How to Live More, Leave More – Maximise Your Legacy without Compromising Your Retirement.

While traveling recently, I met an older couple who were living their retirement dream – exploring the world and joyfully proclaiming they were “spending their children’s inheritance.” Their laughter was infectious, but it made me think:

• Does it always have to be one or the other?

• Can we enjoy life to the fullest and leave a meaningful legacy?

The answer is yes.

For many, legacy planning means hoping there’s something left over for the next generation after death. But with a thoughtful strategy, you can plan for a vibrant, worry-free retirement and ensure you leave a meaningful legacy for your next generation.

A Case Study

John, age 55, dreams of traveling the world with his wife Sarah and experiencing new cultures when he retires at age 65.

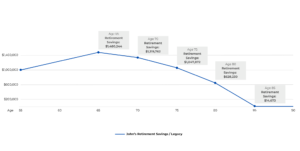

He plans to withdraw $60,000 annually (based on today’s value before accounting for inflation) from his savings, starting at age 65 and continuing until age 85 . With the help of his financial consultant, they determined that he would need a retirement savings of $1.48 million by the time he turns 65.

John also creates a Will to ensure that Sarah, along with his children Emily and Noah, will benefit in the event of his death.

But life is rarely that predictable. What if:

- John lives past 85 and require more funds?

- Unforeseen expenses, such as healthcare costs arise, leading to higher withdrawals?

- Can the legacy he leaves behind make a meaningful difference?

A Smarter Approach: Our Legacy Strategy

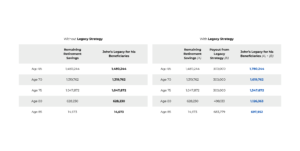

John explores a different path – diversifying $100,000 into our Legacy Strategy at age 55. Here is how it transforms his retirement and legacy:

Supplement for Retirement Needs

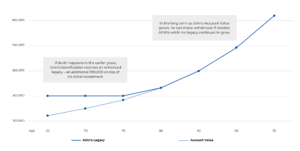

The Legacy Strategy allows John to tailor how he wants to grow his wealth with two distinct accounts. While he receives a consistent income stream from different sources of such as CPF Life, Supplementary Retirement Scheme (SRS) funds, insurance payout, and investment returns, he can withdrawal from the Legacy Strategy if needed.

A Meaningful Legacy

If death happens in the earlier years, John’s beneficiaries receive an enhanced legacy – an additional $200,000 on top of his initial investment of $100,000. In the long term, the account value of his Legacy Strategy grows, along with his legacy. This allows John to leave a meaningful inheritance for Emily and Noah, and even make an impact to causes he is passionate about.

With the Legacy Strategy, John can fulfil his retirement dream and also leave a meaningful legacy. He can live with peace of mind, knowing he has the resources to support both his life’s adventures and his family’s future.

Live More, Leave More

Your retirement should be a time to live more, not worry more. Let us help you align your financial future with your dreams and values.

Click the “Contact Me” button below for a complimentary consultation and discover how our Legacy Strategy can help you live the life you want.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

With over a decade of experience, Ri’an offers more than just financial advice; he provides clarity and confidence. A personal loss inspired his career, and it’s why he’s so passionate about making financial and estate planning straightforward and meaningful for his clients.

Ri’an is known for his ability to simplify complex finances and for his personalized approach. He builds lasting relationships based on trust and clear communication, and you can always depend on him to follow through.

His mission is to give you well-researched, practical solutions so you can feel secure and make informed choices for your future. Let Ri’an help you focus on what matters most.

Ready to take the next step? Connect with Ri’an to learn more.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg