Financial Independence, Retire Early

“I want to retire at 50 with a lifelong monthly income of $3000.”

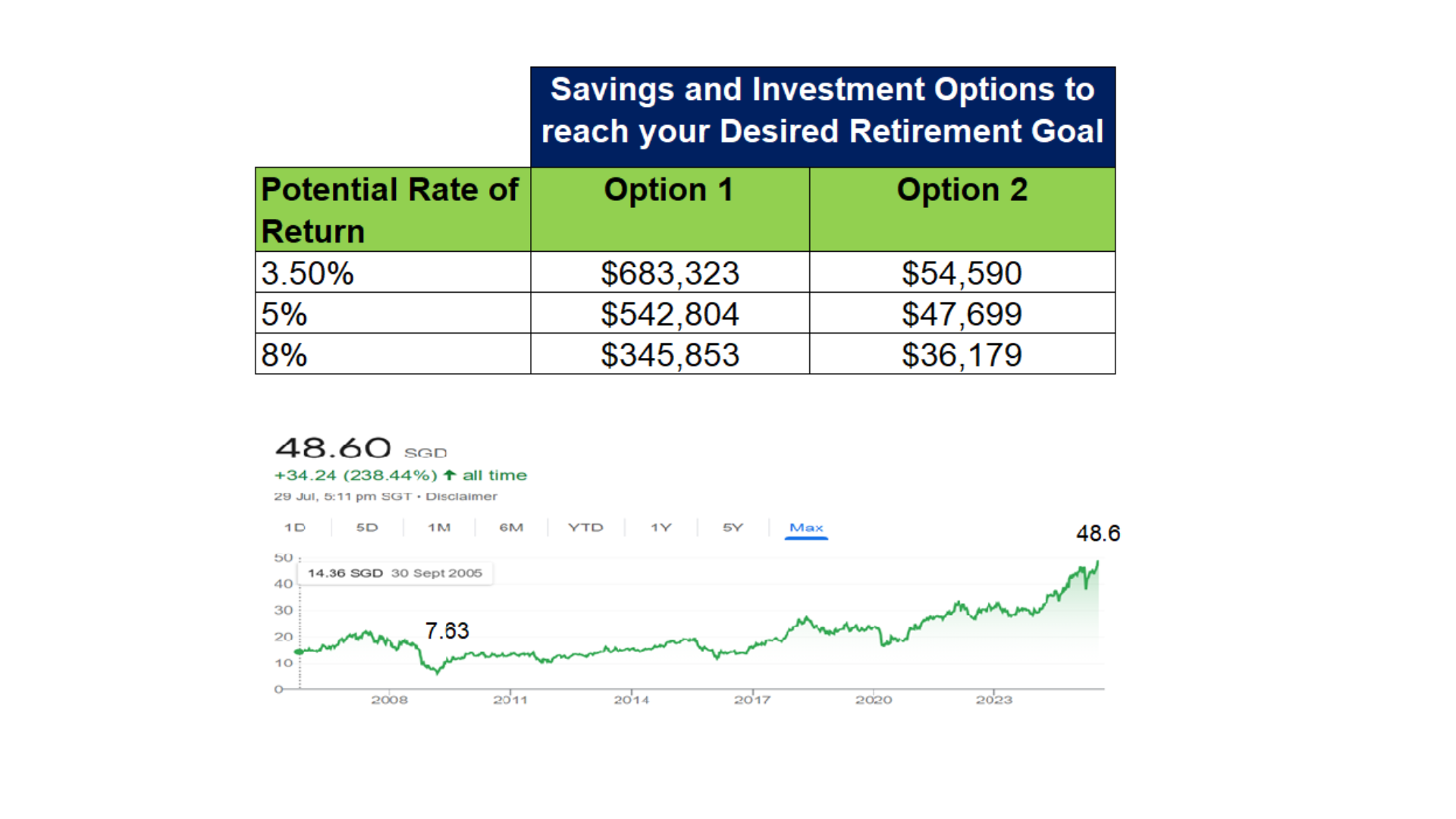

That was the goal from a 34-year-old public servant I recently met. The traditional path to get there, however, felt overwhelming. It required her to save a staggering amount – over $36,000 per year. A figure that only gets higher with any delay.

This is where a simple calculation meets real-life uncertainty. It raises critical questions a standard plan often ignores:

🤔 Can she truly sustain such a high savings rate for 16 consecutive years?

🤔 What about her career? She anticipates her pay will grow steadily, not

exponentially.

This is where a second layer of strategy becomes vital. While the discipline of regular savings is essential—as we can never predict when the next crisis will be—true financial acceleration comes from strategic action during unique moments.

Think back to the Global Financial Crisis. A single, disciplined investment into quality assets during that turmoil could have achieved more than years of stressful monthly savings.

This highlights the crucial difference between simply saving harder and having a multi-layered strategy. If this feeling of being on a financial treadmill resonates with you, and you believe your circumstances require a more tailored approach than the standard one-size-fits-all plan, then I invite you for a conversation.

Let’s explore how a clear, strategic plan can be shaped for your unique goals. Schedule a confidential, no-obligation discussion with me.

#StrategicWealth #RetirementStrategy #SingaporeProfessionals #FinancialClarity #WealthManagement #InvestmentMindset

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Wong Kum Soon 王锦顺

As a former Army Officer turned Financial Consultant, I live by the principle: “If we fail to plan, we plan to fail.” This military precision forms the foundation of my approach to financial planning, helping professionals and civil servants secure their financial independence.

Combining my military leadership experience with MDRT recognition, I transform complex financial situations into clear, actionable plans. My mission is to guide young professionals toward financial independence by 50, while empowering those in their 50s and 60s to pursue their passions. As a caregiver to elderly parents, I deeply understand the importance of comprehensive retirement planning.

Beyond my professional role, I serve as Vice President of a Cantonese Association and actively volunteer in my church. I create a thoughtful space where we can examine your financial position and transform retirement planning into a manageable journey toward financial serenity.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg