Baby on Board! – The Essential Insurance Guide for New Parents

Becoming a parent is an exciting and life-changing experience. Along with the joy of welcoming your child, you will also experience significant changes in your financial commitments. While budgeting for essentials such as diapers, formula, and medical check-ups, one crucial aspect often overlooked is insurance coverage for your child.

Many new parents are unsure about what type of insurance their child needs or how best to get started. Ensuring your child has adequate protection early in life can provide financial security and peace of mind for the years to come. This guide will walk you through key areas of insurance to consider for your child in Singapore.

1. Medical/Hospitalisation Coverage

Medical coverage is one of the most essential insurance for children. Securing coverage early ensures your child is protected against unexpected hospitalisation costs.

Get Started:

- Coverage can begin as early as two weeks old – Enrolling your child early, when they have a clean bill of health, reduces the risk of exclusions for pre-existing conditions, which could make it difficult to get coverage later in life.

- CPF Medisave can help cover part of the premiums – Parents can use their Medisave to pay for selected Integrated Shield Plans (IPs), making hospitalisation coverage more accessible.

2. Education Fund

In many Singaporean households, financing a child’s university education is seen as an essential parental responsibility. With rising education costs, starting an education fund early can help ensure your child has access to quality education without causing financial strain.

Get Started:

Step 1: Understand the costs involved – Whether your child plans to study locally or overseas, education costs vary significantly.

Step 2: Consider your financial commitments – Before setting aside funds, take into account your other financial responsibilities such as mortgage payments, household expenses, and existing insurance premiums.

Step 3: Work out your savings timeline – Parents typically have 18-21 years to save, depending on whether your child has National Service obligation.

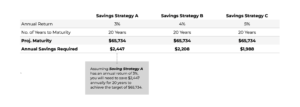

Step 4: Choose the right savings strategy –

- Traditional savings policies: Provide guaranteed payouts but may have lower returns.

- Investing on your own: Offers higher potential returns but require more active management on your part and carries market risks.

- Professionally managed investments (e.g., Unit Trusts): A middle ground for those seeking higher returns with expert guidance.

Step 5: Monitor and adjust your savings plan regularly – Ensure that your strategy is keeping pace with the increasing cost of education.

Above example for Girls

(Assuming the current fee for a 3-year local university course is $30,000, with an annual inflation rate of 4%, the cost will rise to approximately $60,775 in 18 years. With Savings Strategy A, which offers an annual return of 3%, you would need to save $2,596 per year for 18 years to reach the target amount of $60,775).

Above example for Boys

(Assuming the current fee for a 3-year local university course is $30,000, with an annual inflation rate of 4%, the cost will rise to approximately $65,734 in 20 years. With Savings Strategy A, which offers an annual return of 3%, you would need to save $2,447 per year for 20 years to reach the target amount of $65,734).

3. Critical Illness Coverage

Critical illness coverage is typically something adults consider, but starting your child’s coverage early offers significant advantages.

Get Started:

- Secure coverage before any health issues arise – Similar to why you should enrol your child for medical coverage early, this reduces the risk of exclusions due to pre-existing conditions.

- Premiums remain fixed – Unlike medical insurance, premiums are determined by entry age and remain fixed. Purchasing early leads to substantially lower lifetime costs.

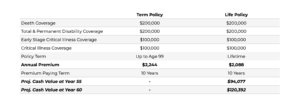

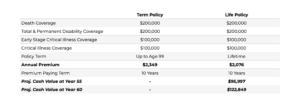

- Opt for limited payment plans with lifetime coverage – Certain plans allow full payment within 10, 15, or 20 years, enabling parents to fully fund the policy before gifting it to their child. In most cases, a whole life policy offers a more cost-effective solution than a term policy in the long run (See comparison below).

Above comparison for Female, age 1.

Above comparison for Male, age 1.

4. Personal Accident Coverage

Children are naturally active and more prone to injuries from falls, sports, and illnesses. A personal accident policy provides financial support for medical expenses resulting from minor injuries or illnesses that do not require hospitalisation.

Get Started:

- Covers minor injuries like sprains and fractures – This is useful for children who are active in sports or outdoor activities.

- Include coverage for infectious diseases – Some plans cover Hand, Foot, and Mouth Disease (HFMD), dengue fever, and food poisoning.

- Affordable premiums – Personal accident policies are relatively inexpensive and can complement existing medical insurance.

Secure Your Child’s Future

As a parent, ensuring your child is well-protected is one of the best gifts you can provide. From hospitalisation coverage to education planning, having the right insurance policies in place can safeguard your child’s future while giving you financial peace of mind.

If you’re unsure about which plans are best for your family, I’m here to help. Reach out today and find the right solutions to give your child the best possible start in life!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg