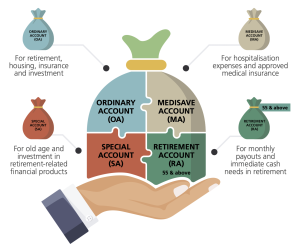

The CPF system, at its very core, serves to provide for your retirement needs through CPF LIFE, a national lifelong annuity scheme. Several major changes happen to your CPF accounts when you turn 55.

Simultaneously, your combined balances from your Ordinary Account (OA) and your Special Account (SA) is transferred into this Retirement Account (RA).

Should you shield CPF Special Account?

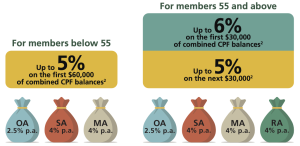

At 55, you start receiving an extra additional interest of 1% on the first $30,000 of your combined CPF balances. This interest is paid into your Retirement Account to help grow it faster. This is on top of the additional 1% interest you receive on your first $60,000 of your combined CPF balances.

Your accounts are used to compute your combined CPF balances in the following order:

– 1st: RA including any CPF LIFE premium balance

– 2nd: OA, with a cap of $20,000*

– 3rd: Special Account (SA)

– 4th: MediSave Account (MA)

*A cap of $20,000 from OA is imposed because OA savings are short-term in nature and can be withdrawn on demand for a few purposes such as housing and education.

**Basic Healthcare Sum raised to $68,500 in 2023

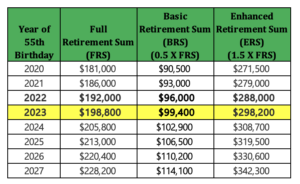

The Full Retirement Sum (FRS) is the default plan.

Choosing to go on the Basic Retirement Sum (BRS) will require you to have sufficient property charge and/or pledge your property.

The Enhanced Retirement Sum (ERS) is not actually a third option, but a maximum cap on the amount you can top-up your Retirement Account to after you turn 55.

Before 55, you can top up your Special Account up to a maximum Full Retirement Sum.

Even if you cannot meet the retirement sum, you can still withdraw up to $5,000 regardless of how much (or little) CPF balances you have.

You can also withdraw anything above your Full Retirement Sum at age 55.

If you have pledged our property, you can withdraw anything above the Basic Retirement Sum (less any top-up monies).

Of course, you can also leave all our funds within the CPF system to grow for a bigger CPF in the future.

You can choose to stop your Ordinary Account balances from flowing into Retirement Account.

How to maximise CPF savings to grow your nest egg for retirement

Straits Times 6 May 2023

Updated on 06 May 2023

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Mui Huang works with families and business owners from diverse backgrounds to develop customized financial strategies that fit their unique needs. She believes strongly in an unbiased, independent financial advisory model to help her clients make informed decisions about their financial future.

She graduated with a Bachelor of Business from Nanyang Technological University (NTU) in 1995. Since 2006, she has been a CFA Chartered Holder (Certified Financial Analyst).

In her personal time, she enjoys exploring nature trails and cloudspotting.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策