How to Plan Your Will: A Guide for Married Couples

Here’s a question I often pose to my clients: “If something happened to you tomorrow, would your family know exactly what your wishes are?” The silence that often follows isn’t from a lack of care, but from a place of discomfort. In Singapore, discussing a will can feel pantang (taboo), as if we are tempting fate. Instead, let’s see it differently. A will isn’t about an ending; it is the ultimate fulfilment of your responsibility to your family.

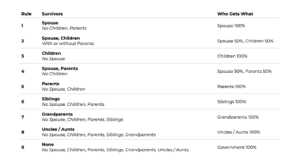

Creating a will is not about planning to die. It is one of the greatest act of love you can undertake for your family. It’s your final instruction manual, ensuring your loved ones are cared for, your assets are distributed according to your wishes, and family harmony is preserved. For non-Muslims in Singapore, passing away without a will means your assets are distributed according to the Intestate Succession Act (see Fig.1). This one-size-fits-all legal formula may not match your personal intentions and can inflict costly delays and painful disputes on the family you leave behind.

Fig. 1: Intestate Succession Act

This article will guide you through the key considerations for married couples in Singapore, transforming a daunting task into a structured and empowering process.

Key Consideration #1: Appointing the Right People

Your will is only as effective as the people you appoint to carry out its instructions. There are three key roles to consider.

- The Executor: This is the person (or professional body, like a trust company) you appoint to administer your estate. They are responsible for gathering your assets, paying off any debts (like taxes or loans), and distributing the remaining assets to your beneficiaries as specified in your will.

- Recommendation: Choose someone who is trustworthy, organised, and residing in Singapore, if possible, for practical reasons. It can be your spouse, an adult child, or a close sibling. Always appoint a substitute executor in case your primary choice is unable or unwilling to act.

- The Guardian (for parents with minor children): This is arguably the most critical decision for young families. If both parents pass away, the guardian you appoint will be legally responsible for raising your children until they reach adulthood (age 21).

- Recommendation: This decision should be based on values, parenting styles, and willingness. Have an open and honest conversation with your chosen guardian(s) to ensure they accept this profound responsibility.

- The Trustee: This person or institution manages the assets on behalf of your beneficiaries. This is crucial if your beneficiaries are minors, have special needs, or if you prefer they receive their inheritance in stages rather than as a lump sum.

- Recommendation: Your trustee should have financial acumen and integrity. While you can appoint a family member, you might consider appointing a professional trustee for impartiality and expertise. The guardian and trustee can be different people to create a system of checks and balances.

Key Consideration #2: Addressing your Real Estate – From HDBs to Private Properties

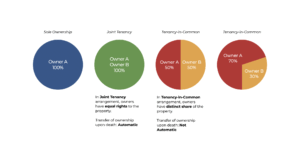

For most couples in Singapore, real estate forms the cornerstone of their family’s wealth. This could be your HDB family home, a private condominium for investment, or a landed property passed down through generations. How you own these assets legally determines whether your will can even control their distribution. The two forms of ownership in Singapore are critical to understand (see Fig. 2).

- Joint Tenancy: This is the most common structure for a marital home. It operates on the “right of survivorship,” meaning when one owner passes away, their interest in the property automatically passes to the surviving joint owner(s). This legal mechanism operates outside of your will and is independent of it. While simple and direct for the primary family home, it means you cannot will your “share” to someone else, like a child from a previous marriage or your parents.

- Tenancy-in-Common: Under this structure, each owner holds a separate and distinct share. This share does not automatically pass to the other owners. It is considered part of your personal estate and must be distributed according to your will (or the Intestate Succession Act if you don’t have one). This structure offers far more flexibility and is often used for investment properties or in complex family structures.

Fig. 2: Types of Property Ownership

For Owners of Multiple or Overseas Properties:

If you and your spouse own multiple properties, a will moves from being important to being absolutely essential. It is the only instrument that allows you to make specific bequests. For example, you can specify that your son inherits the condominium in Marine Parade, while your daughter receives your share of the terrace house in Siglap. Without a will, all properties would be pooled into the estate, potentially leading to disputes or a forced sale if beneficiaries cannot agree on how to divide them.

For properties located overseas, the situation is more complex. They are governed by the succession laws of the country in which they are situated. Your Singapore will may not be automatically recognised, potentially requiring a costly and lengthy legal process called “resealing” the Grant of Probate.

Recommendation: Your first step is to conduct a review of all your properties. You can verify the ownership status of your HDB flat via the HDB portal and your private properties through the Singapore Land Authority (SLA).

- For assets under Joint Tenancy, recognise that they will pass directly to the surviving owner(s). Ensure this automatic transfer aligns with your wishes.

- For assets under Tenancy-in-Common, your will is the primary tool to direct who inherits your share.

- If you have overseas properties, it is crucial to seek legal advice to determine if a separate will in that jurisdiction is necessary.

Properly structuring your will ensures your real estate assets are passed on smoothly, preventing unnecessary legal complications and preserving the value of your legacy for your loved ones.

Key Consideration #3: Providing for All Your Loved Ones

A comprehensive will considers every person who depends on you. While children are often the primary focus, many of us also provide crucial support to our parents or other relatives.

- For Minor Children: The key is to protect their inheritance until they are mature enough to handle it.

- Recommendation: A Testamentary Trust, created within your will, allows your appointed trustee to manage the funds for your children’s education, healthcare, and living expenses. You can specify at what age (e.g., 25) they receive the remaining capital.

- For Adult Children (Fairness vs. Equality): You may feel one child needs more financial support than another. A will allows you to distribute your assets equitably (fairly) rather than just equally.

- Recommendation: If you plan for an unequal distribution, consider writing a separate, private letter to explain your reasoning. This can help your children understand your intentions and prevent hurt feelings or disputes.

- For Dependents with Special Needs: This requires careful, specialised planning. A Special Needs Trust can be set up to provide for their long-term care.

- Recommendation: Engage professionals who specialise in this area. Organisations like the Special Needs Trust Company (SNTC) in Singapore are equipped to manage such trusts to ensure your child is cared for throughout their life.

- For Elderly Parents: As part of the “sandwich generation,” many of us care for our aging parents. If you provide them with regular financial support, your sudden absence could place them in a vulnerable position. Your will is the tool to ensure their care continues.

- Recommendation: You can formalise your support by setting aside a specific sum of money for them in your will. Consider a trust to provide a monthly allowance for their living expenses and medical care. This legally protects the financial support you intend for them and gives you peace of mind that they will always be looked after.

Key Consideration #4: Expanding Your Legacy Beyond Immediate Family and Charitable Giving

While providing for your spouse and children is often the primary focus, your will is also a powerful tool to define a broader legacy. This allows you to support other people or causes you care about deeply.

For couples without children, this aspect of a will is especially critical. Without one, the law directs your assets to your spouse, and upon their passing, to their family if they don’t have a will. A will empowers you to override this default, enabling you to leave assets to nieces, nephews, close friends, or charitable organisations like your alma mater or a favourite cause. It is your opportunity to make a planned, lasting impact beyond your lifetime.

Your Legacy, Your Decision: It’s Time to Act

As a couple, you’ve worked hard to build a secure and loving home for your family. A well-crafted will is the bedrock of that security, ensuring that no matter what happens, your spouse, children, and loved ones are protected according to your exact wishes. This isn’t just a legal document; it’s your final promise to them.

Let’s sit down together to ensure that promise is clear, comprehensive, and provides lasting peace of mind.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg