In my 20 years of recommending insurances, I come to appreciate that protection gaps can be easily covered with a limited budget (couple of hundreds of dollars).In short, you don’t have to allocate a big chunk of your savings to insurances, and use the excess as investments.

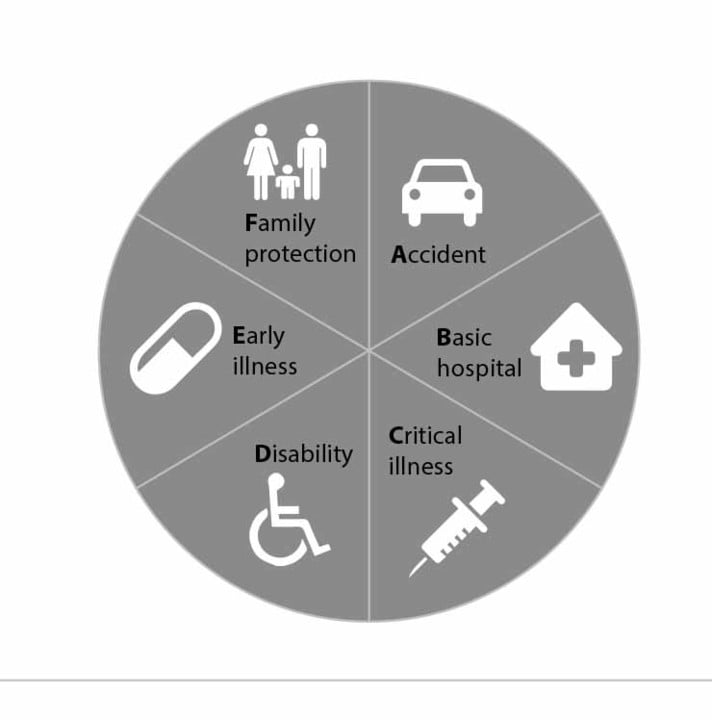

To simplify the complications to insurance needs, below are the 6 areas, classified easily into A to F of insurance and the recommended coverage in brackets.

* Reimburse outpatient GP and specialist medical expenses due to accident.

* Loss of income due to temporary disability from accident

* Lump sum payout to love ones on accidental death.

* In-patient hospital bills in private and/or govt wards

* Pre and post hospital bills

* Outpatient kidney dialysis, chemotherapy, day surgery etc

* Lump sum payout for special drugs/treatments/equip not covered by above, and loss of income

* Lump sum treatment for permanent disability or

* Monthly income for temporary disability or unable to do 3 out of 6 ADLs (Activities of Daily Living)

* Lump sum treatment on early illnesses diagnosis to cover temporary loss of income due to inability to work for a short period.

* Covers loss of income of breadwinner’s death as the death proceeds provide income for the young dependents and/or the elderly parents who are dependent on the breadwinner. This allows the widowed spouse to have a choice of stopping work to tend to the kids.

As the saying goes, the only certainty in life is tax and death (or illnesses). If we have to suffer from those, why not ‘earn’ from it? Why not transfer the risk to others with less than 10% of your income? Life is too precious to leave cheaply. Leave behind a legacy to your love ones so that we can leave with dignity. I am not sure about you. But I am sure if i have to leave this word, I want my family to be richer than when I was alive.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

I have 20 years of experience in financial advisory. Currently, I lead a team of financial advisory representatives. Together, we manage about $75m of clients’ assets and have an average experience of 10 years.

I have been featured in local magazines, Today, Straits Times, Radio 93.8 and Channel U and have published two books “Happiness Within Your Reach and “Even Introverts Can Sell”. I am passionate about financial freedom, mental health and going green.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策