[BREAKING] Your IPs may not cover your Cancer Treatments

Many of us are covered by Integrated shield Plans (IPs) for comprehensive inpatient hospitalization at private and/or government hospitals in Singapore. Due to rising cancer treatment claims, the Ministry of Health (MOH) introduced a list of approved cancer drugs with proven efficacies and are known to be cost effective, to help keep insurance premiums sustainable for the long haul. Regardless of whether you are Singaporeans, PRs or foreigners working in Singapore, the below changes affect your coverage.

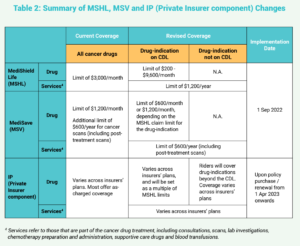

Here are the timelines and main changes to your coverage:

Main changes to Medishield Life wef 01/09/2022

– Only outpatient cancer treatments on the approved cancer drug list (CDL) will be claimable – Approved cancer drugs & services claims will also be revised to a range of $200 to $9,600/month (depending on drug type) instead of a fixed amount previously.

– Only 90% of cancer drugs in government hospitals are on the approved list Read more here: MOH to provide additional support for cancer patients affected by changes to treatment claim policies

Main changes to Integrated shield Plans (IP) wef 01/04/2023

– Only outpatient cancer treatments on the approved cancer drug list (CDL) will be claimable – Even for the approved cancer drug list, claim limits will no longer be on “as charged” basis, but a multiple of Medishield Life limits (above)

Refer to MOH table for summary of changes below:

Source: MOH AFFORDABLE CANCER DRUG TREATMENT FOR ALL

Implications

– Some cancer patients may find their current treatment either no longer claimable, or have the claim limit lowered with no subsidy extended. From Straits Times: Brain cancer patient treated with off-label drug frets over costs when insurance coverage stops in April 2023

Future of Integrated Shield plans (IP)

– Insurers will come up with optional IP riders to cover cancer drugs which are not on the approved list. – May be harder to claim in future, as different insurers may cover a different list of non-approved cancer drug list – Approved Drug list may apply to other types of illnesses such as cardiovascular diseases and diabetes, as well as medical implants.

Read more here: Not all newly approved drugs provide real benefits to patients

Possible solutions

As policyholders, some of the options we can tap on if we were to face such a scenario would be:

1. Understand the scope of our employee medical benefits, if any and utilise them.

2. Check for options to increase our critical illness coverage upon life events on our existing policies

3. Review / Boost our critical illness coverage with a critical illness / cancer plan for ourselves and loved ones (including children)

Still unsure about how these affect you?

Do drop me an email at winniechan@fapl.sg or chat with me here

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Chan Wen Li Winnie

Winnie Chan is a distinguished Certified Financial Planner (CFP) with over a decade of expertise in financial advisory services. Her commitment to her clients has led many to achieve their financial aspirations while ensuring their families’ protection. Winnie‘s extensive experience in insurance claims has been instrumental in securing successful payouts, providing crucial financial relief during challenging times.

Her passion for community engagement is evident through her financial education initiatives. She has conducted insightful financial talks for esteemed organizations such as Carousell Group, Singapore National Eye Centre and Singtel, empowering their employees with valuable financial knowledge.

Outside of her professional commitments, Winnie balances her life with a passion for fitness and music. She enjoys rigorous workouts at the gym and is a pianist, recently awarded ABRSM Piano Performance Grade 6 (Merit).

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg