Are You Financially FIT? T – Transfer of Wealth (Part 3)

Welcome back to Part 3 of our “Are You Financially FIT?” series.

Using our Financially F.I.T. program, we help clients evaluate their overall financial well-being through three pillars:

F – Financial Management,

I – Insurance Planning, and

T – Transfer of Wealth.

In the previous instalments, we built the foundations of financial wellness. Now, we address a topic that many find uncomfortable, yet is arguably one of the most crucial aspects of long-term financial planning – the Transfer of Wealth.

For many Singaporeans, this isn’t about grand fortunes, but about ensuring the security of our loved ones and preventing unnecessary hardship.

Protecting Your Dependents

A lack of clear instruction is a recipe for conflict. Even in seemingly close-knit families, ambiguity over assets can lead to deep-seated disputes. Effective wealth transfer planning is critical for the financial stability of your dependents. This is especially true if you have minor children who will need guardians, elderly parents who rely on your support, or dependents with special needs who require long-term care.

Ensuring Your Wishes are Honored

Without a clear plan, the law will decide how your assets are distributed. This may not align with your personal wishes or your family’s unique needs. A formal plan is the only way to guarantee your intentions are carried out.

Avoiding “Reverse Wealth Transfer”

A growing concern in our aging population is the “reverse wealth transfer,” where the younger generation has to liquidate their own assets to care for their elders. Comprehensive planning, including adequate medical and long-term care insurance ensures that your healthcare needs in your later years are provided for without burdening your children financially.

Preserving Family Legacy and Values

Wealth transfer extends beyond monetary assets. It’s an opportunity to pass on your values. We worked with a client who set up a small educational trust fund for his grandchildren. It wasn’t a vast sum, but it sent a powerful message about the value he placed on education, creating a legacy that will shape his family for generations.

Key Tools and Mechanisms for Wealth Transfer in Singapore

A. Wills

The cornerstone of your plan – a Will is a legal document that outlines how you want your assets to be distributed after your death. It is the most fundamental tool in wealth transfer.

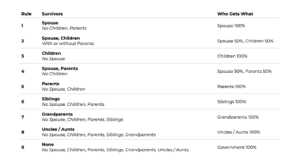

- Dying Without a Will (Intestacy): When a non-Muslim individual dies without a valid Will in Singapore, their estate will be distributed according to the Intestate Succession Act (see Fig. 1). This rigid formula may not reflect your wishes. For Muslims, the Shariah (Islamic) law, specifically the principles of Faraid (the Islamic Inheritance Law for Muslims) applies. While The Act attempts to reflect what most people would likely want for their assets to be distributed, it might not align with your personal wishes.

Fig. 1: Intestate Succession Act.

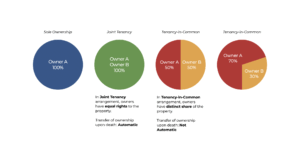

- A Will Covers: Assets that are solely in your name, properties under tenancy-in-common.

- A Will Doesn’t Cover: It’s crucial to understand that a Will does not cover your Central Provident Fund (CPF) savings, insurance policies with nominations, jointly-held assets as such bank account, investment accounts, properties under joint tenancy (see Fig. 2).

Fig. 2: Types of Property Ownership.

- Executors and Guardians: Your Will allows you to appoint an executor to manage your estate and a guardian to care for your minor children. These are vital roles for which you should choose people you trust.

- Reviewing Your Will: Life events such as marriage, divorce, the birth of a child, or a significant change in assets should trigger a review of your Will to ensure it remains current.

B. CPF and Insurance Nominations

- CPF Nominations: Your CPF savings are distributed through a separate nomination you make with the CPF Board. If you don’t make a nomination, your savings will be transferred to the Public Trustee’s Office for distribution, a process that is often slower and incurs fees.

- Insurance Nominations: Naming beneficiaries on your insurance policies ensures a direct and swift payout of death benefits, often within weeks. This can provide immediate financial relief for your family, while probate for a Will can take months. You can make a revocable nomination, which you can change anytime, or a trust nomination, which is irrevocable and creates a statutory trust for your beneficiaries.

C. Trusts

A trust offers more flexibility and control than a will. You can set up a trust to manage assets for beneficiaries who may be too young, lack financial acumen, or have special needs. It allows for staggered distributions and can protect assets from creditors.

Other Essential Tools for Holistic Planning

While not direct wealth transfer tools, the following are indispensable for comprehensive planning:

D. Lasting Power of Attorney (LPA)

An LPA allows you to appoint a trusted person (a ‘Donee’) to make decisions about your personal welfare and financial affairs if you lose mental capacity. Without an LPA, your family would need to apply to the court for deputyship, a process that is both time-consuming and expensive.

E. Advance Medical Directive (AMD)

This legal document allows you to state in advance that you do not want extraordinary life-sustaining treatment if you become terminally ill and unconscious.

F. Advance Care Planning (ACP)

This is a more comprehensive plan that outlines your preferences for future medical care, including your desired quality of life and where you would prefer to be cared for. It serves as a guide for your loved ones and healthcare team.

Practical Steps to Get Started

- Start Early, Review Regularly: Planning the transfer of your wealth is not just for the wealthy or the elderly. It’s a journey that should begin the moment you start accumulating assets and have people who depend on you.

- Create an Inventory of Your Assets and Liabilities: Your family cannot inherit what they don’t know exists. Make a clear list of all your assets – bank accounts, properties, investments, insurance policies, and even digital assets – and where to find them.

- Communicate with Your Family: Open conversations about your wishes can prevent misunderstandings and conflict down the road.

- Choose Trusted Advisers: The complexities of wealth transfer make professional guidance invaluable. A qualified advisor can help you navigate the legalities and create a holistic plan tailored to your unique circumstances.

Case Study

Using our F.I.T. program, we worked with Aaron to curate a personalised plan to Transfer his Wealth. Here’s how it worked for him:

- Protecting His Dependents

As a 50-year-old father to two young children, ages 15 and 13, Aaron’s primary goal was to ensure his family would be secure in any eventuality. We worked with him to structure his Will where, should death happen, the majority of his assets would be seamlessly transferred to his spouse to manage and use for the care of their children. To provide an additional layer of security, he also named substitute guardians to care for his minor children should his spouse not survive him. - Ensuring His Wishes are Honoured

Aaron is also the main financial support for his elderly mother. While he was committed to leaving a sum for her, he worried about her ability to manage a large inheritance or potentially fall victim to scams. To address this, we helped establish a testamentary trust. This structure ensures his mother receives regular, managed payments to cover her needs over the long term, with special provisions for medical expenses, providing her with stability and protecting her from financial risk. - Avoiding “Reverse Wealth Transfer”

A comprehensive plan must also account for personal health challenges. Aaron wisely chose to plan for a situation where his health might deteriorate. He drew up his Lasting Power of Attorney, appointing his spouse as his donee to make decisions on his behalf should he lose mental capacity. As part of the program, we also ensured his medical and long-term care insurance was adequate, preventing the potential depletion of his assets and protecting his family from additional financial burdens. - Preserving Family Legacy and Values

Through our discussions, we learned of Aaron’s passion for animal welfare, reflected in his regular volunteer work at a dog shelter. We helped him integrate this personal value into his plan by including the shelter as a beneficiary in his will. In doing so, he is not only supporting a cause he is passionate about but also instilling the values of compassion and love for animals in his children.

With a robust plan in place, Aaron has the assurance that his family is protected, his wishes are clearly defined, and his legacy of care—for both his family and his community—is secure.

An Act of Love

Proper planning is a final act of love, ensuring your wishes are honored and your family is protected. Ignoring it can have costly and emotionally devastating consequences.

Don’t leave things to chance, experience our Financially F.I.T. program and secure your legacy. Let’s work together to build a plan that gives you and your family peace of mind.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg