So what is CPF Salary Ceiling?

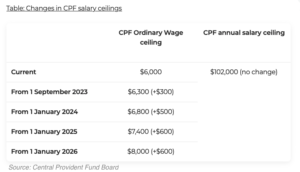

The CPF salary ceiling refers to the maximum income eligible for CPF contributions. Currently, the CPF salary ceiling is set at $6,000 per month until 1st September 2023. If an individual’s monthly income exceeds $6,000, only the first $6,000 will be subject to CPF contributions. The CPF monthly salary ceiling will gradually increase from $6,000 to $8,000 by 2026 for all employees. The increase will take place in four stages to allow employers and employees to adjust to the changes.

However, there is no change in the annual salary ceiling for CPF Contributions – $102,000 (Total Wages).

Total Wages = Ordinary Wages + Additional Wages

Ordinary Wages refer to the basic salary earned by the employee.

Additional Wages refer to any wages paid to the employee in addition to their Ordinary Wages, such as bonuses, leave encasement, etc.

So how does it affects me?

Specimen A:

Monthly Income: $4,000

Toal Annual Bonus: $8,000

Individuals whose income falls below the CPF salary ceiling will not be affected by the changes, and their take-home salary and bonus will remain unchanged.

Specimen B:

Monthly Income: $10,000

Total Annual Bonus: $40,000

In 2026, the CPF contribution will be based on the first $8,000 of an individual’s monthly income. This means that an individual whose monthly income is $10,000 will have a take-home salary of $8,400 instead of $8,800, and only $6,000 of their bonus will be subjected to CPF contribution.

Before 1 Sep 2023: Take-Home Salary

Monthly Income:

Monthly Take-Home Income: $8,800 [$10,000 – ($6,000 X 20%)]

Total Take-Home Monthly Income in a Year = $8,800 X 12 = $105,600

Bonus:

$102,000 (Total Wage) – $72,000 (Ordinary Wage) = $30,000 will be subjected to CPF contribution

Bonus Take-Home Income: $34,000 [$40,000 – ($30,000 X 20%)]

Total Take-Home Income in Year 2023 = $105,600 + $34,000 = $139,600

After 1 Jan 2026: Take-Home Salary

Monthly Income:

Monthly Take-Home Income: $8,400 [$10,000 – ($8,000 X 20%)]

Bonus:

However, for your bonus, it will only take $102,000 – $8,000 X 12 = $6,000 for CPF contribution.

So the bonus of $40,000; only $6,000 will be subjected to CPF contribution. Hence, take home bonus will be $38,800 [$40,000 – ($6,000 X 20%)]

Total Take-Home Salary in the Year 2026 with the new changes will be:

$8,400 X 12 + $38,800 = $139,600

Which is exactly the same as what you will receive as of 2023.

The total take-home salary in the year 2026 will be the same as in 2023, but the monthly take-home income cash flow will be reduced, which may affect individuals with narrow positive monthly cash flow due to loan repayments, such as mortgages or motor vehicles. It is therefore important to maintain emergency funds and strategies for cashflow usage.

Specimen C:

Monthly Income: $9,000

Total Annual Bonus: $0

Before 1 Sep 2023: Take-Home Salary

Monthly Income:

Monthly Take-Home Income: $7,800 [$9,000 – ($6,000 X 20%)]

Total Take-Home Income in a Year = $7,800 X 12 = $93,600

After 1 Jan 2026: Take-Home Salary

In 2026, your CPF contribution will be on the first $8,000 of your Ordinary Wage aka Monthly Income, hence your take-home income will be $7,200 [$9,000 – ($8,000 X 20%)] instead of $7,800

Total Take-Home Monthly Income in a Year = $7,200 X 12 = $86,400

The actual take-home salary will be reduced, and the difference will be contributed to the individual’s CPF account. While some individuals may prefer higher cash receivables to deploy into other instruments, such as investments or mortgage repayments, the higher CPF contribution helps reduce income taxes without putting the money into SRS (one of the many methods).

Also, the CPF RA account is able to withdraw a certain amount at 55 years old depending on the criteria.

Potential Impacts if CPF increases Annual Total Wage Ceiling

At present, CPF has chosen to maintain the Annual Wage Ceiling for contributions, although this decision may have certain implications if certain assumptions are made.

As a result, it would be advisable for you to consult with a trusted Financial Advisor for further guidance on this matter.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

As an independent financial adviser, I’m passionate with assisting clients in navigating the often complex world of personal finance. With a diverse range of experiences and qualifications, I provide a tailored approach to suit each individual’s unique financial situation.

My aim is to educate and empower my clients, enabling them to make well-informed decisions about their money and work towards their financial objectives. Whether you’re considering investments, planning for retirement, or seeking a better grasp of your finances, I’m here to support you. Let’s connect and begin discussing your financial future.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策