See the Big Picture

Leveraging Technology for Financial Planning

As a financial consultant with 17 years experience, I have seen firsthand how challenging it can be for busy professionals to plan for retirement. With pressing work commitments and personal responsibilities, finding the time to focus on financial planning can be daunting. However, leveraging the right tools can make this process more manageable and transparent. Here’s how I use technology to help clients create a clear, trackable retirement plan.

How Technology Enhances Financial Planning

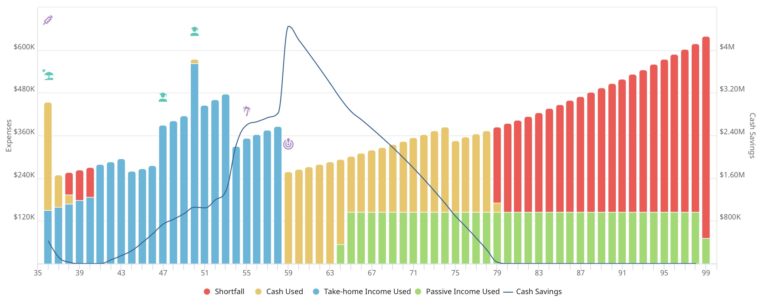

Comprehensive Analysis: Using the software, we can get a detailed overview of your current financial status. By inputting your assets, liabilities, income, and expenses, you get a clear picture of where you stand financially.

Personalized Goal Setting: Craft specific retirement goals based on your lifestyle preferences and financial needs. Whether you want to travel, pursue hobbies, or simply enjoy a comfortable retirement, the discussion will help define and quantify your objectives.

Scenario Planning: We can explore different retirement scenarios by adjusting factors like retirement age, savings rate, investment returns and desired retirement lifestyle. This helps you understand the flexibility of your plan and make informed decisions.

Educational Insights: Detailed financial reports offers insights and tips tailored to your financial situation. This education empowers you to make better financial decisions and understand the impact of different variables on your retirement plan.

Key Takeaways for Busy Professionals

Start Early: The sooner you start planning for retirement, the more time your investments have to grow.

Regular Reviews: Periodically reviewing your plan ensures it remains aligned with your goals and adjusts for any life changes.

Leverage Technology: Technology simplify the planning process, making it easier to manage and track your progress.

By integrating technology into your retirement planning process, you can achieve greater clarity and confidence in your financial future. This means less time worrying about finances and more time focusing on what matters most.

Disclaimer: The content above, including all information, opinions, and interactive elements, was created by the individual financial consultant. The views expressed are the consultant’s own and do not necessarily reflect the official policy or position of Financial Alliance. Financial Alliance does not guarantee the accuracy or completeness of this content and is not responsible for any errors or omissions. If you believe any information is inaccurate or have other feedback regarding this content, please contact us at feedback@fa.com.sg.

Readers should seek independent, unbiased financial advice that is customised to their specific financial objectives, situation, and needs. This publication has not been reviewed by the Monetary Authority of Singapore.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg