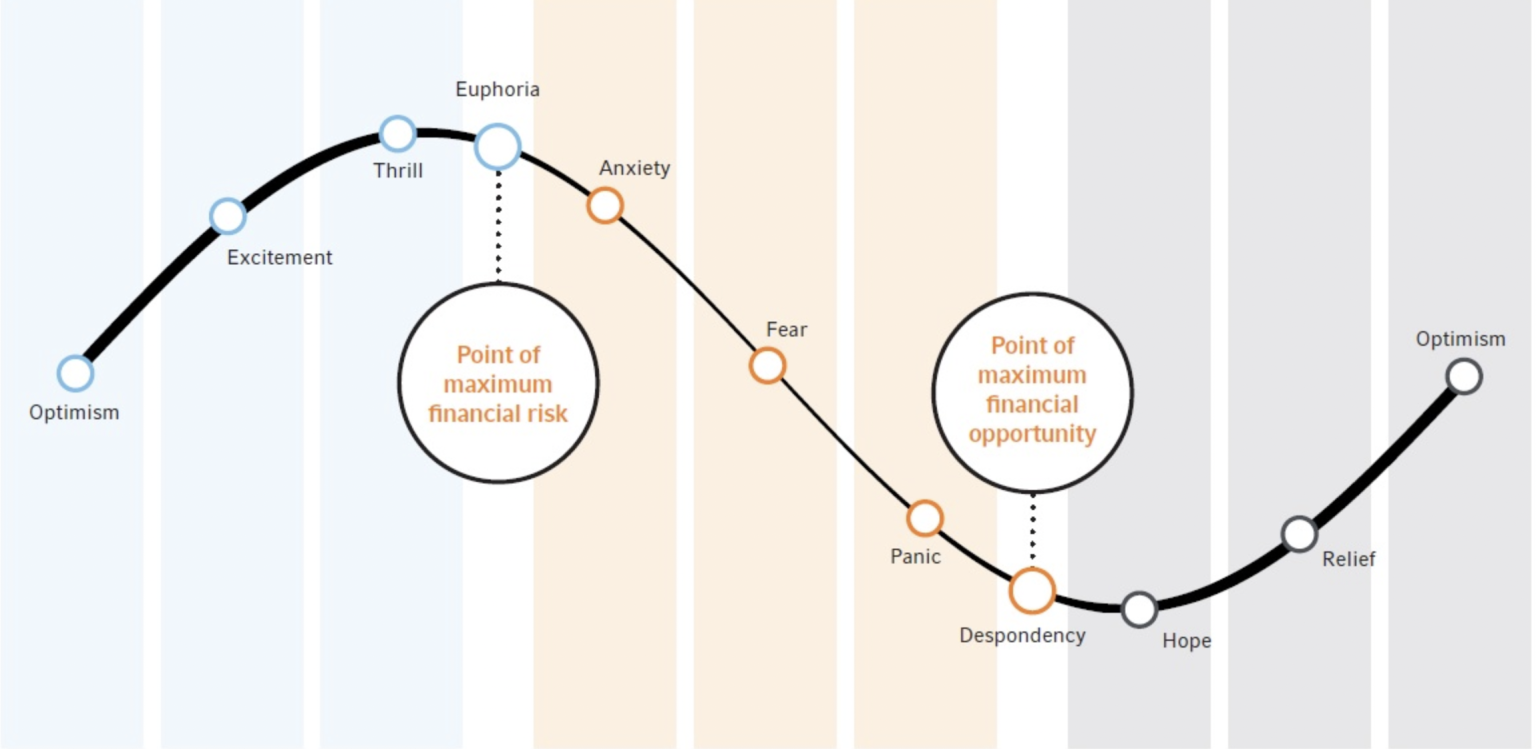

It is important for investors to understand that markets go through cycles. Because emotions can be such a threat to an investor’s financial health, it is important to be aware of them. This awareness can then help protect you from the negative consequences of impulsive and irrational reactions to these emotions.

Source: Russell Investments

STAGE 1: OPTIMISM, THRILL AND EUPHORIA Investors all start with optimism. We commonly expect things to go our way, or we expect to receive a return for the risk of investing. We go into the markets because we believe we will be able to grow our wealth through our investment choices. When markets move in the direction we had hoped to see, we start to get excited about the possibility of even greater gains. And when the momentum continues, we find the experience thrilling and begin to anticipate even higher returns. As markets reach the top of the cycle, investors may experience euphoria. We start to think that we made a smart move to invest when we did, and we believe that the good times will continue unchecked. This is the point of maximum financial risk. We may even fool ourselves into believing we can tolerate higher levels of risk – and may begin to trade more frequently or invest in riskier asset classes.

STAGE 2: DENIAL, FEAR The second phase of the cycle occurs when the market starts to turn. At first, we watch anxiously to see if the downturn is just a blip. We may believe that things will improve shortly and therefore hang on to our investments. But as the markets continue to fall, anxiety turns quickly to fear. Investment values decline perhaps even to the point that we begin to see losses. Reality sets in that maybe we weren’t as smart as we thought. Some investors may then turn defensive and switch out of riskier equities to more defensive equities or other asset classes such as bonds.

STAGE 3: PANIC, CAPITULATION, DESPONDENCY In the third stage of the cycle, we are in a bear market, defined as when an index declines by 20% or more from its peak. In some cases, all gains have been lost. Many of us missed our chance to take profits, and we may try to get our positions back into the black by either selling our worst-performing investments or moving into securities that don’t fit our risk profile. When that doesn’t work, panic sets in: we are at the mercy of the market. Some of us pull out altogether – afraid of further losses. Those who remain may become despondent and wonder whether the markets are ever going to recover and whether we should ever have invested our hard-earned money in the markets. This is the point of maximum financial opportunity.  STAGE 4: SKEPTICISM, CAUTION, WORRY. In the fourth phase, we remain skeptical even when the markets start to recover. As momentum builds, we stay cautious and may be reluctant to invest even though prices are still relatively low and opportunities are attractive. What are the consequences of this emotional roller coaster? Eventually we come to realization the market is recovering. And for those investors who let their emotions rule their investment decisions, the market cycle can begin all over again. Emotions can turn rational investors into irrational investors. Markets do move in cycles, and investments will always go in and out of favor. If we let our emotions guide us, our long-term financial plan could be placed in jeopardy.

STAGE 4: SKEPTICISM, CAUTION, WORRY. In the fourth phase, we remain skeptical even when the markets start to recover. As momentum builds, we stay cautious and may be reluctant to invest even though prices are still relatively low and opportunities are attractive. What are the consequences of this emotional roller coaster? Eventually we come to realization the market is recovering. And for those investors who let their emotions rule their investment decisions, the market cycle can begin all over again. Emotions can turn rational investors into irrational investors. Markets do move in cycles, and investments will always go in and out of favor. If we let our emotions guide us, our long-term financial plan could be placed in jeopardy.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Mui Huang works with families and business owners from diverse backgrounds to develop customized financial strategies that fit their unique needs. She believes strongly in an unbiased, independent financial advisory model to help her clients make informed decisions about their financial future.

She graduated with a Bachelor of Business from Nanyang Technological University (NTU) in 1995. Since 2006, she has been a CFA Chartered Holder (Certified Financial Analyst).

In her personal time, she enjoys exploring nature trails and cloudspotting.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策