The Value of Dollar-Cost Averaging (DCA) in Volatile Markets

In today’s uncertain stock market, many investors grapple with questions like:

When should I enter or exit the market? Should I invest a lump sum or use a dollar-cost-averaging (DCA) approach?

The truth is, very few can accurately time the market, and even professionals often fail to consistently buy low and sell high due to short-term market unpredictability.

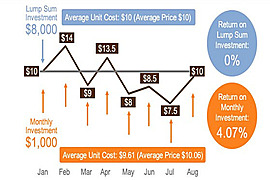

Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of market price fluctuations. Instead of committing all your capital at once, you spread your investments over time in smaller increments-typically in stocks, index funds, or mutual funds.

Why Consider Dollar-Cost Averaging?

* Mitigates Market Timing Risk

* Reduces Emotional Impact

* Lowers Average Cost Per Share

* Encourages Disciplined Investing

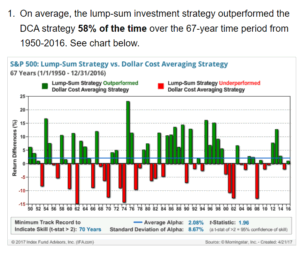

DCA vs. Lump Sum Investing

Lump Sum Investing in the S&P 500 during the bull market for the last 10 years (2014-2024) yields an inflation-adjusted return of about 8% annually, whereas for the DCA strategy, the return is slightly lower.

While lump sum investing often outperforms DCA in rising markets because it exposes more capital to potential gains sooner, it also carries higher risk if the market declines immediately after investing.

DCA, by contrast, can help mitigate losses in volatile or falling markets by spreading out the investment risk.

For many investors, especially those contributing regularly from paychecks or retirement plans, DCA is a natural and practical approach. It balances risk and reward by smoothing out market volatility and removing the guesswork from timing decisions.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Sofan Tan

| Certified Estate Planner

|20+ Years in Wealth Management

| Holistic, Personalized Wealth Strategies

| All-in-one Solution from Singapore’s largest FA

👨👩👧👦 Empowering You To Build Financial Security And A Lasting Legacy

I get it. A decade in Asian IT sales taught me resilience — the dot-com crash taught me reinvention.

The dot-com crash reshaped everything, showing me the need to take control of my own financial future.

That turning point led me to wealth management, uncovering my passion for guiding others to grow and protect their financial futures.

💎 Lessons learnt: “Don’t just work hard for the money, but make money work smart for you.”

Estate and legacy planning deepened my purpose: true wealth means more than numbers — it’s securing your family’s story and values for generations.

Now I combine two decades of experience with a client-first, heartfelt approach.

I focused on what matters most — balancing financial growth with real-life protection.

👨👩👧👦 Today, I help families design holistic wealth strategies that endure through change.

🎯 My vision: I believe wealth should empower family values and create lasting legacies.

Holistic planning empowers you to:

🌟 Grow, protect, and preserve your wealth in alignment with your values, vision, purpose, and goals.

🌟 Navigate life’s uncertainties with confidence via risk-managed strategies.

🌟 Engage in a comprehensive, top-down, and goal-driven approach.

🎯 You’ll get:

✅ CLARITY ⇒ from tailored strategies — wealth growth, protection, and preservation aligned to your objectives.

✅ PROTECTION ⇒ from unexpected risks — liabilities, life events and market volatility — so you can focus on what matters most.

✅ PEACE OF MIND ⇒ from understanding hidden risks — blind spots and portfolio vulnerabilities — so you can protect what you’ve built, and what’s still to come.

💎 Here’s what my clients told me matters most:

➡️ Clear strategies that work: I restructured one client’s portfolio and and re-balanced regularly, doubling his returns in 5 years.

➡️ Protection when it matters: When a client was diagnosed with cancer and lost her job, her critical illness waiver kept her coverage intact.

➡️ Fiduciary advisory that puts the client’s interests at heart — not just pushing product sales.

➡️ Educating Clients on the risk of the products purchased — not just the benefits.

➡️ Estate plan that protects their assets and provide liquidity during crisis – providing them peace of mind.

🤝 If these concerns resonate with you, let’s together build a wealth blueprint for your legacy.

📧 Email me @ sofantan@fapl.sg

➡️ www.linkedin.com/in/sofantan-cep

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg