Holistic Estate and Legacy Planning Services For Family

Welcome to Kenny Loh Holistic Legacy Planning. Securing your family’s future is a journey, not a single transaction. As a certified estate planner, I provide a comprehensive, four-step approach designed to organize your wealth, protect your beneficiaries, and ensure your legacy is passed on exactly as you intend.

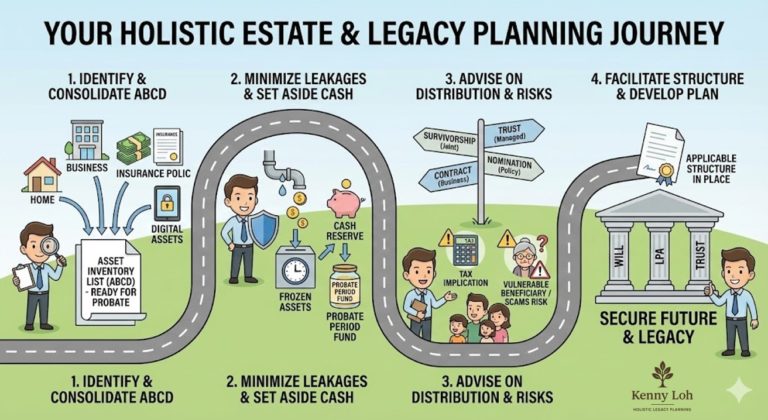

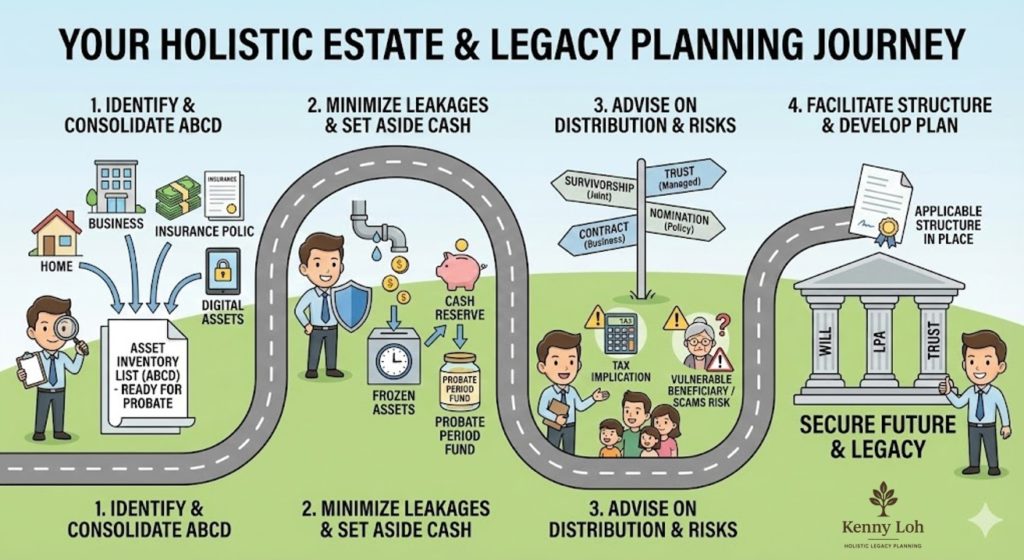

Here is the holistic process we will navigate together:

Step 1: Identify & Consolidate Your Assets (The ‘ABCD’)

Our journey begins with clarity. We work together to conduct a thorough examination of your entire financial landscape. This involves identifying and consolidating all asset types, often referred to as the ‘ABCD’ of your estate: your physical Assets (like your home), Business interests, Cash and Insurance policies, and increasingly important Digital Assets.

My goal during this phase is to help you create a comprehensive “Asset Inventory List”. By having this list organized and “Ready for Probate,” we significantly reduce the administrative burden and confusion for your executors in the future.

Step 2: Minimize Leakages & Ensure Liquidity

A common challenge during estate administration is that assets can become temporarily “frozen” while legal processes take place. Without proper planning, this can leave your loved ones without access to funds when they need them most.

In this step, we develop strategies to act as a shield, minimizing potential estate value leakages. Crucially, we plan to set aside a dedicated “Cash Reserve” to serve as a “Probate Period Fund,” ensuring immediate liquidity is available to bridge the gap while other assets are frozen.

Step 3: Advise on Distribution Methods & Assess Risks

Determining how your assets are transferred is vital. I will advise you on the various distribution channels available and which best suit your specific assets and goals. These methods may include Joint Survivorship, managed Trusts, Business Contracts, or Policy Nominations.

This phase also involves a critical risk assessment. We will examine potential tax implications of your distribution plan. Furthermore, we will address the human element by highlighting potential risks, such as protecting vulnerable beneficiaries who may not be financial literate or are at risk of falling victim to scams.

Step 4: Facilitate Structure & Develop the Plan

The final stage is bringing your customized plan to life by building the necessary legal foundation. I facilitate the development of the applicable structures tailored to address your unique needs.

This involves implementing the core pillars of a robust estate plan, which typically include a Will, a Lasting Power of Attorney (LPA), and Trusts. With the correct structure in place, you gain the peace of mind that comes with a secure future and a well-protected legacy.

Ready to begin your Holistic Estate & Legacy Planning Journey? Contact Kenny Loh today.

Disclaimer: The content above, including all information, opinions, and interactive elements, was created by the individual financial consultant. The views expressed are the consultant’s own and do not necessarily reflect the official policy or position of Financial Alliance. Financial Alliance does not guarantee the accuracy or completeness of this content and is not responsible for any errors or omissions. If you believe any information is inaccurate or have other feedback regarding this content, please contact us at feedback@fa.com.sg.

Readers should seek independent, unbiased financial advice that is customised to their specific financial objectives, situation, and needs. This publication has not been reviewed by the Monetary Authority of Singapore.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg