Firstly, what is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement, over and above their CPF savings. Contributions to SRS are eligible for tax relief. Investment returns are tax-free before withdrawal and only 50% of the withdrawals from SRS are taxable at retirement.

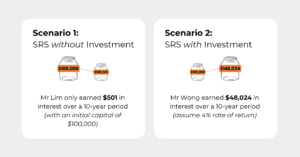

You can grow your SRS funds exponentially through long term investments, which could better increase your investment value to give you a more comfortable retirement.

Scenario 1: Mr Lim’s Regret on Not Investing

Mr Lim’s decision to keep his SRS funds idle led to only $501 in interest after 10 years. He regrets missing out on the opportunity to significantly grow his savings. With inflation and rising living costs, Mr Lim realises that his stagnant funds won’t be sufficient for his retirement needs.

Scenario 2: Mr. Wong’s Return on Investment

Mr Wong, on the other hand, invested his SRS funds and earned $48,024 in interest over the same period. With this return, he could enjoy a more comfortable retirement, fund his grandchildren’s education, or even take a long-desired vacation. His wise investment decisions have given him greater financial freedom and peace of mind for the future.

Are you missing out on potential growth?

Keeping your hard-earned money in your SRS without investing could mean losing out on significant gains over the long term. Don’t let your savings sit idle – talk to your adviser today to tailor an SRS plan that works for you.

Frequently Asked Questions

Q. Who is eligible to open an SRS account?

Any Singapore Citizens, Singapore Permanent Residents (SPRs) and foreigners who is a Singapore Tax Resident may make SRS contributions in the current year.

Q. What is the maximum contribution that I can make to the SRS?

The annual contribution limit for SRS is $15,300 for Singapore Citizens/Permanent Residents and $35,700 for foreigners.

Q. Am I entitled for SRS tax relief?

You will be allowed SRS tax relief in the Year of Assessment following the year of contribution, provided you are a tax resident for that Year of Assessment. However, a personal income tax relief cap of $80,000 applies to the total amount of all tax reliefs claimed (including relief on SRS contributions).

Q. What investment products can I purchase within SRS?

You are able to make a wide variety of investments, including shares, insurance, bonds, unit trusts and fixed deposits.

Optimise your SRS savings through long term investments to maximise returns for your retirement needs.

Let us assist you with all the calculations.

Maximise your SRS funds with us today.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Meet Ri’an, an esteemed independent financial adviser representative with a decade-long experience in financial and estate planning. His steadfast commitment to prioritising his clients’ well-being and consistently acting in their best interests, sets him apart from the rest. The inherent values of partnership and accountability are firmly rooted in Ri’an’s practice.

Ri’an’s approach is all about understanding each client’s unique aspirations and circumstances before guiding them step by step with a personalised action plan that lead to achieving their financial goals. He is able to simplify difficult-to-understand processes, or policies and highlight the essentials, thus empowering clients to make well-informed choices and be at ease with every decision.

Approachable and enthusiastic, Ri’an finds joy in providing assistance. If you’re ready to work with a financial planning professional who not only understands your financial goals but actively works to achieve them, connect with Ri’an today.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策