Salary Ceiling changes and your Retirement Nest Egg

During the budget 2023 speech by DPM Lawrence Wong on Valentine’s Day, one of the key things that he announced is the Increase in Monthly Salary Ceiling for CPF contributions for individuals (and employers).

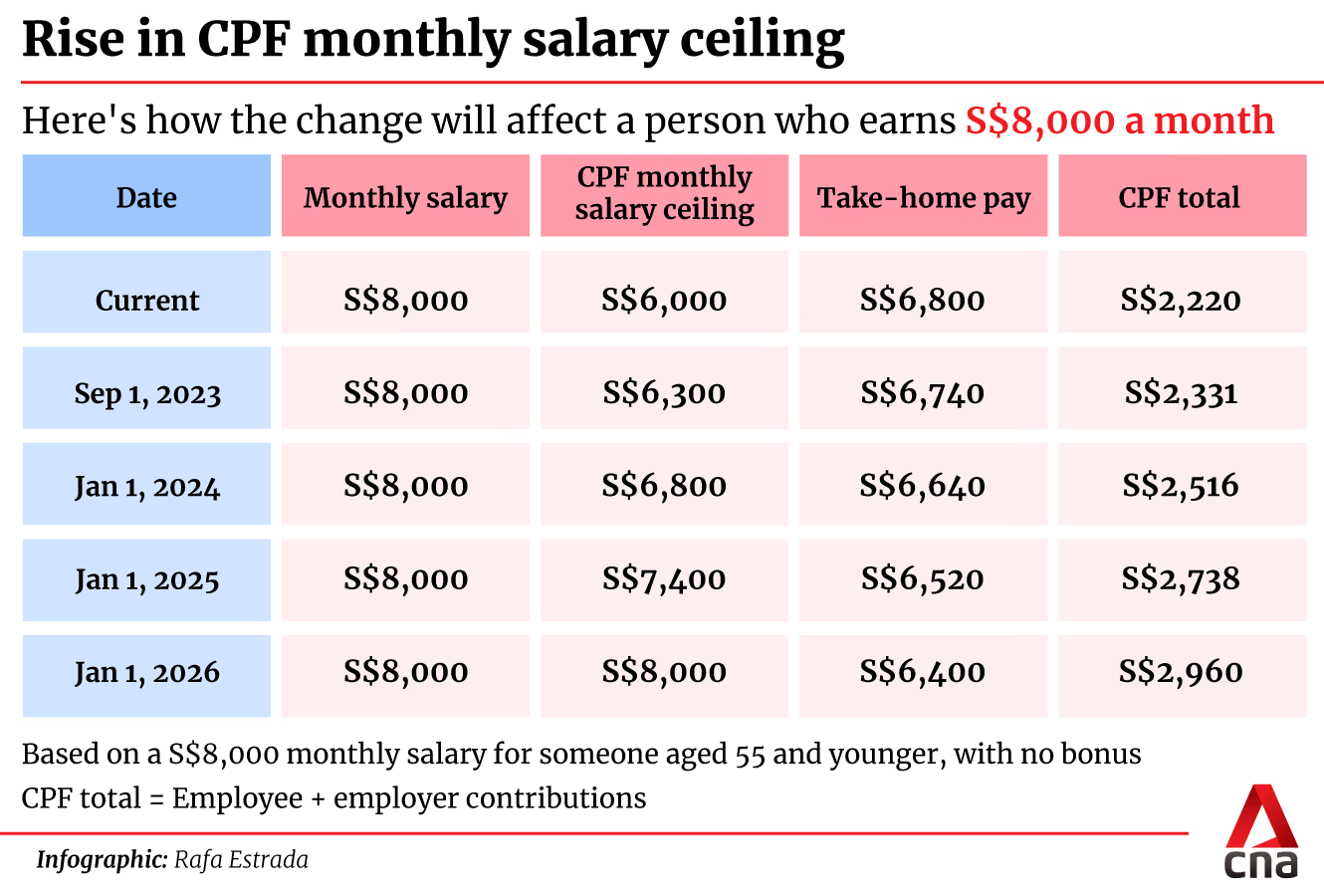

The Salary Ceiling will gradually increase from S$6000 to S$8000. It will be done in 4 stages, with the current first stage already in effect as of 1 Sep 2023. (Refer to table below)

Direct Impact on Singaporean/PR : Reduction in take-home pay

With this change, those earning above $6000 will start to see reduction in their take-home-pay, but, fret no, given an example of an individual that is already earning $8000 per month, and assuming there is no change in salary throughout till Jan 2026, this individual will only have a reduction in take-home salary from $6800 (before Sep 2023) to $6400 (from Jan 2026). This $400 difference should not make a huge impact for those in this salary range hypothetically.

Even with the change in salary ceiling taking full effect on Jan 2026, the annual salary ceiling still remains at $102,000. This means that even for someone earning $8,000 today, the total amount of CPF contribution will still be up to the CPF Annual Limit of $37,740. What will change is how much of it comes via the Ordinary Wage (OW) compared to Additional Wages (AW). When that happens (in 2026), we will only receive CPF contributions on up to $6,000 of Additional Wages (compared to $30,000 on the current system where the monthly salary ceiling is $6,000).

Direct Impact on Companies: Increase in Cost of Labour for Employers

Raising the wage ceiling will mean that companies will have to pay more in CPF contributions for their staff that are earning more than $6000 in monthly salary effective 1 Sep.

As business owners, you might want to manage your cash flow, and here at Pinnacle Wealth, we have corporate solution for you.

Reminder to plan ahead for Retirement Planning

Be it that this move by the Government is a Yay or Nay for some, but this move is evidently pointing at reminding all of us to look at our own retirement nest egg.

Referring to the articles below, our cost-of-living has definitely increased gradually.

- Transportation Cost that is increasing from Dec 2023: https://www.channelnewsasia.com/singapore/mrt-bus-fare-increase-10-11-cents-public-transport-council-3779086

- Singapore’s January Core Inflation rises 5.5%, fastest in 14 years: https://www.reuters.com/markets/asia/singapores-january-core-inflation-rises-55-2023-02-23/

- Rise in Water Prices coming our way: https://www.straitstimes.com/singapore/s-pore-water-price-to-rise-by-50-cents-per-cubic-m-by-2025-lower-middle-income-families-to-get-help

The best thing you can do for your retirement planning is to start early, and let me illustrate with the magic of compound interest when it comes to saving and investing for retirement. The earlier you start growing your retirement nest egg, the more time you will have for your money to grow through compound interest.

Effect of Compounding Interest

Let us illustrate just how powerful compounding interest is with an example. Assuming, given your current income and expenses, you can afford to put aside S$1200 a year towards your retirement. This amount could be invested in a balanced portfolio that gives a modest average rate of returns of 5% per year. By investing your S$1200 yearly, you would have accumulated $91,917.98 towards your retirement after just 35 years.

If you have started your retirement savings 10 years earlier, you would have accumulated a staggering S$151,044.68 by saving the same amount yearly at the same rate of return. By starting earlier, you would only have had to save an additional S$12,000 but you would be able to accumulate an additional of $59,126.70.

So, don’t make the mistake of relying on your CPF as your one golden retirement nest egg, why not let us create that additional one or two more nest egg that can set you on a plan to possibly retire earlier. Speak to us here at Pinnacle Wealth to help you have a head-start on your retirement planning now.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Chiang Wen Kai 詹渂凯

The Financial Architect, advising business owners, SMEs business owners.

While business owners dedicate themselves to the everyday demands of running their companies, I apply my financial expertise to ensure they are fully shielded from life’s uncertainties and financial storms.

About Me: Having worked in the SME/Corporate banking industry in my early years, I share the passion of what business owners shared of waking up everyday ready to grind and make their business dream come true. ever since, for more than 10 years now, I have been helping business owners and their family find predictability, stability and financial certainty in the uncertain landscape.

My Services: Offering expert business advisory services focused on protecting retirement assets and safeguarding business value, I help entrepreneurs, business owners, and family enterprises stay resilient amid uncertainties and succession events.

My comprehensive suite of solutions ensures business owners can secure their legacy, provide for their families, and maintain organizational stability through life’s critical transitions.

Advisory Services Overview

Protection of Retirement Assets: Design holistic plans to shelter personal and business retirement savings against creditor claims and market risks, leveraging compliant structures and diversified portfolios.

Protecting Business Value: Implement strategies such as asset segregation, trusts, and liability coverage to shield business assets and maintain value through turbulence or ownership change.

Family Cash Out & Continuity: Enable families to access fair value from business assets after an owner’s demise, and provide business buyout funding for smooth generational succession or exit planning.

Business Continuity for Shareholders: Structure buy-sell agreements, shareholder insurance, and continuity funding to ensure the ongoing operation of the business in the face of partner exits, deaths, or disabilities.

Debt Cancellation & Collateral: Advise on optimized use of insurance, structured loans, and collateral assignments to handle liabilities, support business growth, and mitigate loan risk.

Cash Flow Management: Develop tailored cash flow strategies for operational stability, including debt management, liquidity planning, and revenue smoothing for greater financial resilience.

Buy/Sell Agreements: Facilitate buy-in, buy-out, and share-exchange arrangements between shareholders, simplifying ownership transitions and reducing conflict during changes.

Golden Handcuffs/Handshake: Advise on bespoke compensation plans, such as deferred bonuses or retirement gratuities, that help attract, retain, and reward key employees or family members in the business.

Key Person Protection: Secure profits and operational stability through keyman insurance or contingency arrangements to offset the financial impact of losing crucial team members.

Family Business Expansion Funding: Structure funding and succession vehicles to support family business growth, help families tap into new markets, or recapitalize when leadership changes.

Distinctive Approach

Personalized Strategies: All solutions are customized to the client’s unique business, family, and personal financial profile, with a focus on both wealth preservation and business growth.

Succession-Ready Planning: Use proven frameworks and tools for succession planning, including role mapping, successor assessment, and implementation timelines to future-proof your business.

Holistic Protection: Integrate asset protection, business value, tax strategies, and employee incentives into a single, coherent advisory offering.

Trusted Guidance: Extensive experience helping owners address both business and personal financial risks, ensuring smooth transitions and peace of mind for all stakeholders.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg