[NEW] How to save tax: Maximising your Tax Reliefs 2024

Tax season is around the corner. Here are some ways to maximize your Tax Reliefs:

Part 1: Upon Tax Reporting in March / April (FY2024)

1. Course fee tax relief: $5,500

You may claim the actual course fees incurred by yourself, up to a maximum of $5,500 each year

2. Life Insurance tax relief: $5,000

If your CPF contribution is < $5,000 last year, you may claim the lower of:

a. the difference between $5,000 and your CPF contribution; or

b. up to 7% of the insured value of your own/your wife's life, or the amount of insurance premiums paid

New! The voluntary cash contribution to your Medisave account is not considered for the $5,000 limit for the total CPF contribution for YA 2023 onwards.

3. Parents relief: $9,000

You may claim this relief if you have supported the following dependants:

• Parents / Parents-in-law / Grandparents / Grandparents-in-law

• Stay with dependent $9,000 / Don’t stay with dependent $5,500

You may also discuss with your siblings on how to share the parents relief.

4. Qualifying Child Relief: $4,000

For parents, you may claim tax relief of $4,000 per child.

Tip! Depending on your income, it may be better for QCR to be claimed under fathers, as mothers have Working Mother Child Relief

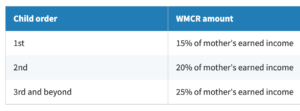

5. Working Mother Child Relief: 60% income

For working mothers, you may claim up to 60% of your income depending on the number of children as below, and your child did not have an annual income exceeding $4,000.

Tip! If your child worked part-time before tertiary education, your WMCR will be automatically removed.

But you may write to IRAS to request to re-instate the WMCR once your child is back to full-time studies.

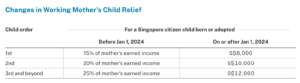

Update to Working Mother Child Relief (wef FY2025)

Budget 2023: Child relief for working mothers to be fixed from 2024

Check your tax relief eligibility here

Do note that there is an overall tax reliefs cap at $80,000

Tip! When claiming reliefs, if you are aware that you have exceeded the relief cap of $80,000, you may consider giving up certain reliefs (e.g. Qualifying Child Relief, Parent Relief and Grandparent Caregiver Relief) and let others (e.g. your spouse, your siblings) claim the reliefs

Part 2: By end of the year (FY2025)

Other Reliefs & Deductions to reduce tax for 2024 income (to be done before 31/12/2024)

6. Donations: 2.5x tax relief

Donations to approved Institution of a Public Character (IPC) enjoy tax deductions of 2.5 times the qualifying donation amount.

7. CPF contribution

For employees: Yearly CPF top-up $8,000

You can enjoy tax relief of up to $16,000 for cash top-ups made in each calendar year. Get up to $8,000 tax relief when you top up for yourself and up to $8,000 when you help your loved ones build their retirement savings.

For self-employed: Max contribution $37,740

You may contribute the maximum CPF contribution of $37,740 to reduce your taxable income

Tip!

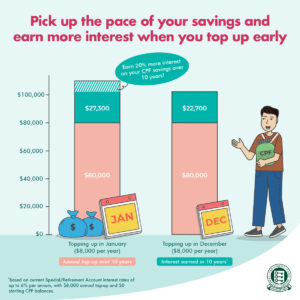

You should top up as early as possible to benefit from the power of compound interest over the years.

You can also earn more interest if you top up earlier in the year. For example, if you top up in January each year instead of in December, you can earn up to 20% more interest on your top-ups in 10 years!

8. Supplementary Retirement Scheme: $15,300 / $35,700

Similarly, contributions to SRS can be made in the earlier part of the year, so that the funds can be invested earlier in the year to participate in equity markets or other insurance plans.

Maximum tax relief: $15,300 (Singaporeans/PR) & $35,700 (foreigners)

Read more on IRAS tax relief & deductions here!

Hope that the above information is useful!

If you are still unsure about the tax reliefs or have any queries, do email me at winniechan@fapl.sg and we can have a chat to see how best to reduce your tax payable.

Meanwhile, you can watch my latest video on Tiktok @ SquirrelFinance on How to Save Tax

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Chan Wen Li Winnie

Winnie Chan is a distinguished Certified Financial Planner (CFP) with over a decade of expertise in financial advisory services. Her commitment to her clients has led many to achieve their financial aspirations while ensuring their families’ protection. Winnie‘s extensive experience in insurance claims has been instrumental in securing successful payouts, providing crucial financial relief during challenging times.

Her passion for community engagement is evident through her financial education initiatives. She has conducted insightful financial talks for esteemed organizations such as Carousell Group, Singapore National Eye Centre and Singtel, empowering their employees with valuable financial knowledge.

Outside of her professional commitments, Winnie balances her life with a passion for fitness and music. She enjoys rigorous workouts at the gym and is a pianist, recently awarded ABRSM Piano Performance Grade 6 (Merit).

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg