Are You Financially FIT? I – Insurance Planning (Part 2)

Welcome back to Part 2 of our “Are You Financially FIT?” series, where we explore how to build a strong financial foundation.

In Singapore, insurance is often misunderstood or overlooked – not because people don’t care, but because the landscape is complex. Many people I speak to feel lost in a maze of jargon and product choices (just consider the many variations of ‘shields’). Frankly, I don’t blame them. Even as a practitioner, I often consult insurers to clarify the finer details.

But make no mistake – insurance is a cornerstone of financial well-being. It protects what matters most: your health, your family, and your financial future. Without it, a single illness or accident could derail decades of careful planning.

Using our Financially F.I.T. program, we help clients evaluate their overall financial well-being through three pillars:

F – Financial Management,

I – Insurance Planning, and

T – Transfer of Wealth.

Today, we unpack Insurance Planning in a way that makes sense—and more importantly, helps you take action.

First, let’s understand the different type of insurance available:

- Life Insurance: Provides a lump sum payout to your dependents in the event of your death, total and permanent disability or terminal illness. This helps to ensure their financial stability and ability to manage expenses in your absence. Example:

- Whole Life Insurance: Offers lifelong coverage. These policies typically have a savings or investment component, building up cash value over time that you may be able to borrow against or withdraw. Premiums are generally higher than for term life insurance.

- Term Insurance: Provides coverage for a specific period (e.g., 20 or 30 years). It is a pure protection plan with no savings or investment component, making it a more affordable option. The payout is made if the insured event occurs within the policy term.

- Critical Illness Insurance: Provides a lump sum payout upon diagnosis of a specific critical illness, such as major cancers, heart attack, or stroke. This payout can be used to cover medical expenses, supplement lost income, or for any other financial need. These can be standalone plans or attached to Whole Life Insurance or Term Insurance.

- Medical Insurance: Helps to cover large hospital bills and selected outpatient treatments, such as dialysis and chemotherapy. Example:

- MediShield Life: A basic, mandatory scheme for all Singapore Citizens and Permanent Residents with benefits sized for treatment in Class B2/C wards in public hospitals.

- Integrated Shield Plans (IPs): Offered by private insurers, these plans supplement MediShield Life coverage, providing for higher-ward classes in public hospitals or treatment in private hospitals.

- Disability Income Insurance: Provides regular monthly payout to replace a portion of lost earnings due to inability to work resulting from an illness or accident.

- Long-Term Care Insurance: Provides regular monthly payout upon inability to perform Activities of Daily Living (ADL), especially during old age. Payouts are intended to help with the costs of long-term care services. Example: ElderShield, CareShield Life and their enhancements.

- Personal Accident Insurance: Provides lump sum payout in the event of accidental death, disability, or injury. It can also cover medical expenses and offer a daily cash benefit for hospitalisation.

Other category of products includes Motor Insurance, Home Insurance, Travel Insurance, Maid Insurance, Pet Insurance, etc – which we will not go into details in this article.

Practical Steps to Get Started

1. Understand Your Unique Situation

We begin by asking the right questions:

- What are you trying to protect?

- Who depends on you financially?

- What would happen to them if you could no longer provide?

Take a moment to think about your family, your job, your mortgage, and your long-term goals. These answers reveal your financial vulnerabilities and help define your insurance needs.

2. Determine the Right Coverage Amount

Once we understand what’s most important to you, we use a practical, needs-based approach to calculate the coverage you truly require:

- First, we estimate your total coverage need using this simple formula:

[Amount required per year × Number of years to provide]

*A quick note: While we use this formula for simplicity, a detailed financial plan would also factor in inflation to ensure the coverage holds its value over time. - Then, we factor in your existing insurance, assets, and savings.

The goal is to avoid over-insuring, while ensuring you’re not under-protected.

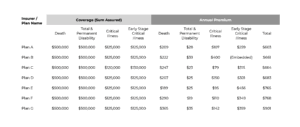

3. Shortlist the Right Products – without bias

As Singapore’s leading financial advisory, we provide impartial advice tailored to you. We survey the entire market for solutions that best fit your needs and budget, offering clear, unbiased comparisons that give you clarity and confidence over your decisions.

Above sample comparison of Term policies from lowest to highest premium.

4. Balance Coverage with Affordability

It’s not just about buying the “best” policy – it’s about finding the right fit. You might ask:

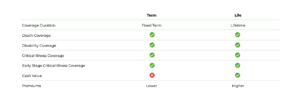

- Do I want lifetime coverage or just for a specific period?

- Do I need cash value that can be used for retirement?

- What can I realistically afford monthly?

Above difference between Term Insurance and Life Insurance.

5. Review Regularly

Life changes—so should your insurance. Whether you change jobs, buy a home, have kids, or experience a health issue, it’s crucial to keep your policies updated. A regular review ensures your coverage continues to meet your needs.

Case Study

Using our F.I.T. program, we help Natalie navigate her insurance planning journey:

- Step 1: Understand Her Unique Situation

Natalie’s situation is representative of many young, dual-income families in Singapore today. She and her husband jointly manage their household expenses while raising their young daughter. This co-reliance brings a significant financial concern to the forefront: Natalie is worried that her family would struggle to maintain their lifestyle if they were to lose her income stream as a result of death, disability, or a critical illness. - Step 2: Determine the Right Coverage Amount

Following our discussion, we determined Natalie’s share of household expenses to be $3,000 per month. Her goal is to ensure this amount is provided for the next 20 years, safeguarding her family’s finances until her daughter can support herself.- Using our simple formula above: [Amount required per year × Number of years to provide]

- Natalie will required a coverage of [$3,000 × 12 months × 20 years] = $720,000

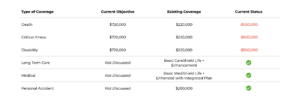

As part of our comprehensive financial review, we then consolidated and analysed Natalie’s existing insurance plans. This allowed us to give her a clear, concise summary of her current protection and identify where the shortfalls lie.

Above summary of Natalie’s current coverage vs. her objectives

- Step 3: Shortlist the Right Products – without bias

We compared various product options across multiple insurers and guided Natalie through the pros and cons of each. With no product bias, she was able to make an informed, confident decision that suited her needs. - Step 4: Balance Coverage with Affordability

Through our in-depth analysis and tailored guidance, Natalie was able to pick the right product to address her concerns while balancing her budget. - Step 5: Review Regularly

We conduct annual reviews with Natalie to ensure her coverage stays aligned with her evolving needs and family goals.

Protect What Matters Most

Insurance planning isn’t just about buying policies—it’s about securing peace of mind, protecting your loved ones, and being prepared for the unexpected.

If you’re unsure where to start or whether your current coverage is sufficient, I’m here to help. Through the Financially F.I.T. program, we simplify insurance planning and tailor it to your unique situation so you can move forward with confidence.

Let’s work together to make sure you’re financially fit.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Tan Ri'an 陈日安

Ri’an transforms financial complexity into stress-tested roadmaps for pre-retirees. Moving beyond standard advice, he partners with you to secure your future through:

- Meticulous Strategy: Optimizing CPF payouts, shielding assets from volatility, and structuring reliable retirement income.

- Visual Simplicity: Consolidating fragmented portfolios into clear, single-view insights.

- Unwavering Objectivity: Sincere, logic-based advice aligned strictly with your long-term interests.

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg