Is Your SRS Working for You – or Against You?

The Supplementary Retirement Scheme (SRS) is a valuable tool for boosting retirement savings in Singapore. However, many individuals leave their SRS funds sitting idle, earning a mere 0.05% interest per annum. With inflation eroding purchasing power over time, uninvested SRS funds may lose value rather than grow. Understanding how to maximize your SRS savings through strategic contributions and investments is key to securing a comfortable retirement.

Understanding the Supplementary Retirement Scheme (SRS)

The SRS is a voluntary savings scheme designed to supplement CPF savings for retirement. Unlike CPF, which has mandatory contributions, individuals can contribute varying amounts to their SRS accounts (subject to an annual cap) at their discretion. These funds can then be invested in a wide range of SRS-approved instruments to generate higher returns.

Part 1: Tax Benefits of SRS

One of the most attractive aspects of the SRS is its tax benefits. There are three key advantages:

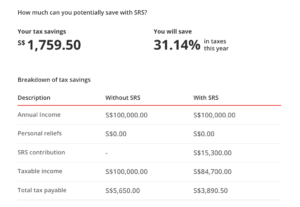

- Tax Relief on Contributions – Every dollar contributed to SRS reduces your taxable income, lowering your overall tax burden. For high-income earners, this can translate into significant tax savings. For example, an individual earning $100,000 who contributes $15,300 (the maximum for Singaporeans and PRs) can lower their taxable income to $84,700, reducing their tax payable.

- Tax-Free Investment Growth – Investment returns generated within the SRS account are not taxed. This allows your savings to compound over time without reducing your returns.

- 50% Taxable Withdrawals at Retirement – Upon retirement, only 50% of SRS withdrawals are taxable. If managed properly, retirees can stagger withdrawals to stay within lower tax brackets, reducing the overall tax burden.

Table is for illustration purpose only.

Part 2: Retirement Savings and the Cost of Keeping SRS Funds Idle

While the tax benefits are compelling, leaving your SRS funds in the account without investing could mean losing out on potential growth. The default interest rate of 0.05% per annum is significantly lower than inflation. Over time, this erodes the purchasing power of your savings.

Instead of letting your SRS funds sit idle, you can invest in various SRS-approved instruments, such as:

- Bonds

- Singapore Government Securities (SGS) / Singapore Savings Bonds (SSB)

- Fixed Deposits

- Shares

- Unit Trusts

- Fixed Deposits

- Savings Policies / Annuities

Here’s an example of how investment returns can help you to grow your SRS money:

Frank contributes $15,300 annually to his SRS accounts, totalling $459,000 in his account after 30 years of annual contribution.

Scenario 1: Frank is content to let his funds lie un-invested, earning an interest of 0.05% per annum (SRS deposit rate).

Scenario 2: Frank invests in a SRS-approved instrument that earns him a return of 3% per annum.

Scenario 3: Frank is slightly more aggressive and invests in a SRS-approved instrument that earns him a return of 5% per annum.

Take Action to Maximize Your SRS

The SRS is a powerful tool, but only if used effectively. Simply contributing isn’t enough—investing your SRS funds wisely is crucial to beating inflation and growing your retirement nest egg.

Let’s discuss how you can make the most of your SRS savings. Reach out today for a consultation and take control of your financial future!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

With over a decade of experience, Ri’an offers more than just financial advice; he provides clarity and confidence. A personal loss inspired his career, and it’s why he’s so passionate about making financial and estate planning straightforward and meaningful for his clients.

Ri’an is known for his ability to simplify complex finances and for his personalized approach. He builds lasting relationships based on trust and clear communication, and you can always depend on him to follow through.

His mission is to give you well-researched, practical solutions so you can feel secure and make informed choices for your future. Let Ri’an help you focus on what matters most.

Ready to take the next step? Connect with Ri’an to learn more.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg