[NEW] Budget 2024: Closure of CPFSA & its Implications

Closure of CPFSA from 2025

As you are aware, the recent Budget 2024 announced important changes to CPF.

First is the closure of CPFSA for those aged 55 and above with effect from 2025.

Second is the increase of Enhanced Retirement Sum to 4x Basic Retirement Sum.

Read more here: How will closing of Special Account impact CPF members when they turn 55?

What does this mean for CPF members?

1. Closure of CPFSA upon reaching 55 with effect from 2025

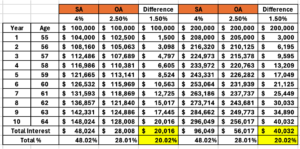

– Any existing CPFSA savings (interest 4.08%pa) will be transferred to the Retirement Account (RA) up to the Full Retirement Sum (FRS). Any amount exceeding the FRS will be transferred to the Ordinary Account (OA) which offers a lower interest rate 2.5%pa

– This translates to ‘lost’ interest of 1.58%pa, which in absolute terms is lost interest of $20,000 (20%) for every $100,000 CPFSA funds over a 10-year period (see below chart)

Note: CPF SA/RA to drop to 4.05% from Q2 2024

2. Increase of Enhanced Retirement Sum to 4x Basic Retirement Sum

You would be able to top up to a higher Retirement Sum for increased CPF Life payouts.

But should you top up to ERS?

A recent article discussed the possibility of receiving over $3,300 monthly payouts through the enhanced CPF Life scheme, where the author mentioned that “CPF Life is the only annuity in the market that can guarantee stable and lifelong payouts because it is backed by the Government.”

Putting things into perspective

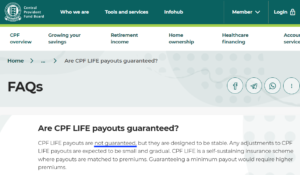

Based on CPF Board’s FAQ, CPF Life payouts are not guaranteed but are based on a self-sustaining model.

It does not claim to be “backed by the Government.”

Another point to note is that CPF life is subject to change.

The assumptions used to calculate payouts, like life expectancy, are susceptible to future changes.

For instance, if life expectancy increases, payouts might decrease to maintain the scheme’s sustainability.

Ensuring a Secure Retirement

While CPF Life plays a significant role, it’s prudent to diversify your retirement income sources. Consider incorporating:

Private annuities for stable income, with the flexibility to choose your preferred payout period and amount. Some plans also provide added financial security upon a disability

Dividend-paying investments to help keep up with inflation and provide a boost to your retirement lifestyle.

Indexed Universal life which also provide an income (crediting rates 6-7%pa), with the benefit of estate transfer 3-8x of original sum.

Diversify your Retirement Income

By diversifying your income sources, you can gain greater control and flexibility to personalize your retirement income and lifestyle.

Do reach out if you have any questions relating to the recent changes to CPF, or your retirement portfolio!

Disclaimer: This article provides general information and does not constitute financial advice. Please consult a qualified financial professional before making any investment decisions.

#ChooseIndependent

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Chan Wen Li Winnie

Winnie Chan is a distinguished Certified Financial Planner (CFP) with over a decade of expertise in financial advisory services. Her commitment to her clients has led many to achieve their financial aspirations while ensuring their families’ protection. Winnie‘s extensive experience in insurance claims has been instrumental in securing successful payouts, providing crucial financial relief during challenging times.

Her passion for community engagement is evident through her financial education initiatives. She has conducted insightful financial talks for esteemed organizations such as Carousell Group, Singapore National Eye Centre and Singtel, empowering their employees with valuable financial knowledge.

Outside of her professional commitments, Winnie balances her life with a passion for fitness and music. She enjoys rigorous workouts at the gym and is a pianist, recently awarded ABRSM Piano Performance Grade 6 (Merit).

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg