How to Plan Your Will: A Guide for Singles

As a financial advisor specialising in estate planning, I often meet clients who believe that will planning is only for the wealthy, the married, or those with children. This is one of the biggest misconceptions I encounter, especially among singles. The truth is, if you are single in Singapore, having a will is not just important—it is absolutely crucial for protecting your legacy and the people you care about.

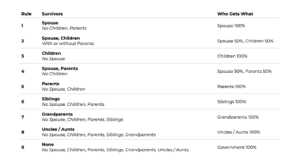

Without a will, you give up your right to decide who inherits your hard-earned assets. Instead, the law, specifically the Intestate Succession Act for non-Muslims, takes over (see Fig. 1). For a single individual, this means your estate automatically goes to your parents. If they are no longer with you, it passes to your siblings. While this may be acceptable for some, for many it is far from ideal.

Fig. 1: Intestate Succession Act

A will is your voice when you are no longer here. It empowers you to distribute your assets according to your precise wishes, provide for loved ones who may not be next-of-kin, and prevent potential family disputes. It is the ultimate tool for ensuring your final wishes are respected. Let’s explore how you can thoughtfully plan your will by addressing the top 5 most common concerns I hear from my single clients.

Concern #1: “If the Intestate Succession Act already lists my beneficiaries, do I still need a will?”

That is a very practical question. On the surface, if the law already reflects your wishes, a will can seem like an unnecessary step. However, the law provides a rigid, ‘one-size-fits-all’ solution that cannot account for the unique nuances of your life and relationships. A will is your opportunity to move beyond this default and think more deeply about how you can best provide for the people you care about.

Recommendation:

Instead of getting stuck, think about your relationships and what you want to achieve.

- Look Beyond the Obvious: Your beneficiaries don’t have to be family. You can include your lifelong best friend, a significant other you aren’t married to, a favourite niece saving for university, or even a mentor who changed your life.

- Provide for Dependents Strategically: If you are caring for aging parents or a special needs sibling, a will is essential. Instead of leaving them a lump sum they may struggle to manage, I often recommend setting up a testamentary trust within your will. This allows you to appoint a trusted person or a professional trust company (a trustee) to manage the funds and disburse them over time for your dependent’s care, ensuring their long-term security.

Concern #2: “Who Can I Trust to Be My Executor?”

The executor is the person you appoint to carry out your will’s instructions. Your concern about finding someone trustworthy, capable, and willing to take on this complex role is completely valid.

Recommendation:

Your executor should be someone you trust implicitly, but they must also be organised and resilient enough to handle legal and administrative tasks during a difficult time.

- Assess Your Candidates: Consider siblings, trusted friends, or other relatives. Have an open conversation with your preferred candidate first to ensure they are willing and able to accept the responsibility. It’s wise to appoint a backup executor in case your first choice is unable to act.

- Consider a Professional Trustee: For complex estates or if you don’t have a suitable candidate, appointing a professional trust company as your executor is an excellent option. They offer impartiality, expertise, and continuity, ensuring your estate is administered efficiently and without emotional bias. This can be particularly useful if you anticipate potential conflict among family members.

Concern #3: “It Seems So Expensive”

Viewing estate planning as a mere cost is a mistake; it’s a crucial investment in your legacy.

Here’s a clear breakdown of your options.

- DIY Will Kits (Not Recommended): While the cheapest option, the risks are severe. Simple mistakes in wording or witnessing can invalidate the entire will, creating far greater legal costs and distress for your loved ones later. Due to the high probability of failure, I strongly advise against this route.

- Engaging a Lawyer: A lawyer ensures your will is legally valid and correctly drafted—a vital step. However, their advice is typically limited to the legal execution of your instructions. Without a full picture of your finances, they cannot provide strategic advice, potentially resulting in a plan that is legally sound but not financially optimal for your estate or beneficiaries.

- Engaging a Specialist Estate Planner (The Recommended Route): This is the most effective approach. A financial advisor specialising in estate planning starts with a deep understanding of your entire financial portfolio—investments, insurance, property, and business interests. We are uniquely positioned to integrate this knowledge with your personal wishes. This ensures your will is not just a legal document, but the cornerstone of a holistic and intelligent legacy plan that truly protects your assets and provides for your loved ones. This is the recommended path to genuine peace of mind.

Concern #4: “It’s troublesome and time-consuming to list all my assets.”

The thought of listing every asset is a common reason people delay writing a will. The good news is, a smart will doesn’t require an exhaustive inventory.

Instead of a rigid list, a well-structured will uses a powerful distribution framework. This three-step approach is designed to cover all your assets—both current and future—precisely and without ambiguity, solving this problem elegantly.

Recommendation:

- Identify Your “Specific Gifts”: First, list any specific assets you wish to give to particular people. These are “specific gifts,” such as a fixed cash sum, your share in a property held under a tenancy-in-common, or a valuable personal item like a watch. This handles sentimental or targeted bequests.

- Define Your “Residuary Estate” in Percentages: Your residuary estate is everything left after specific gifts and expenses are paid. The most crucial step is to distribute this portion by percentage (e.g., 60% to my sibling, 40% to a charity). Using percentages makes your will adaptable, ensuring it remains fair and relevant as your asset values change, and automatically covers any assets you acquire in the future.

- Appoint “Substitute Beneficiaries”: To prevent a gift from failing if a beneficiary passes away before you, always name a substitute. This vital contingency plan allows you to redirect that share to another person or a charity, ensuring you retain full control over your legacy no matter what happens.

Concern #5: “My Life is Always Changing. How Do I Keep My Will Updated?”

This is a key concern for singles whose lives can be dynamic. A will is not a “one and done” document.

Recommendation:

- Schedule Regular Reviews: I advise my clients to review their will every 3 to 5 years, or whenever a major life event occurs. These events include:

- A significant change in your financial status (e.g., buying a property).

- The birth of a niece or nephew you wish to include.

- A major falling out or, conversely, reconciliation with a family member.

- The death of a beneficiary or executor.

- Update via a Codicil or a New Will: For minor changes, you can add a codicil (a legal amendment) to your existing will. For major changes, it is often simpler and safer to draft an entirely new will, which will automatically revoke all previous versions.

A Note on CPF: Remember, your will does not cover your CPF savings. To distribute your CPF funds, you must make a separate CPF nomination online. This is a simple, free process that should be done alongside your will planning.

Take Control of Your Legacy Today

Planning your will is one of the most profound acts of responsibility and care you can undertake. As a single individual, it grants you the power to create a legacy that truly reflects your life, your values, and your relationships.

The concerns you have are valid, but they are all surmountable with the right guidance. You don’t have to navigate this journey alone. If you’re ready to take the first step towards securing your legacy and achieving peace of mind, I invite you to reach out. Let’s have a conversation about your unique situation and craft a plan that honours your wishes.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg