended for most investors. While it may be possible to achieve such returns in a short period of time, it typically requires taking on a high level of risk and investing in volatile assets such as stocks or cryptocurrencies.

Instead, we would recommend a more balanced and diversified approach to investing that aligns with your financial goals and risk tolerance. This may include a mix of stocks, bonds, and other assets that offer a more stable and predictable return on investment over the long term.

It’s also important to consider the fees and expenses associated with investing, as these can eat into your returns and impact your overall investment performance. By working with a financial advisor, you can develop a personalized investment plan that takes into account your unique financial situation and goals, and helps you achieve the returns you need to achieve your financial goals.

It’s important to remember that investing is a long-term strategy that requires patience and discipline. While it may be tempting to chase high returns in a short period of time, it’s typically not a sustainable or realistic approach to building wealth and achieving financial independence. By taking a more balanced and diversified approach, you can minimize your risk and maximize your returns over the long term.

“I don’t have enough money to invest.”

You may feel like you don’t have enough money to invest, but there are many investment options that are accessible to people with a range of budgets. For example, you can start investing in stocks with as little as $100, or invest in unit trusts with as little as $1,000.

“Investing is too risky.”

Investing does carry some degree of risk, but by diversifying your portfolio and choosing investments that align with your goals and risk tolerance, you can minimize your risk and potentially maximize your returns.

“I don’t have time to manage my investments.”

Investing does require some time and effort, but there are many tools and resources available that can help you manage your investments more effectively. For example, you can use robo-advisors to automate your investment decisions or work with a financial advisor who can help you manage your portfolio.

“I don’t understand how to invest.”

Investing can seem complicated at first, but there are many resources available that can help you learn the basics. For example, you can read books, attend seminars, or take online courses to learn more about investing.

“I don’t trust the stock market.”

While the stock market can be volatile, it has historically provided strong returns over the long term. By diversifying your portfolio and choosing investments that align with your goals and risk tolerance, you can minimize your risk and potentially earn strong returns.

“I’m too old to start investing.”

It’s never too late to start investing, and even small investments can make a big difference over time. By starting now, you can take advantage of the power of compounding and potentially achieve your financial goals. With a proper strategy and by implementing what you have properly, you’ll be able to achieve modest returns. It might mean that you’ll have to take certain risks in order to gain significant amount of returns. I would suggest however that proper planning comes with this step rather than rush into it without thinking about the implications of other parts of your life. IMPORTANT: Invest money that you don’t need access to over the course of a 5 to 10 year period at the very minimum

“I’m too young to start investing.”

It’s never too early to start investing, and even small investments can make a big difference over time. By starting now, you can take advantage of the power of compounding and potentially achieve your financial goals. (lol, it might seem like I’m repeating the same advice but this really is the case) If you start younger you compound your earnings harder as you have a longer runway. You can afford to take some risks. It is advisable to start investing when you’re stable though, investing at a younger age means you have wants or you want a lifestyle that is less encumbered, and that’s alright, however you might want to consider something prudent while you take on other forms of risks. IMPORTANT: Invest money that you don’t need access to over the course of a 5 to 10 year period at the very minimum

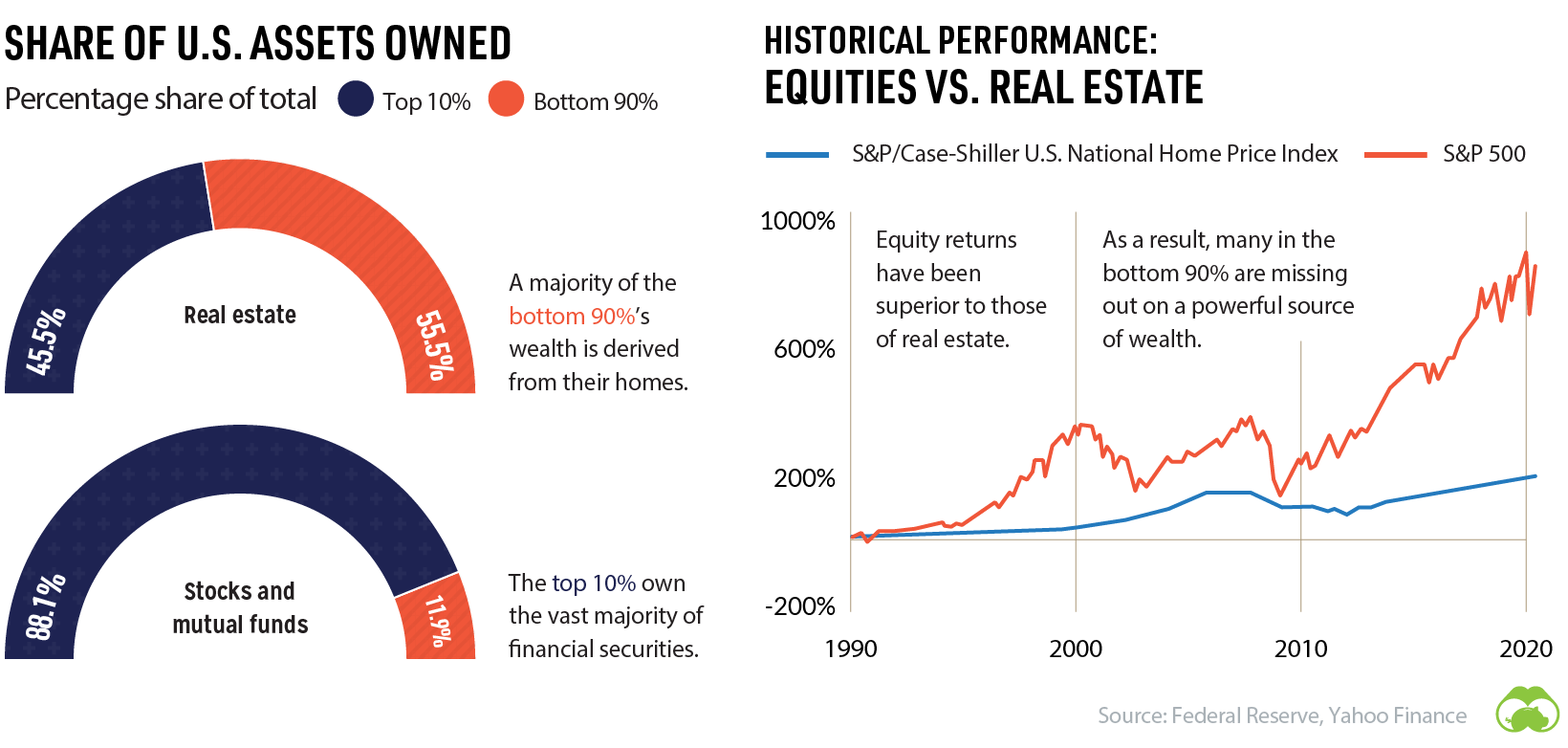

“I only believe in investing in property, it’s stable and give some good capital gain and income.”

Investing in property can provide stable returns and potential capital gains over the long term. Rental income is a main advantage of property investment, generating a steady stream of income. Properties can also appreciate in value over time, realizing a capital gain if sold for more than purchased. However, property investment comes with its own set of risks, such as market fluctuations, changes in interest rates, and changes in the economy. Managing rental properties can also be time-consuming and requires effort and resources. Property investment may be a good option for The Independent Investor if they are looking for a long-term investment with stable returns and potential capital gains. However, it is important to carefully consider the risks and challenges before making a decision. Consider the following:

While it is beneficial holding on to a property for investments, there are several risks associated with it such as liquidity. This is a topic on its own.

By addressing these and other objections that you may have about investing, you can feel more confident and empowered to take control of your finances and achieve your financial goals.

Investing may seem intimidating at first, but it is a key component of achieving financial independence in Singapore. By understanding the basics of investing and following a disciplined approach, you can start building your wealth and achieving your financial goals. Remember to do your research, choose investments that align with your goals and risk tolerance, and stay disciplined for the long haul. With these tips in mind, you can start your journey towards financial freedom today.

When investing in Singapore, it’s important to understand that there is no one-size-fits-all approach. Your investment strategy should be tailored to your unique financial situation and goals in Singapore. Consider working with a financial advisor like me who is familiar with the investment landscape in Singapore to help you create a personalised investment plan that can help you achieve your financial goals.

Overall, investing is a powerful tool for building wealth and achieving financial independence in Singapore. By following the steps outlined in this article and staying disciplined, you can start your journey to financial freedom in Singapore today.

Tags: #Investing101 #BeginnersGuide #IndependentLifestyles #FinancialAdvice

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

As an independent financial advisor, I am passionate about helping my clients navigate the often complex and overwhelming world of personal finance. With a diverse set of experiences and qualifications, I am able to provide a tailored approach to each individual’s unique financial situation. My mission is to educate and empower my clients, so they can make informed decisions about their money and work towards achieving their financial goals. Whether you are looking to invest, plan for retirement, or simply gain a better understanding of your finances, I am here to help. Let’s connect and start the conversation about your financial future.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策