3 Common Estate Planning Mistakes in Personal Investment

Photo: Bob Carlson’s Retirement Watch

Estate Planning is a complex topic as it involves many parties, with legal, social, emotional effects. Many people underestimate the importance of estate planning, and treat estate planning as a simple will-writing and nomination making exercise.

Without proper estate planning, your beneficiaries will have to pay for unnecessary taxes, if any, on your assets, or even suffer leakages during the distribution of your estate. Worse still, it can create disputes and pass down unnecessary financial burdens to your beneficiaries.

We are dealing with more complex investment products nowadays. The following are the most common mistakes one may overlook in their estate planning as far as personal investment is concerned.

1. Ignorance of Estate Duty when investing in the overseas stock market.

The United States imposes 40% estate duty for any investment amount > US$60,000. If you have an investment portfolio worth US$200,000, your beneficiaries will have to fork out US$56,000 in cash before they can inherit your investment holdings.

If you have overseas investment properties in Japan or Chile, you might only be able to retrieve half (or less) than its value! Photo: The Edge

Depending on your investment portfolio, there may be certain estate taxes that may or may not apply to you. Do seek proper tax advice from a qualified tax consultant to find out more.

2. Lack of planning when holding multiple investment properties (local and overseas)

There is no estate duty in Singapore at the moment. However, there are additional duties such as ABSD (Additional Buyer Stamp Duty) and SSD (Seller Stamp Duty) under certain conditions. If you have multiple properties in Singapore and have more than 2 beneficiaries, it is highly likely your beneficiaries have to pay for those for the ownership transfers if you do not plan for your wealth distribution properly. BSD + ABSD could be up to 28% and SSD could be up to 12%. Furthermore, your beneficiaries may have to pay IRAS first before the change of ownership. On top of the stamp duties, there are legal fees involved as well. As for the overseas properties, legal fee and possible estate duty imposed. E.g. Estate duty of 40% of assets more than GBP325,000 in the United Kingdom.

3. Beneficiaries are not trained in dealing with complex investments such as crypto-currency, CFD or options.

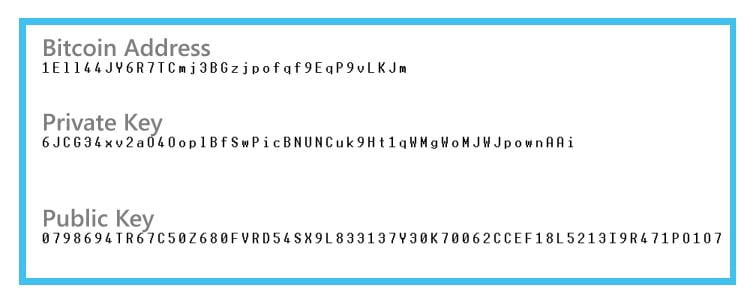

There are many types of investments the testator can own during his/her lifetime. He may be actively trading the equity market using CFDs (Contract of Difference), writing US stocks options, crypto-currency such as Bitcoin, Ethereum, Electroneum, etc. All these trading or investment activities involve complex operations and beneficiaries may not understand or know-how to carry out instructions in closing out positions and withdraw the money from the trading accounts. Without the proper knowledge, all the money in the trading or investment will either expire or be worthless (options), suffer complex losses or for digital currencies be lost in cyberspace due to the inability to locate addresses and/or convert back to fiat. Personally, despite being an investor in digital currencies, sometimes I still find it difficult to manage all the addresses, wallets, cryptocurrency exchanges etc.

Examples of Digital Currency Keys. For some digital currencies wallets, without the Private Key, all the monies cannot be retrieved. Photo: Coinsource

Unlike traditional asset classes such as shares and bonds, which are held in the bank or with brokers, lawyers may not have the knowledge or expertise to retrieve the monies in those trading accounts. In addition, the hefty professional fees will hinder beneficiaries to take that route to retrieve the monies and may have to write-off the estate.

Estate planning is all about protecting your loved ones and enables you to pass on your hard-earned assets to your loved ones according to your wishes. Life is unpredictable and we never know what will happen tomorrow. Thus, it is important to start planning for your estate before it’s too late while considering the above common mistakes that people usually make.

Speak to an experienced estate planning professional to understand more about the importance of estate planning and to develop your holistic estate plan. “Failing to plan is planning to fail”.

Kenny Loh is a Certified Estate Planning Consultant and also a CERTIFIED FINANCIAL PLANNER (CFPTM). He specialises in Holistic Estate Planning, using a unique “3-in-1 Will, LPA and Standby Trust” solution, to address his client’s social consideration, legal obligation, emotional needs and family’s harmony in his approach. Kenny has Double Master degree in Business Administration and Electrical Engineering, and also an AEPP (Associate Estate Planning Practitioner) jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of The United Kingdom, in collaboration with Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Loh Kok Keong Kenny

Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

罗国强(Kenny Loh) 是一位杰出的财富咨询总监,专长于综合投资规划与遗产管理。他擅长协助客户实现投资资本增值,并建立退休被动收入来源。同时,他通过税务优化的方式帮助客户将投资组合高效转移给受益人,运用风险缓释策略确保资本增值的税务效率,并通过战略性资产配置实现财富传承的最优化。

除咨询工作外,罗国强是新加坡交易所学院(SGX Academy)的特聘讲师,专注于新加坡房地产投资信托(S-REIT)投资领域,并定期在MoneyFM 89.3电台分享专业见解。他拥有认证遗产与传承规划顾问(Certified Estate & Legacy Planning Consultant)及国际认证财务规划师(CFP)资格。

在逾十年的综合遗产规划经验中,他独创“遗嘱、持久授权书与备用信托三合一”解决方案,兼顾客户的社会责任、法律义务、情感需求及家庭和谐。他持有工商管理硕士与电气工程硕士双学位,并获英国遗嘱撰写及遗产规划从业者协会(SWWEPP)与亚洲认证机构遗产规划从业者有限公司(EPPL)联合授予副遗产规划从业师(AEPP)专业资格。

Arrange for a non-obligatory one-to-one free consultation here!

立即预约免费一对一咨询(无需承担任何义务)!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg