How much Tax can I save from SRS Tax Relief?

How does SRS allows us to enjoy Tax Relief?

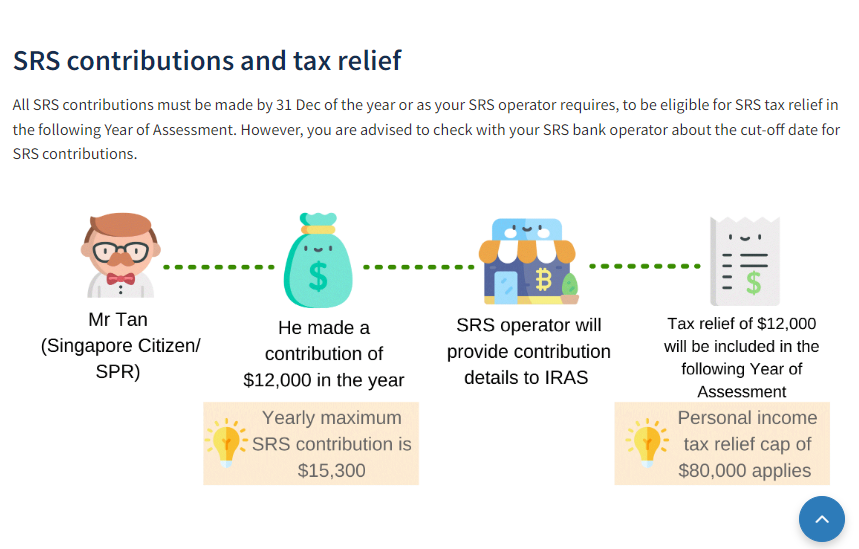

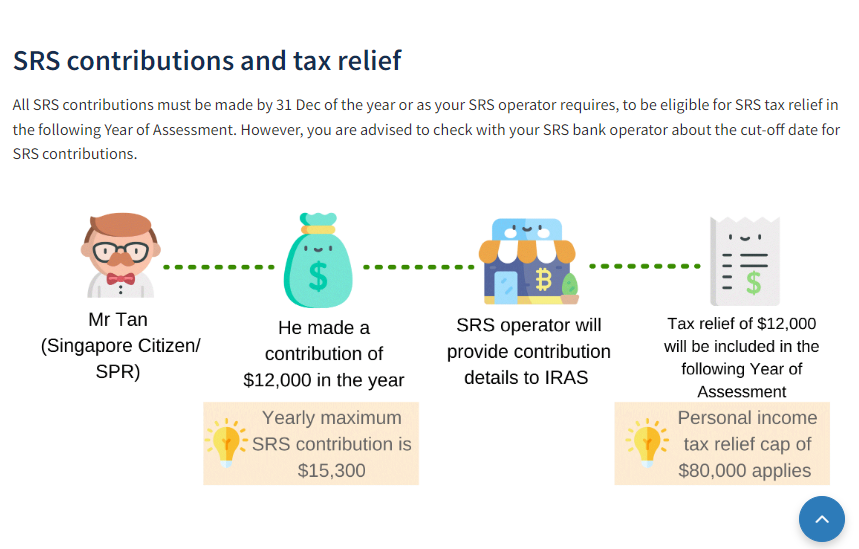

The Supplementary Retirement Scheme (SRS) is designed to encourage individuals to voluntarily save more for their golden years. SRS contributions are made over and above CPF contributions and enjoy tax relief as well. 𝗟𝗲𝘁’𝘀 𝗵𝗮𝘃𝗲 𝗮𝗻 𝗶𝗹𝗹𝘂𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 : Annual Income: $150,000 Personal Tax Relieft: $10,000 Amount Contributed to SRS: $15,300 – Tax Relief of $15,300 will be included in the following Year of Assessment So what is the Tax Payable, with and without tax relief? Without SRS Contribution: Tax Payable is $10,950 𝐖𝐢𝐭𝐡 𝐒𝐑𝐒 𝐂𝐨𝐧𝐭𝐫𝐢𝐛𝐭𝐢𝐨𝐧: 𝐓𝐚𝐱 𝐏𝐚𝐲𝐚𝐛𝐥𝐞 𝐢𝐬 $𝟖,𝟔𝟓𝟓 (𝐘𝐨𝐮 𝐜𝐚𝐧 𝐬𝐚𝐯𝐞 $𝟐,𝟐𝟗𝟓 𝟐𝟏% 𝐨𝐟 𝐭𝐚𝐱) Note that there is a limit to the amount of tax relief each of us has. If you wish to find out more if this SRS contribution makes sense to your financial portfolio, happy to explore it with you.

Important: The information and opinions in this article are for general information purposes only. They should not be relied on as professional financial advice. Readers should seek unbiased financial advice that is customised to their specific financial objectives, situations & needs. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Published By:

Zephanie Lau 刘晓莹

“𝙱𝚎 𝚝𝚑𝚎 𝚊𝚛𝚌𝚑𝚒𝚝𝚎𝚌𝚝 𝚘𝚏 𝚢𝚘𝚞𝚛 𝚏𝚒𝚗𝚊𝚗𝚌𝚒𝚊𝚕 𝚍𝚎𝚜𝚝𝚒𝚗𝚢!” ✍I am a seasoned Financial Advisory Manager in Singapore, with over a decade of expertise, committed to transforming lives. I stand ready to guide Working Adults in Singapore towards greatness through meticulous Financial Planning and Independent Financial strategies.

As Warren Buffett wisely said, “𝗦𝗼𝗺𝗲𝗼𝗻𝗲 𝗶𝘀 𝘀𝗶𝘁𝘁𝗶𝗻𝗴 𝗶𝗻 𝘁𝗵𝗲 𝘀𝗵𝗮𝗱𝗲 𝘁𝗼𝗱𝗮𝘆 𝗯𝗲𝗰𝗮𝘂𝘀𝗲 𝘀𝗼𝗺𝗲𝗼𝗻𝗲 𝗽𝗹𝗮𝗻𝘁𝗲𝗱 𝗮 𝘁𝗿𝗲𝗲 𝗮 𝗹𝗼𝗻𝗴 𝘁𝗶𝗺𝗲 𝗮𝗴𝗼.” Let me help you plant the seeds of financial success, so you can bask in the shade of abundance in the Singapore Financial Hub.

“I am not a product of my circumstances. I am a product of my decisions.” With your goals in sight, I become your relentless Goal Getter, ensuring nothing holds you back from achieving your dreams.

Remember, “Time is more valuable than money. You can get more money, but you cannot get more time.” Let’s avoid wasted efforts on wrong choices and focus on what truly matters, uncovering the meaning of life and securing your future.

With your vision and my guidance, we shall create a legacy of financial empowerment, proving that success is within reach for every determined soul. Let’s ignite the fire of transformation and begin our journey today! 🌟💼

#efficient #financialhappiness

█▓▒░ 𝐈’𝐦 𝐙𝐞𝐩𝐡𝐚𝐧𝐢𝐞, 𝐚𝐧 𝐈𝐧𝐝𝐞𝐩𝐞𝐧𝐝𝐞𝐧𝐭 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐀𝐝𝐯𝐢𝐬𝐨𝐫 𝐑𝐞𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐚𝐭𝐢𝐯𝐞. 𝐈𝐟 𝐲𝐨𝐮’𝐫𝐞 𝐥𝐨𝐨𝐤𝐢𝐧𝐠 𝐭𝐨 𝐥𝐞𝐯𝐞𝐥 𝐮𝐩 𝐰𝐢𝐭𝐡 𝐚 𝐡𝐨𝐥𝐢𝐬𝐭𝐢𝐜 𝐚𝐧𝐝 𝐮𝐧𝐛𝐢𝐚𝐬𝐞𝐝 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐩𝐨𝐫𝐭𝐟𝐨𝐥𝐢𝐨, 𝐥𝐞𝐭’𝐬 𝐜𝐨𝐧𝐧𝐞𝐜𝐭! 𝐓𝐡𝐢𝐬 𝐲𝐞𝐚𝐫, 𝐈 𝐚𝐢𝐦 𝐭𝐨 𝐞𝐧𝐠𝐚𝐠𝐞 𝐢𝐧 𝐝𝐞𝐞𝐩𝐞𝐫 𝐜𝐨𝐧𝐯𝐞𝐫𝐬𝐚𝐭𝐢𝐨𝐧𝐬 𝐰𝐢𝐭𝐡 60 𝐧𝐞𝐰 𝐩𝐫𝐨𝐟𝐞𝐬𝐬𝐢𝐨𝐧𝐚𝐥𝐬. 𝐈𝐟 𝐲𝐨𝐮’𝐫𝐞 𝐚𝐥𝐬𝐨 𝐥𝐨𝐨𝐤𝐢𝐧𝐠 𝐭𝐨 𝐞𝐱𝐩𝐚𝐧𝐝 𝐲𝐨𝐮𝐫 𝐧𝐞𝐭𝐰𝐨𝐫𝐤, 𝐃𝐌 𝐦𝐞—𝐥𝐞𝐭’𝐬 𝐠𝐫𝐨𝐰 𝐭𝐨𝐠𝐞𝐭𝐡𝐞𝐫! ░▒▓█

Drop me a Text to schedule a One-To-One Consultation Session!

CONTACT US

- 150 Beach Road #12-01/08, Gateway West Singapore 189720

- +65 62221889

- +65 62221019

- feedback@fa.com.sg