Mortgage Protection Made Simple: Home Protection Scheme (HPS) vs. Private Term Insurance

For most Singaporeans, purchasing a home is one of the most significant financial commitments they will make in their lifetime. Protecting your home and ensuring your loved ones are not burdened with mortgage payments in unforeseen circumstances is crucial. This is where mortgage insurance comes in.

If you are using CPF savings to finance your HDB flat, enrolment in the Home Protection Scheme (HPS) is mandatory. However, you may apply for an exemption if you have private insurance coverage that is sufficient to cover your outstanding housing loan for its full term or until you turn 65, whichever comes first.

Understanding the differences between HPS and private insurance will help you make an informed decision that best aligns with your financial and protection needs.

What is HPS?

HPS is a mortgage-reducing insurance scheme that ensures the outstanding home loan is covered in the event of death, terminal illness, or total permanent disability. This prevents financial distress for your co-owners or family members, ensuring they can continue living in the home without worrying about mortgage repayments.

Key Benefits of HPS

- Convenient premium payment – Premiums are automatically deducted from your CPF Ordinary Account (OA).

- Affordable premiums.

Above based on Home Protection Scheme premium calculator for Male, age 30.

Above based on Home Protection Scheme premium calculator for Female, age 30.

Potential Limitations of HPS

- Coverage reduces over time – The sum assured decreases in line with your outstanding mortgage balance.

- Terminates upon property change – If you purchase a new property (e.g., private residential properties, executive condominium (ECs), or privatised Housing and Urban Development Company (HUDC) flats), your HPS coverage will be discontinued.

Private Term Insurance: An Alternative to HPS

While HPS is a simple and effective way to protect your home, a private term insurance policy offers additional flexibility and benefits that may be worth considering.

Key Benefits of Private Term Insurance

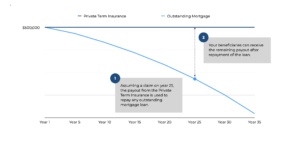

- Fixed Coverage Amount – Unlike HPS, where coverage decreases over time, a private term insurance policy provides a fixed sum assured throughout the policy term. This means that after repaying the loan, your beneficiaries will receive any remaining payout (See Fig. 1).

- Portability Across Properties – A private term insurance policy remains active even if you switch properties. This is ideal if you are planning to upgrade from an HDB flat to a private property.

- Comparable Premiums – Many private term insurance policies offer competitive premiums compared to HPS, making them a cost-effective alternative.

Fig. 1: How fixed coverage amount can add value to your beneficiaries.

Above comparison for Male, age 30, non-smoker.

Above comparison for Female, age 30, non-smoker.

Get Professional Advice

Ensuring your home and loved ones are financially protected is a crucial part of financial planning. While HPS provides a basic level of mortgage protection, a private term insurance policy may offer greater flexibility and long-term value.

Not sure which option suits you best? Reach out today for a consultation and take control of your financial future!

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an’s mission to elevate financial well-being often begins in the boardrooms and town halls of Singapore’s leading companies. His work promoting financial literacy across the workforce has given him a unique insight: the years leading up to retirement are when people need more than just information—they need a dedicated, trusted strategist.

This conviction is deeply personal. A family loss, which could have been mitigated with proper planning, inspired Ri’an’s career and is the reason he is so passionate about ensuring financial and estate plans provide genuine peace of mind during this critical life stage.

Ri’an understands the specific concerns that can keep you up at night. He specialises in simplifying the complex questions you now face: how to protect your hard-earned nest egg from market volatility, structure a reliable retirement income that outpaces inflation, and plan for future healthcare costs without becoming a burden on your loved ones. He helps clients confidently balance the responsibility of supporting their family with the absolute necessity of securing their own future.

His mission is to provide you with a well-researched, stress-tested roadmap that transforms retirement anxiety into a clear, actionable plan. Building lasting relationships on a foundation of trust and clear communication, Ri’an ensures you can feel secure and make informed choices for the future you’ve worked so hard to build.

Ready to navigate your retirement with confidence? Connect with Ri’an for a meaningful conversation.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg