What is Retirement? Well, the answer varies from person to person and some of the common responses include:

Despite the different expectations of retirement life, we would definitely want to be able to lead comfortable lives.

Now that we have a target end goal, how do we go about achieving it? What would stop us from fulfilling our retirement goals?

It might seem like a dream and “Mission Impossible” to many of us but is that really true?

Well, dreams have a higher probability of coming true if you have a plan in place.

Let me introduce to you the Network of Wealth (N.O.W) concept, which will aid you in building your retirement fortress.

Prior to being a financial consultant, I was an IT Network Consultant who helped companies design the IT network infrastructure. As part of my job, I helped to design how data flow and its security aspects. Hence, drawing a parallel to that of network design, the idea is to be able to expand the core sources of wealth progressively whilst protecting the core from any form of enemy attack which is detrimental.

As you are happily increasing your different streams of income, you will need to ensure that your defense structure is strong enough to withstand potential attacks.

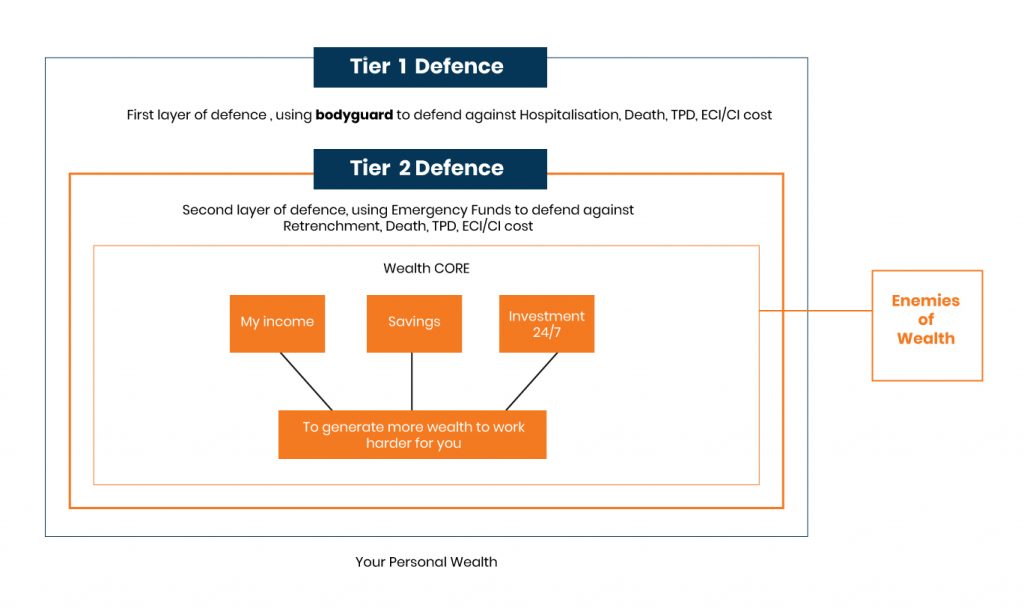

Now let me present to you the Network of Wealth (N.O.W)

1) Wealth Core

The Wealth CORE consists of Income, Savings and Investments. We will be spending a large portion of life generating more income to keep up with the ever-increasing cost of living.

The progress in Wealth Core will determine whether you are on track towards your financial goals (Retirement Goals etc).

2) Tier 2 Defence

Emergency funds are cash one sets aside for rainy day situations. A good gauge is 6 months’ worth of expenses or salary. However, the ultimate amount is dependent on your own set of requirements.

Tier 2 Defence utilises Emergency Funds (What you have) as a defence mechanism to temporarily alleviate the situation if you have been retrenched or if your Tier 1 resources have been depleted by the ‘Enemies of Wealth’ (Which we will touch on later).

3) Tier 1 Defence

Tier 1 Defence is similar to hiring bodyguards for the specific purpose of defending against possible known enemies. This is your first line of wealth defence. If managed well, you will have peace of mind building the Wealth Core. How then should one construct this moat of defence? What are the steps that can be implemented? Here, you may engage a qualified professional to carry out an audit on this tier to check if your current coverage is sufficient to defend your personal situational needs.

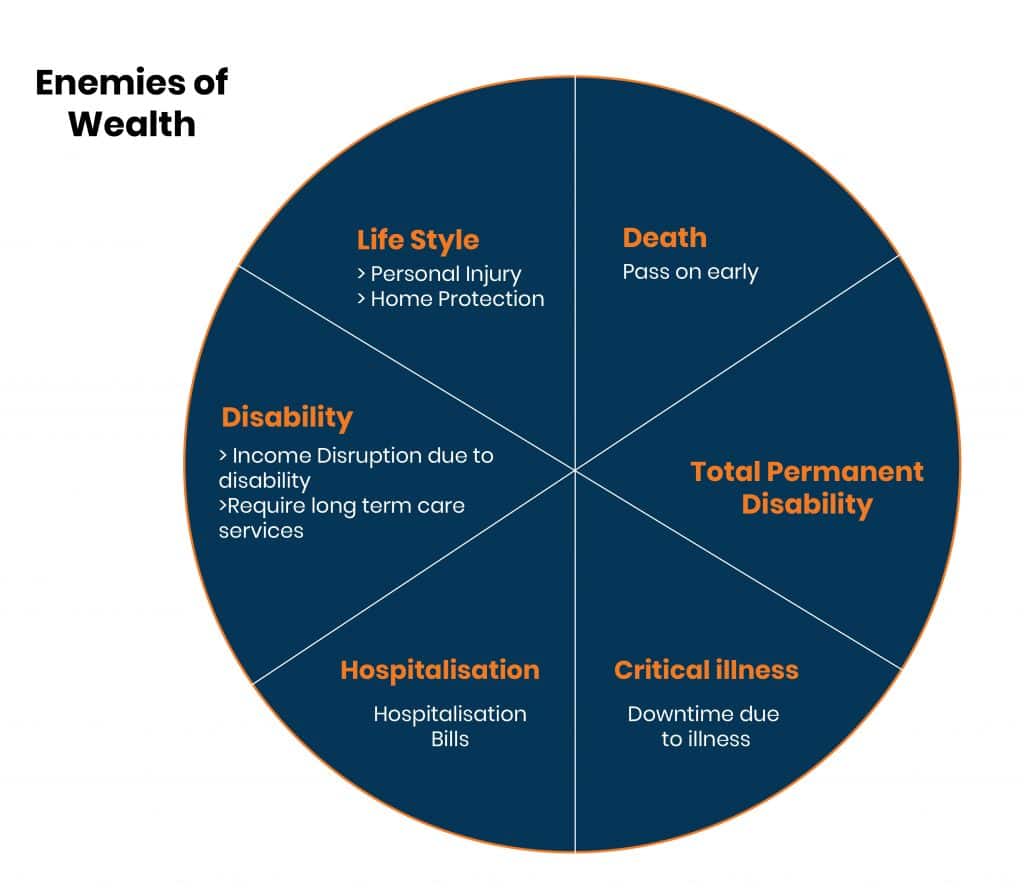

Next, we will be exploring the Enemies of Wealth which is detrimental to our accumulation of wealth.

A good defence strategy protects us against possible damage to our Wealth Core. We can better protect what is known to us. The list of known enemies is what I call the “Enemies of Wealth”.

The list of enemies includes but is not limited to the following:

1) Death

An early demise would result in your partner/spouse/children/anyone having to take on additional responsibilities to fund any necessary expenses/liabilities that you previously co-funded. Typically, such expenses would not have been budgeted for and will place a huge pressure on the sole breadwinner/next-of-kin.

2) Total Permanent Disability

This is the stage where you are alive but heavily reliant on your caregiver. Typically, you will not be able to perform 3 out of 6 ADL (Activities of Daily Living). Henceforth, there might be specific requirements in terms of food intake and the possible remodelling of your bedroom to allow for comfortable living conditions on top of income loss.

3) Critical Illness

Critical Illness is no stranger to all. We have had friends, relatives and loved ones suffer from cancer, stroke, heart attack, etc. In the event that any of us are struck by a major illness, we would have to give serious thought to the following: Would you still have the energy to work? Or are you still capable to work? How long would you take to recover? Do you have enough cash on hand to supplement the downtime required by your body? Do you need to seek alternative medical opinions?

4) Hospitalisation

Medical inflation is rising at an exponential rate and hence, we increasingly see heftier hospital bills incurred. Are we then prepared to foot the bills when the need arises? Would you like the option to have a more comfortable hospital stay with dedicated medical attention?

5) Disability

Given the limitations of certain bodily functions, this will affect the performance of our work. How then would you ensure a constant income stream given your hampered ability to work? For a prolong period of disability, what are the sources of income that you have?

6) Lifestyle

This includes Home liabilities and Personal accidental injuries resulting from our daily activities.

In life, known wealth risks can be mitigated with a risk management strategy. Hence, as part of my personal retirement planning, I have built up layers of defence to protect myself from the above-mentioned enemies. Now that you are aware of the various Enemies of Wealth, do give a thought on how you may counter them as part of your defence strategies.

Once the necessary defence strategies are in place, you can then divert your attention towards building your Income Asset with peace of mind. In the next article, I will be using the N.O.W concept to help you visualise how the Wealth CORE engine works for you towards retirement.

All the best with your retirement journey!

Xavier Koh

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek independent financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策

Subscribe to our newsletter to receive updates on our latest content!

By submitting this form, I confirm that

提交此表格,即表示

In compliance with the Personal Data Protection Act, Financial Alliance Pte Ltd (“FAPL”) seek your consent to collect and use your personal data (e.g. name, NRIC, contact numbers, mailing addresses, email addresses and photograph) for the purposes of and in accordance with FAPL’s Data Protection Policy, which can be found on FAPL’s website at https://fa.com.sg/data-protection-policy/.

根据《个人数据保护法》,鑫盟理财私人有限公司征求您的同意向您收集并使用您的个人信息。鑫盟理财将根据公司的个人数据保护政策所阐述的用途使用您的个人资料(例如姓名,证件号码,联系电话,邮寄地址,电邮地址和照片)。 该政策可在本公司网站上查寻,网址为 https://fa.com.sg/data-protection-policy/.

By submitting this form, you are deemed to have read and understood FAPL’s Personal Data Policy.

提交此表格,即表示您已阅读并理解鑫盟理财私人有限公司的个人数据政策