How does earning $250 per annum for a $500,000 fixed deposit account sound?

If that return amount makes you feel frustrated ?, you won’t be happy to know that these are the existing returns mentioned on a local bank’s website. This is worrying many banking clients, especially with Singapore’s inflation hitting 3.2% in October 2021; the highest rate in more than eight years!

My client, KC similarly felt this frustration as he felt that with such low returns, he was unable to save up for his retirement and fund his children’s future. He was not too sure about where to invest his money as he had a low-risk propensity and was worried about losing money in the investment.

With this in mind, I met up with KC to understand his needs; taking the necessary baby steps towards investing his money properly, starting with Unit Trust, and gradually moving into stocks.

These are the lessons learned from the session with KC:

? By putting your money in the bank, you will potentially be getting a -3.15% return, taking inflation into account. Is this truly the best and safest investment to be made?

? As KC is a more conservative investor, we have tailored a solution specifically for him; one that can allow him to sleep peacefully at night without worrying about the choppy market. By doing this, we managed to deliver a 15% return over three years.

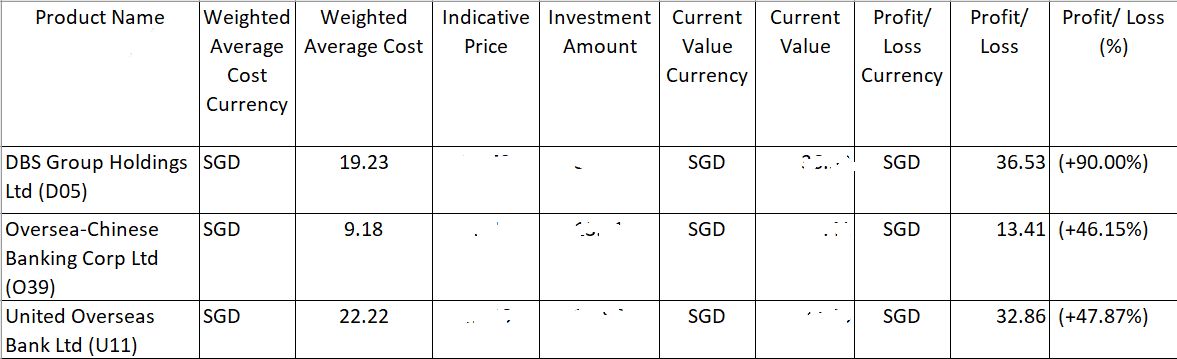

? I have heard that many investors were buying DBS near its lowest in 2020 and selling when it became $21. By doing so, they have missed out on a much higher return. During this time, KC also asked me many times if he should be selling, but I am glad he trusted my advice and held on to his investment.

If you’re looking at the interest rates from your local bank and worried about the low returns that may be insufficient for you to fulfill your retirement dreams, feel free to DM me for a portfolio review. I’ll be more than happy to help in any way I can.

#soulwealthygroup # #bank #investing #investment #investment #future #interestrates #retirement #retirementplanning

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Wong Kum Soon 王锦顺

As a former Army Officer turned Financial Consultant, I live by the principle: “If we fail to plan, we plan to fail.” This military precision forms the foundation of my approach to financial planning, helping professionals and civil servants secure their financial independence.

Combining my military leadership experience with MDRT recognition, I transform complex financial situations into clear, actionable plans. My mission is to guide young professionals toward financial independence by 50, while empowering those in their 50s and 60s to pursue their passions. As a caregiver to elderly parents, I deeply understand the importance of comprehensive retirement planning.

Beyond my professional role, I serve as Vice President of a Cantonese Association and actively volunteer in my church. I create a thoughtful space where we can examine your financial position and transform retirement planning into a manageable journey toward financial serenity.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg