The 3 Pillars of a Healthy Retirement and Must-Have Insurance Coverages

When I sit down with my clients in their 50s and 60s to plan for retirement, one financial fear consistently rises to the top: the risk of a single, major illness wiping out a lifetime of hard-earned savings. In Singapore, we are fortunate to have a robust national framework designed to protect us, but navigating it can feel confusing.

Understanding this system isn’t just an administrative task; it’s the cornerstone of a secure retirement. Knowing what you’re covered for, and more importantly, where the potential gaps lie, is the key to ensuring that a health crisis doesn’t become a financial crisis. Think of our national schemes as three essential “pillars” that work together to protect you and your family. Let’s break them down.

Pillar #1: Medisave

Think of Medisave as your personal healthcare savings account. A portion of your monthly income has been automatically channelled into this CPF account throughout your working life. In retirement, this becomes your primary fund for a wide range of personal and family medical expenses. It’s designed for smaller, more predictable healthcare costs.

You can use your Medisave for:

- Paying Insurance Premiums: Your annual premiums for MediShield Life, Integrated Shield Plans, and CareShield Life enhancements are often deducted directly from your Medisave (up to applicable limits).

- Chronic Disease Management: Under the Chronic Disease Management Programme (CDMP), you can use up to $700 per year for outpatient treatments for conditions like diabetes, hypertension, and high cholesterol.

- Vaccinations and Health Screenings: Recommended vaccinations and certain health screenings are Medisave-claimable.

- Minor Surgical Procedures: It can be used for various day surgeries, such as cataract operations.

The Bottom Line: Medisave is your frontline fund for routine and smaller medical bills. However, it is a finite savings account. A major hospital stay could deplete it quickly, which is why we need the second pillar.

Pillar #2: MediShield Life

If Medisave is your savings account, MediShield Life is your essential insurance policy. It’s a mandatory national health insurance scheme that provides a safety net for large hospital bills and certain costly outpatient treatments, like chemotherapy.

Key features you need to know:

- Universal Coverage: All Singapore Citizens and Permanent Residents are covered for life, regardless of age or pre-existing conditions.

- Focus on Subsidised Treatment: MediShield Life benefits are designed based on the cost of treatment in B2 and C class wards in public hospitals.

The Gap in this Pillar: While MediShield Life protects you from catastrophic bills, it does not cover the full amount. You are still responsible for a deductible (the initial amount you pay) and co-insurance (a percentage of the bill). If you choose to stay in an A/B1 ward or a private hospital, your out-of-pocket costs can still amount to thousands of dollars.

[Must-Have Coverage]: Integrated Shield Plans (IPs)

This is where private insurance plays a critical role. An Integrated Shield Plan (IP) is an optional plan from a private insurer that works on top of your basic MediShield Life. To put it simply, if MediShield Life is your standard, functional HDB flat, an IP is the renovation you add on. It doesn’t replace the flat, but enhances it with upgrades for greater comfort and choice, giving you access to higher ward classes or private hospital care for a more comfortable experience.

The main benefits of an IP are:

- Coverage for Higher Ward Classes: IPs allow you to receive treatment in A or B1 wards in public hospitals, or in private hospitals, with much greater coverage.

- Higher Claim Limits: IPs offer significantly higher annual claim limits, giving you peace of mind for very large medical bills.

- Optional Riders: You can add on “riders” to your IP to also cover the deductible and co-insurance, reducing your final cash outlay to a much more manageable amount.

Pillar #3: CareShield Life

This is the newest and perhaps least understood pillar, but it protects against one of the biggest fears of aging: the loss of independence. CareShield Life is a long-term care insurance scheme that provides basic financial support if you become severely disabled. What does “severely disabled” mean? It’s defined as being unable to perform three or more Activities of Daily Living (ADLs) on your own (see Fig. 1). These are fundamental tasks like washing, dressing, feeding yourself, using the toilet, walking, and moving from a bed to a chair. The scheme provides monthly cash payouts for as long as you remain severely disabled.

Fig. 1: Activities of Daily Living (ADL).

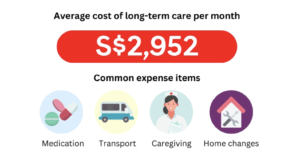

The Gap in this Pillar: The monthly payout (currently $662 per month as of 2025) is a crucial lifeline, but it may not cover the full cost of long-term care, which can easily exceed $2,000-$3,000 per month in Singapore for a caregiver or nursing home (see Fig. 2).

Fig. 2: Average cost of long-term care per month (source: Singlife).

[Must-Have Coverage]: CareShield Life Enhancements

To address this gap, private insurers offer optional CareShield Life enhancements. These supplementary plans are designed to boost your long-term care coverage significantly.

Key benefits include:

- Higher Monthly Payouts: You can choose to increase your monthly payout by an additional $200 to $5,000, ensuring you have enough to cover your desired level of care without burdening your family.

- Lower Disability Threshold: Some enhancement plans will pay out even if you can’t perform just one or two ADLs, providing financial support much earlier than the basic scheme’s three-ADL requirement.

Reinforcing Your Foundation

As you can see, our “3 Pillars” provide a powerful foundation for your healthcare needs in retirement. However, they are designed to be a safety net, and significant gaps can remain if you desire more comprehensive coverage or higher levels of care. By understanding how Integrated Shield Plans and CareShield Life enhancements can reinforce this foundation, you can build a truly complete and secure structure.

You’ve spent a lifetime building your nest egg; the final step is to ensure it is properly protected from the financial impact of major health issues. If you would like to have a confidential discussion to review your current healthcare coverage and ensure it aligns with your desired lifestyle in retirement, I am here to help.

Reach out today for a no-obligation consultation to build your complete and worry-free retirement health plan.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg